Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Cash flow and Financing Luis and Carlos believe that there is a need for better forecasting regarding the company's cash inflows and outflows. After

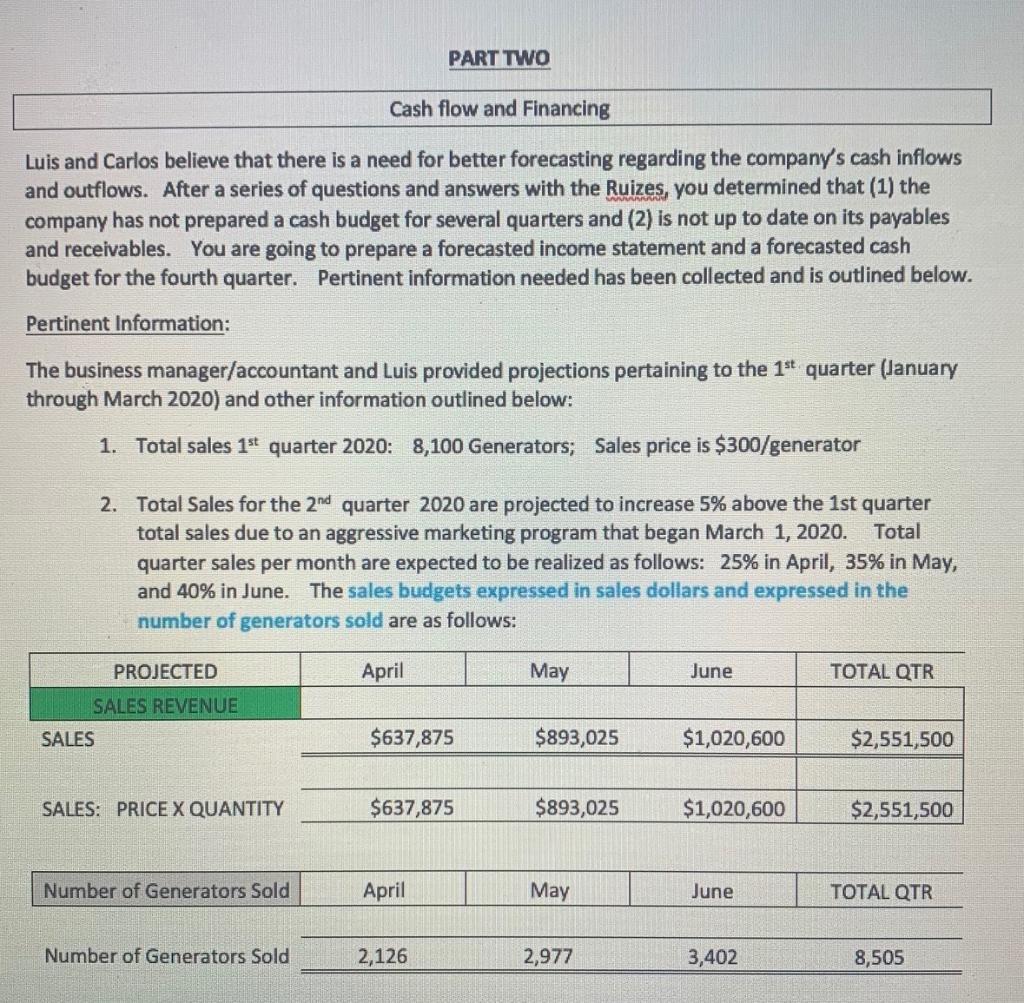

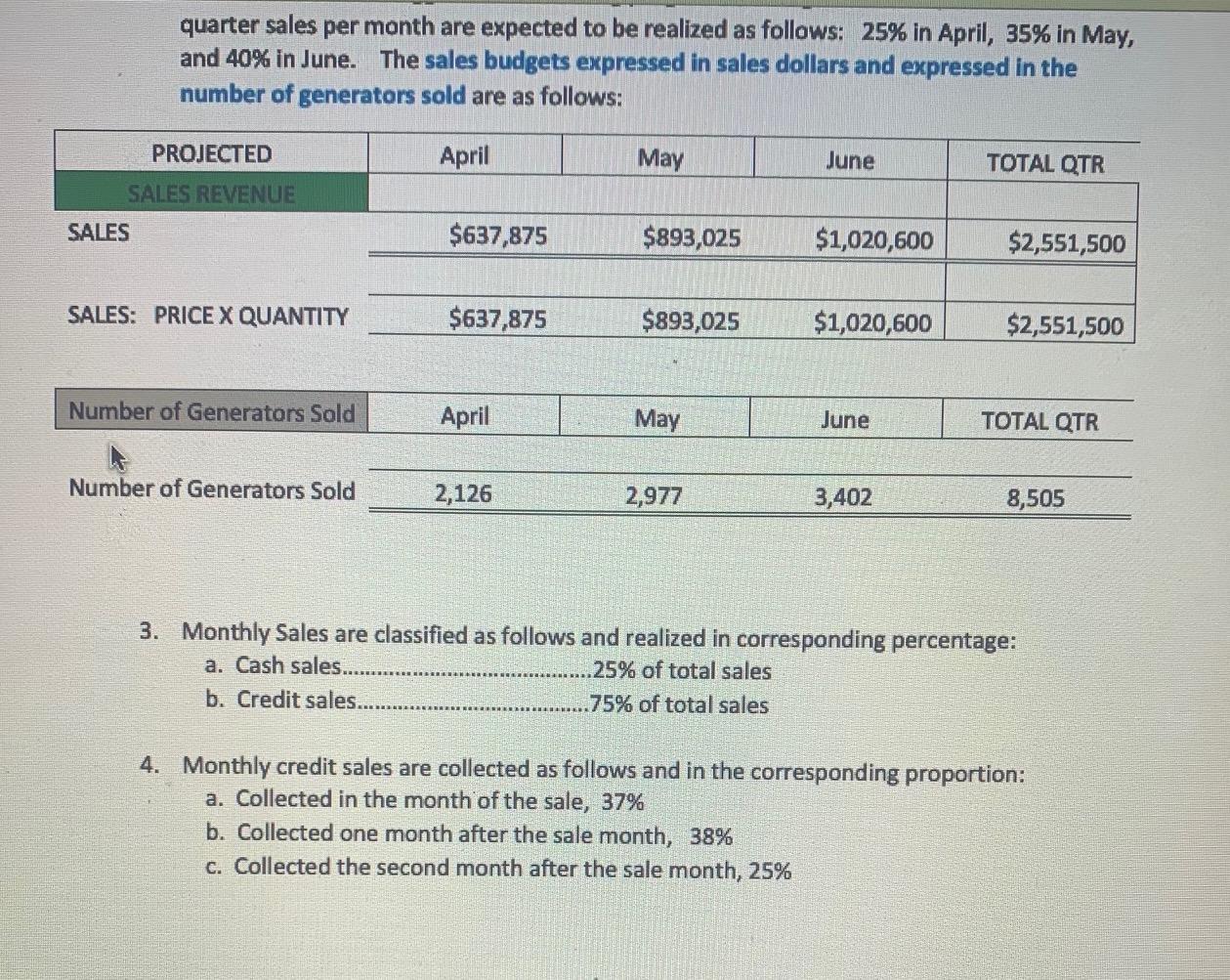

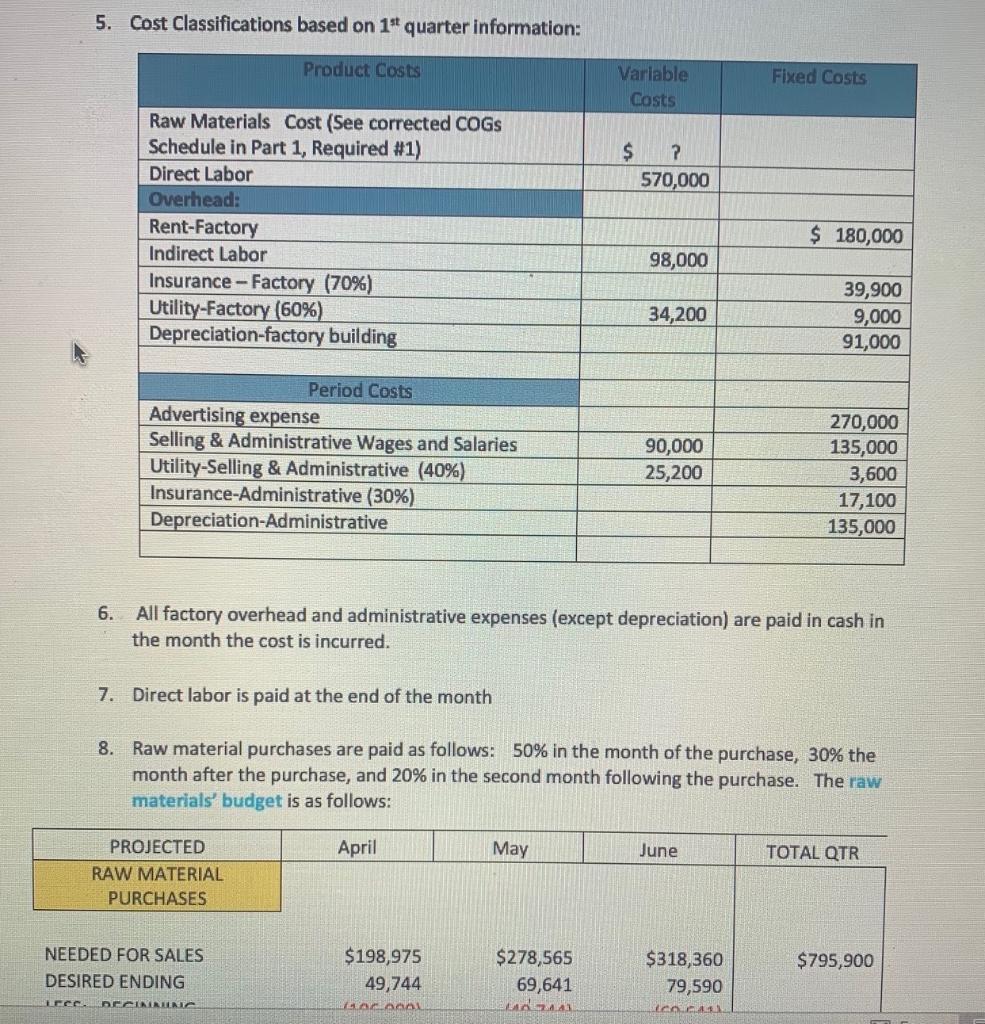

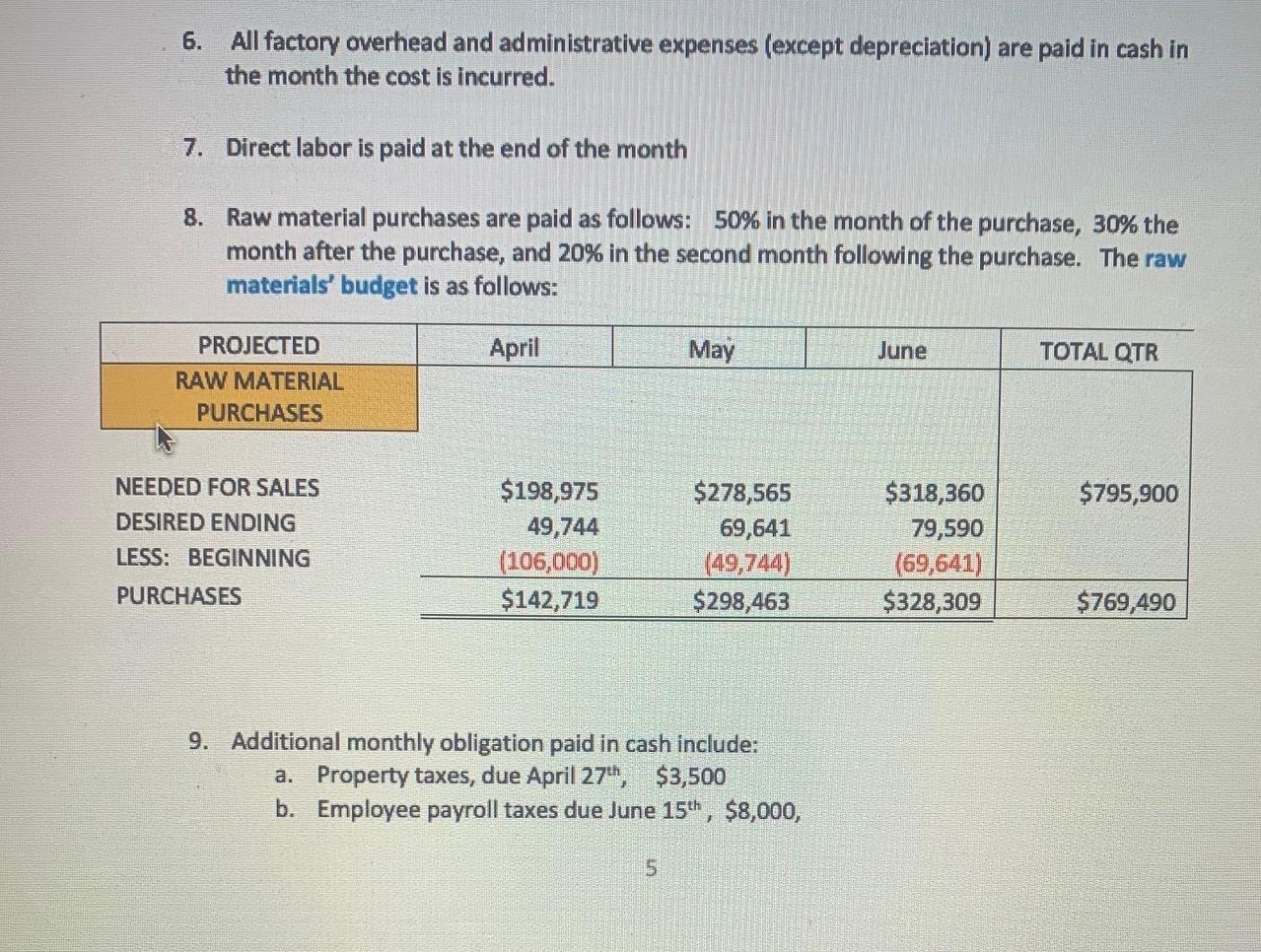

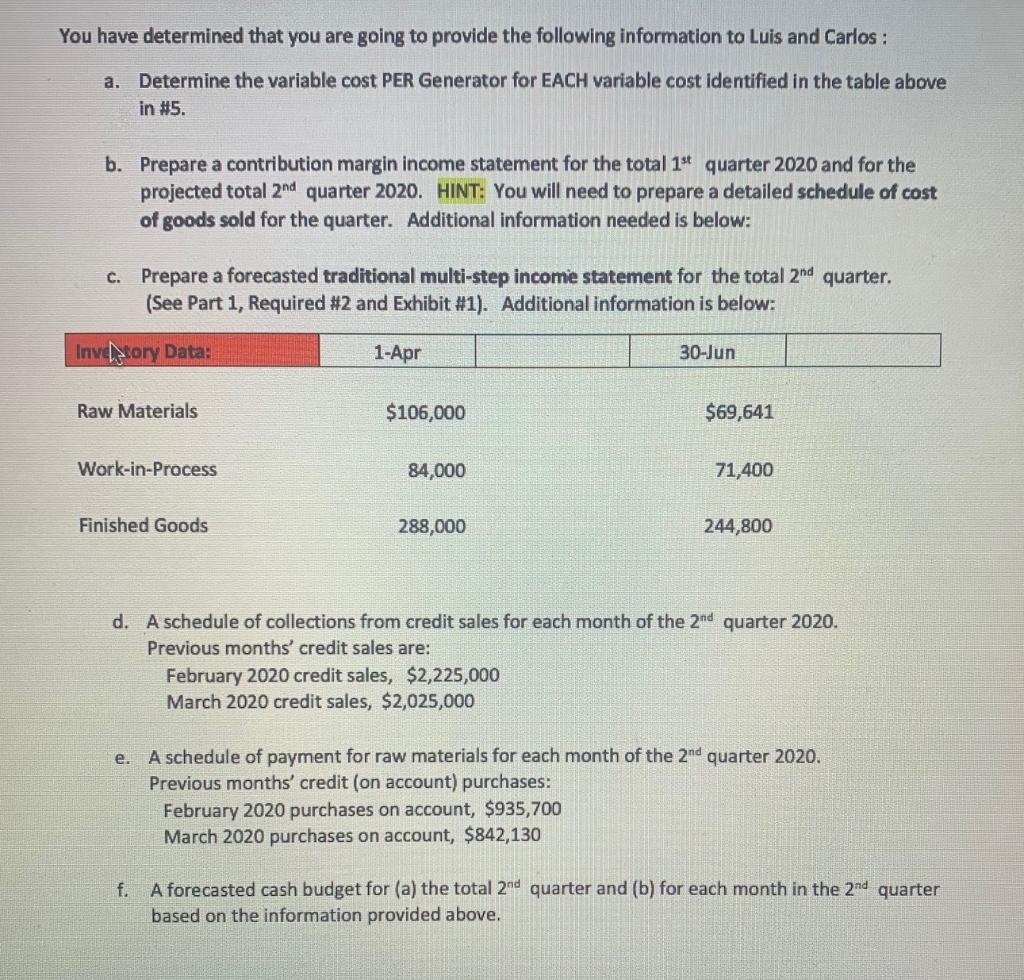

Cash flow and Financing Luis and Carlos believe that there is a need for better forecasting regarding the company's cash inflows and outflows. After a series of questions and answers with the Ruizes, you determined that (1) the company has not prepared a cash budget for several quarters and (2) is not up to date on its payables and receivables. You are going to prepare a forecasted income statement and a forecasted cash budget for the fourth quarter. Pertinent information needed has been collected and is outlined below. Pertinent Information: The business manager/accountant and Luis provided projections pertaining to the 1st quarter (January through March 2020) and other information outlined below: 1. Total sales 1st quarter 2020: 8,100 Generators; Sales price is $300/generator PROJECTED SALES REVENUE SALES 2. Total Sales for the 2nd quarter 2020 are projected to increase 5% above the 1st quarter total sales due to an aggressive marketing program that began March 1, 2020. Total quarter sales per month are expected to be realized as follows: 25% in April, 35% in May, and 40% in June. The sales budgets expressed in sales dollars and expressed in the number of generators sold are as follows: April SALES: PRICE X QUANTITY Number of Generators Sold PART TWO Number of Generators Sold $637,875 $637,875 April 2,126 May $893,025 $893,025 May 2,977 June $1,020,600 $1,020,600 June 3,402 TOTAL QTR $2,551,500 $2,551,500 TOTAL QTR 8,505 quarter sales per month are expected to be realized as follows: 25% in April, 35% in May, and 40% in June. The sales budgets expressed in sales dollars and expressed in the number of generators sold are as follows: April PROJECTED SALES REVENUE SALES SALES: PRICE X QUANTITY Number of Generators Sold Number of Generators Sold $637,875 $637,875 April 2,126 May $893,025 $893,025 May 2,977 June $1,020,600 b. Collected one month after the sale month, 38% c. Collected the second month after the sale month, 25% $1,020,600 June 3,402 TOTAL QTR $2,551,500 $2,551,500 TOTAL QTR 8,505 3. Monthly Sales are classified as follows and realized in corresponding percentage: a. Cash sales. .25% of total sales b. Credit sales.... .75% of total sales 4. Monthly credit sales are collected as follows and in the corresponding proportion: a. Collected in the month of the sale, 37% 5. Cost Classifications based on 1st quarter information: Product Costs Raw Materials Cost (See corrected COGS Schedule in Part 1, Required #1) Direct Labor Overhead: Rent-Factory Indirect Labor Insurance-Factory (70%) Utility-Factory (60%) Depreciation-factory building Advertising expense Selling & Administrative Wages and Salaries Utility-Selling & Administrative (40%) Insurance-Administrative (30%) Depreciation-Administrative Period Costs PROJECTED RAW MATERIAL PURCHASES NEEDED FOR SALES DESIRED ENDING LECC. DECINANC $198,975 49,744 106.000L Variable Costs May $ $278,565 69,641 140-2441 ? 570,000 98,000 34,200 90,000 25,200 6. All factory overhead and administrative expenses (except depreciation) are paid in cash in the month the cost is incurred. 7. Direct labor is paid at the end of the month 8. Raw material purchases are paid as follows: 50% in the month of the purchase, 30% the month after the purchase, and 20% in the second month following the purchase. The raw materials' budget is as follows: April Fixed Costs June $ 180,000 $318,360 79,590 ICO.CA11 39,900 9,000 91,000 270,000 135,000 3,600 17,100 135,000 TOTAL QTR $795,900 in 6. All factory overhead and administrative expenses (except depreciation) are paid in cash in the month the cost is incurred. 7. Direct labor is paid at the end of the month 8. Raw material purchases are paid as follows: 50% in the month of the purchase, 30% the month after the purchase, and 20% in the second month following the purchase. The raw materials' budget is as follows: April PROJECTED RAW MATERIAL PURCHASES NEEDED FOR SALES DESIRED ENDING LESS: BEGINNING PURCHASES $198,975 49,744 (106,000) $142,719 May 5 $278,565 69,641 (49,744) $298,463 9. Additional monthly obligation paid in cash include: a. Property taxes, due April 27th, $3,500 b. Employee payroll taxes due June 15th, $8,000, June $318,360 79,590 (69,641) $328,309 TOTAL QTR $795,900 $769,490 You have determined that you are going to provide the following information to Luis and Carlos: a. Determine the variable cost PER Generator for EACH variable cost identified in the table above in #5. b. Prepare a contribution margin income statement for the total 1st quarter 2020 and for the projected total 2nd quarter 2020. HINT: You will need to prepare a detailed schedule of cost of goods sold for the quarter. Additional information needed is below: c. Prepare a forecasted traditional multi-step income statement for the total 2nd quarter. (See Part 1, Required #2 and Exhibit #1). Additional information is below: Investory Data: 30-Jun Raw Materials Work-in-Process Finished Goods 1-Apr $106,000 84,000 288,000 February 2020 credit sales, $2,225,000 March 2020 credit sales, $2,025,000 $69,641 71,400 d. A schedule of collections from credit sales for each month of the 2nd quarter 2020. Previous months' credit sales are: February 2020 purchases on account, $935,700 March 2020 purchases on account, $842,130 244,800 e. A schedule of payment for raw materials for each month of the 2nd quarter 2020. Previous months' credit (on account) purchases: f. A forecasted cash budget for (a) the total 2nd quarter and (b) for each month in the 2nd quarter based on the information provided above.

Step by Step Solution

★★★★★

3.49 Rating (169 Votes )

There are 3 Steps involved in it

Step: 1

a Variable cost per generator for each variable cost identified in the table Raw Materials Cost per Generator Total Raw Materials Cost Total Number of Generators Sold 795900 8505 generators 9371 per g...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started