Question

1. Assume you are a financial analyst who works for a major brokerage company that is heavily invested in Bre-X Minerals. a. In what ways

1. Assume you are a financial analyst who works for a major brokerage company that is heavily invested in Bre-X Minerals.

a. In what ways would investigating management and directors help determine the value of Bre-X€™s gold prospects?

b. In what ways would investigating the company€™s relationships with other entities help determine the value of Bre-X€™s gold prospects?

c. In what ways would investigating the organization and its industry help determine the value of Bre-X€™s gold prospects?

d. In what ways would investigating the financial results and operating characteristics help determine the value of Bre-X€™s gold prospects?

2. How were the gold industry and Canadian stock markets affected by this fraud?

3. Some of the aspects of the perfect fraud storm that were discussed in the chapter were also present in the Bre-X scandal. Which elements were common to both the perfect fraud storm and the Bre-X scandal?

4. What were some of the perpetrators€™ motivations to commit fraud?

In April 1997, Bre-X Minerals, a Canadian company, was supposedly one of the most valuable companies in the world. Bre-X had convinced numerous mining experts that they had rights to one of the largest gold deposits ever discovered. It was hailed as the mining find of the century. The gold mine, located on a remote island in the East Kalimantan Province of Indonesia, supposedly had so much gold that the actual price of gold on the open market dropped significantly due to the anticipation of an increased gold supply. Within a few months, thousands of Canadians€”big-time investors, pension and mutual fund, managers and many small investors, including factory workers€”got caught up in €œBre-X fever.€ The company€™s stock price shot from pennies to more than $250 per share before a 10-for-1 stock split was announced. Thousands of investors believed they were on the verge of becomingmillionaires.

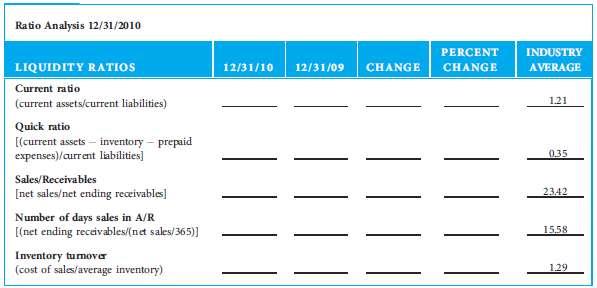

Ratio Analysis 12/31/2010 PERCENT INDUSTRY LIQUIDITY RATIOS 12/31/10 12/31/09 CHANGE CHANGE AVERAGE Current ratio 1.21 (current assets/current liabilities) Quick ratio [(current assets inventory prepaid expenses)/aurrent liabilities) 035 Sales/Receivables [net sales/net ending receivables) 2342 Number of days sales in A/R [(net ending receivables/(net sales/365)] 15.58 Inventory tumover (cost of sales/average inventory) 129

Step by Step Solution

3.34 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Answer a By investigating management and directors can help to determine the value of BreXs gold prospects to show the correct value of the company As ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started