Answered step by step

Verified Expert Solution

Question

1 Approved Answer

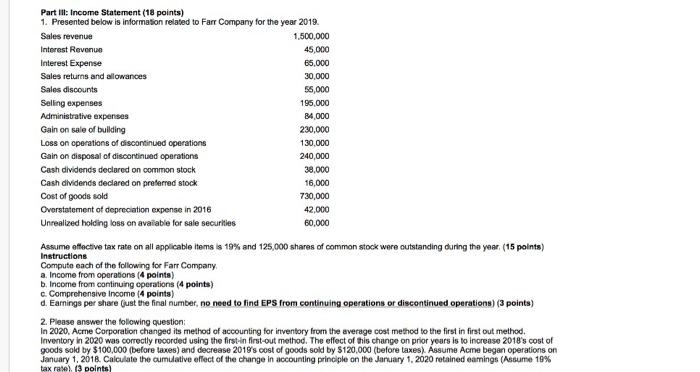

Part II: Income Statement (18 points) 1. Presented below is information related to Farr Company for the year 2019. Sales revenue 1.500,000 Interest Revenue

Part II: Income Statement (18 points) 1. Presented below is information related to Farr Company for the year 2019. Sales revenue 1.500,000 Interest Revenue 45,000 Interest Expense 65,000 Sales returns and allowances 30,000 Sales discounts 55,000 Seling expenses 195,000 Administrative expenses 84,000 Gain on sale of bulding 230,000 Loss on operations of discontinued operations 130,000 Gain on disposal of discontinued operations 240,000 Cash dividends declared on common stock 38,000 Cash dividends declared on preferred stock 16,000 Cost of goods sold 730,000 Overstatement of depreciation expense in 2016 42,000 Unrealized holding loss on available for sale securities 60,000 Assume effective tax rate on all applicable tems is 19% and 125,000 shares of common stock were outstanding during tha year. (15 points) Instructions Compute each of the following for Farr Company. a. Income from operations (4 points) b. Income from continuing operations (4 points) c. Comprehensive Income (4 points) d. Earnings per share (just the final number, no need to find EPS from continuing operations or discontinued operations) (3 points) 2. Please answer the following question: In 2020, Acne Corporation changed its method of accounting for inventory from the average cost method to the first in first out method. Inventory in 2020 was correctly recorded using the first-in first-out method. The effect of this change on prior years is to increase 2018's cost of goods sold by $100,000 (before taxes) and decrease 2019's cost of goods sold by $120,000 (before taxes). Assume Acme began operations on January 1, 2018. Calculate the cumulative effect of the change in accounting principle on the January 1, 2020 retained eamings (Assume 19% tax rate). (3 points)

Step by Step Solution

★★★★★

3.39 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started