Answered step by step

Verified Expert Solution

Question

1 Approved Answer

As a Congressional representative, you have been tasked with coming up with a proposal to make up for a projected shortfall in federal tax

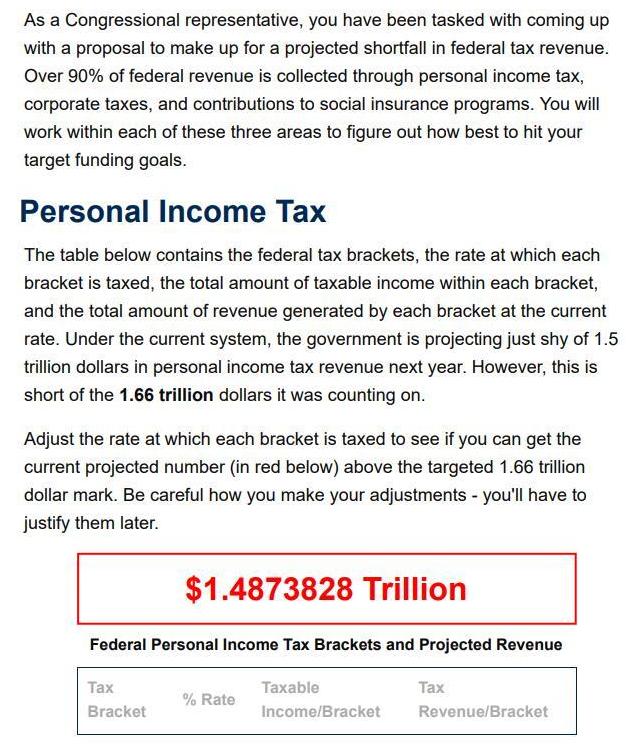

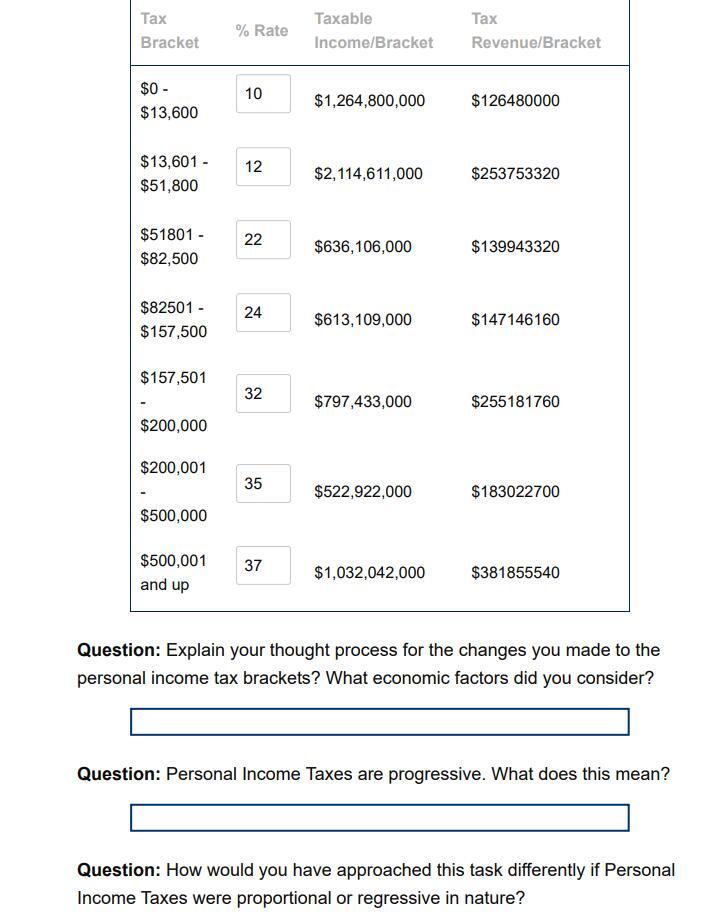

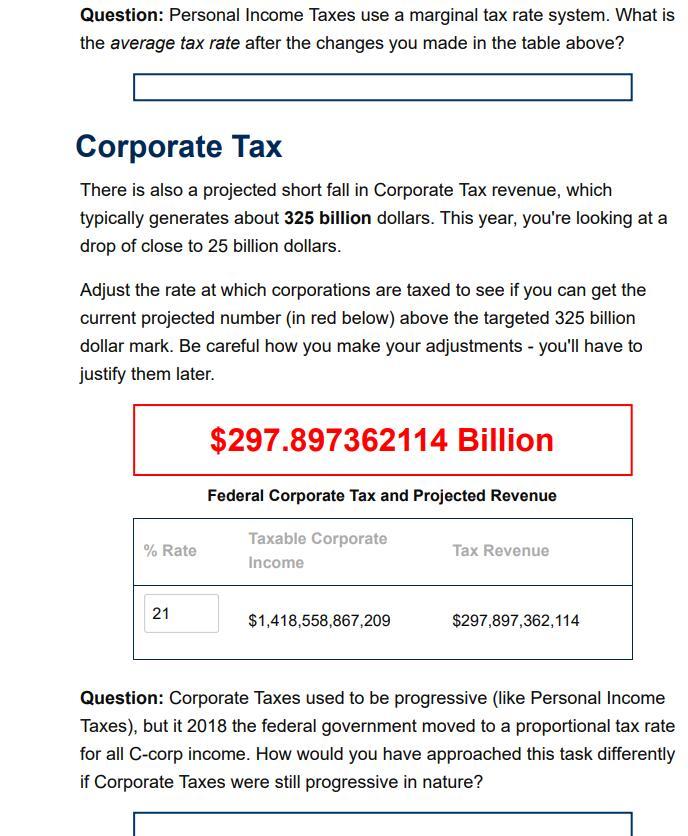

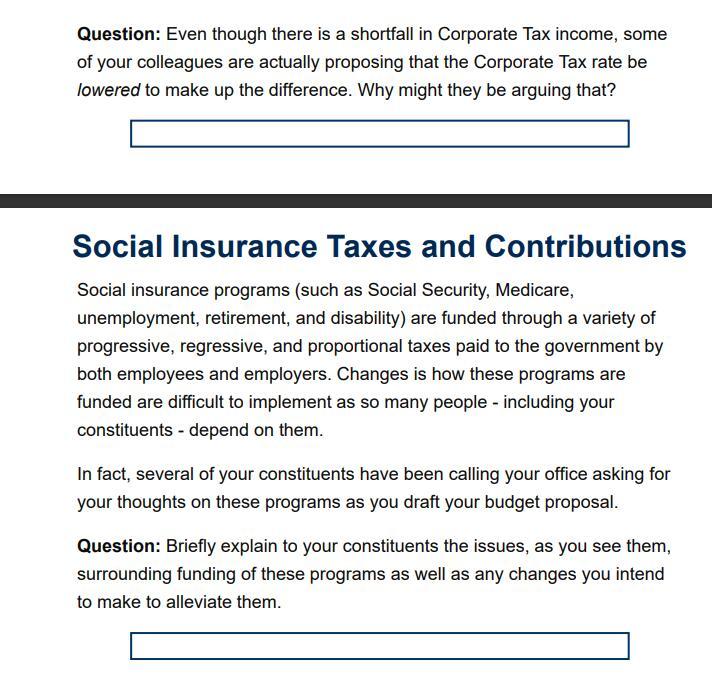

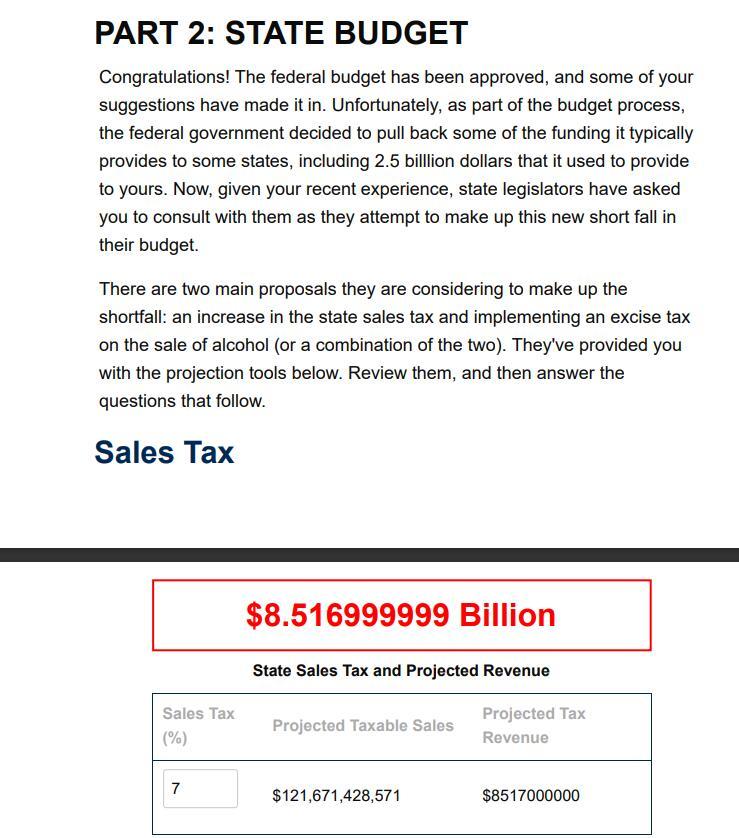

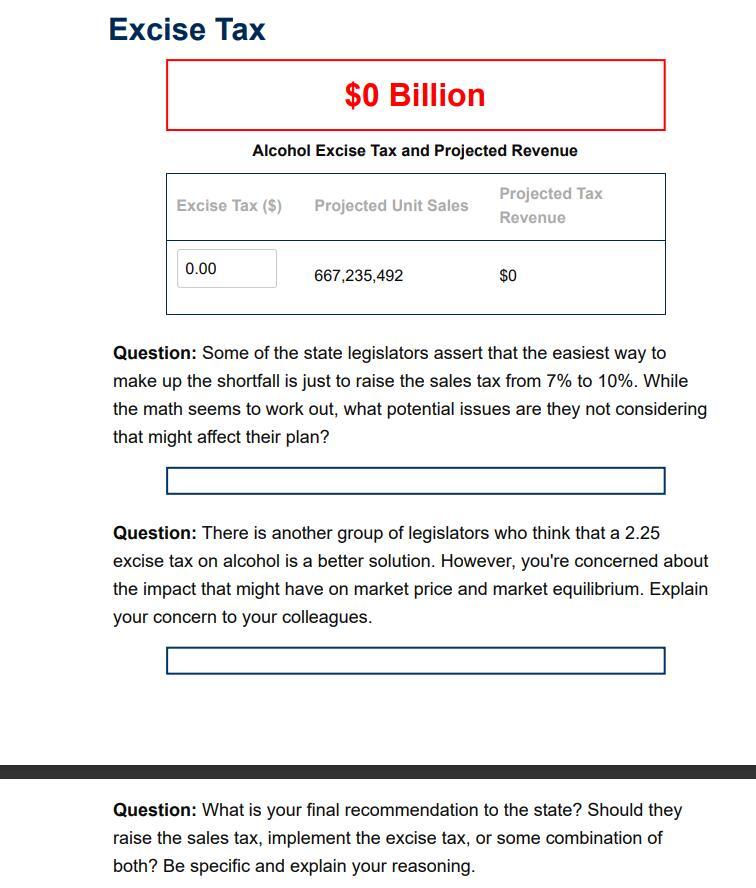

As a Congressional representative, you have been tasked with coming up with a proposal to make up for a projected shortfall in federal tax revenue. Over 90% of federal revenue is collected through personal income tax, corporate taxes, and contributions to social insurance programs. You will work within each of these three areas to figure out how best to hit your target funding goals. Personal Income Tax The table below contains the federal tax brackets, the rate at which each bracket is taxed, the total amount of taxable income within each bracket, and the total amount of revenue generated by each bracket at the current rate. Under the current system, the government is projecting just shy of 1.5 trillion dollars in personal income tax revenue next year. However, this is short of the 1.66 trillion dollars it was counting on. Adjust the rate at which each bracket is taxed to see if you can get the current projected number (in red below) above the targeted 1.66 trillion dollar mark. Be careful how you make your adjustments - you'll have to justify them later. $1.4873828 Trillion Federal Personal Income Tax Brackets and Projected Revenue Tax Taxable Tax % Rate Bracket Income/Bracket Revenue/Bracket Taxable Tax Tax Bracket % Rate Income/Bracket Revenue/Bracket 10 $0 - $13,600 $1,264,800,000 $126480000 $13,601 - 12 $2,114,611,000 $253753320 $51,800 $51801 - 22 $636,106,000 $139943320 $82,500 $82501- 24 $613,109,000 $147146160 $157,500 $157,501 32 $797,433,000 $255181760 $200,000 $200,001 35 $522,922,000 $183022700 $500,000 $500,001 37 and up $1,032,042,000 $381855540 Question: Explain your thought process for the changes you made to the personal income tax brackets? What economic factors did you consider? Question: Personal Income Taxes are progressive. What does this mean? Question: How would you have approached this task differently if Personal Income Taxes were proportional or regressive in nature? Question: Personal Income Taxes use a marginal tax rate system. What is the average tax rate after the changes you made in the table above? Corporate Tax There is also a projected short fall in Corporate Tax revenue, which typically generates about 325 billion dollars. This year, you're looking at a drop of close to 25 billion dollars. Adjust the rate at which corporations are taxed to see if you can get the current projected number (in red below) above the targeted 325 billion dollar mark. Be careful how you make your adjustments - you'll have to justify them later. $297.897362114 Billion Federal Corporate Tax and Projected Revenue % Rate Taxable Corporate Income Tax Revenue 21 $1,418,558,867,209 $297,897,362,114 Question: Corporate Taxes used to be progressive (like Personal Income Taxes), but it 2018 the federal government moved to a proportional tax rate for all C-corp income. How would you have approached this task differently if Corporate Taxes were still progressive in nature? Question: Even though there is a shortfall in Corporate Tax income, some of your colleagues are actually proposing that the Corporate Tax rate be lowered to make up the difference. Why might they be arguing that? Social Insurance Taxes and Contributions Social insurance programs (such as Social Security, Medicare, unemployment, retirement, and disability) are funded through a variety of progressive, regressive, and proportional taxes paid to the government by both employees and employers. Changes is how these programs are funded are difficult to implement as so many people - including your constituents - depend on them. In fact, several of your constituents have been calling your office asking for your thoughts on these programs as you draft your budget proposal. Question: Briefly explain to your constituents the issues, as you see them, surrounding funding of these programs as well as any changes you intend to make to alleviate them. PART 2: STATE BUDGET Congratulations! The federal budget has been approved, and some of your suggestions have made it in. Unfortunately, as part of the budget process, the federal government decided to pull back some of the funding it typically provides to some states, including 2.5 billion dollars that it used to provide to yours. Now, given your recent experience, state legislators have asked you to consult with them as they attempt to make up this new short fall in their budget. There are two main proposals they are considering to make up the shortfall: an increase in the state sales tax and implementing an excise tax on the sale of alcohol (or a combination of the two). They've provided you with the projection tools below. Review them, and then answer the questions that follow. Sales Tax $8.516999999 Billion State Sales Tax and Projected Revenue Projected Taxable Sales $121,671,428,571 Sales Tax (%) 7 Projected Tax Revenue $8517000000 Excise Tax $0 Billion Alcohol Excise Tax and Projected Revenue Excise Tax ($) Projected Unit Sales Projected Tax Revenue 0.00 667,235,492 $0 Question: Some of the state legislators assert that the easiest way to make up the shortfall is just to raise the sales tax from 7% to 10%. While the math seems to work out, what potential issues are they not considering that might affect their plan? Question: There is another group of legislators who think that a 2.25 excise tax on alcohol is a better solution. However, you're concerned about the impact that might have on market price and market equilibrium. Explain your concern to your colleagues. Question: What is your final recommendation to the state? Should they raise the sales tax, implement the excise tax, or some combination of both? Be specific and explain your reasoning. As a Congressional representative, you have been tasked with coming up with a proposal to make up for a projected shortfall in federal tax revenue. Over 90% of federal revenue is collected through personal income tax, corporate taxes, and contributions to social insurance programs. You will work within each of these three areas to figure out how best to hit your target funding goals. Personal Income Tax The table below contains the federal tax brackets, the rate at which each bracket is taxed, the total amount of taxable income within each bracket, and the total amount of revenue generated by each bracket at the current rate. Under the current system, the government is projecting just shy of 1.5 trillion dollars in personal income tax revenue next year. However, this is short of the 1.66 trillion dollars it was counting on. Adjust the rate at which each bracket is taxed to see if you can get the current projected number (in red below) above the targeted 1.66 trillion dollar mark. Be careful how you make your adjustments - you'll have to justify them later. $1.4873828 Trillion Federal Personal Income Tax Brackets and Projected Revenue Tax Taxable Tax % Rate Bracket Income/Bracket Revenue/Bracket Taxable Tax Tax Bracket % Rate Income/Bracket Revenue/Bracket 10 $0 - $13,600 $1,264,800,000 $126480000 $13,601 - 12 $2,114,611,000 $253753320 $51,800 $51801 - 22 $636,106,000 $139943320 $82,500 $82501- 24 $613,109,000 $147146160 $157,500 $157,501 32 $797,433,000 $255181760 $200,000 $200,001 35 $522,922,000 $183022700 $500,000 $500,001 37 and up $1,032,042,000 $381855540 Question: Explain your thought process for the changes you made to the personal income tax brackets? What economic factors did you consider? Question: Personal Income Taxes are progressive. What does this mean? Question: How would you have approached this task differently if Personal Income Taxes were proportional or regressive in nature? Question: Personal Income Taxes use a marginal tax rate system. What is the average tax rate after the changes you made in the table above? Corporate Tax There is also a projected short fall in Corporate Tax revenue, which typically generates about 325 billion dollars. This year, you're looking at a drop of close to 25 billion dollars. Adjust the rate at which corporations are taxed to see if you can get the current projected number (in red below) above the targeted 325 billion dollar mark. Be careful how you make your adjustments - you'll have to justify them later. $297.897362114 Billion Federal Corporate Tax and Projected Revenue % Rate Taxable Corporate Income Tax Revenue 21 $1,418,558,867,209 $297,897,362,114 Question: Corporate Taxes used to be progressive (like Personal Income Taxes), but it 2018 the federal government moved to a proportional tax rate for all C-corp income. How would you have approached this task differently if Corporate Taxes were still progressive in nature? Question: Even though there is a shortfall in Corporate Tax income, some of your colleagues are actually proposing that the Corporate Tax rate be lowered to make up the difference. Why might they be arguing that? Social Insurance Taxes and Contributions Social insurance programs (such as Social Security, Medicare, unemployment, retirement, and disability) are funded through a variety of progressive, regressive, and proportional taxes paid to the government by both employees and employers. Changes is how these programs are funded are difficult to implement as so many people - including your constituents - depend on them. In fact, several of your constituents have been calling your office asking for your thoughts on these programs as you draft your budget proposal. Question: Briefly explain to your constituents the issues, as you see them, surrounding funding of these programs as well as any changes you intend to make to alleviate them. PART 2: STATE BUDGET Congratulations! The federal budget has been approved, and some of your suggestions have made it in. Unfortunately, as part of the budget process, the federal government decided to pull back some of the funding it typically provides to some states, including 2.5 billion dollars that it used to provide to yours. Now, given your recent experience, state legislators have asked you to consult with them as they attempt to make up this new short fall in their budget. There are two main proposals they are considering to make up the shortfall: an increase in the state sales tax and implementing an excise tax on the sale of alcohol (or a combination of the two). They've provided you with the projection tools below. Review them, and then answer the questions that follow. Sales Tax $8.516999999 Billion State Sales Tax and Projected Revenue Projected Taxable Sales $121,671,428,571 Sales Tax (%) 7 Projected Tax Revenue $8517000000 Excise Tax $0 Billion Alcohol Excise Tax and Projected Revenue Excise Tax ($) Projected Unit Sales Projected Tax Revenue 0.00 667,235,492 $0 Question: Some of the state legislators assert that the easiest way to make up the shortfall is just to raise the sales tax from 7% to 10%. While the math seems to work out, what potential issues are they not considering that might affect their plan? Question: There is another group of legislators who think that a 2.25 excise tax on alcohol is a better solution. However, you're concerned about the impact that might have on market price and market equilibrium. Explain your concern to your colleagues. Question: What is your final recommendation to the state? Should they raise the sales tax, implement the excise tax, or some combination of both? Be specific and explain your reasoning.

Step by Step Solution

★★★★★

3.43 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started