Pasqual Melo is employed by a public corporation. On January 1, 2019, she was given an option to purchase 1,000 shares of the public corporation

Pasqual Melo is employed by a public corporation. On January 1, 2019, she was given an option to purchase 1,000 shares of the public corporation for $8 per share (the option extended for two years).

On December 15, 2019, she exercised her option and bought 1,000 shares at $8 per share (total = $8,000).

On June 15, 2022, she sold 1,000 shares. The value of the shares at the particular dates was as follows:

Date option granted | $ 8.50 |

Date option exercised | 10 |

Date shares sold | 14 |

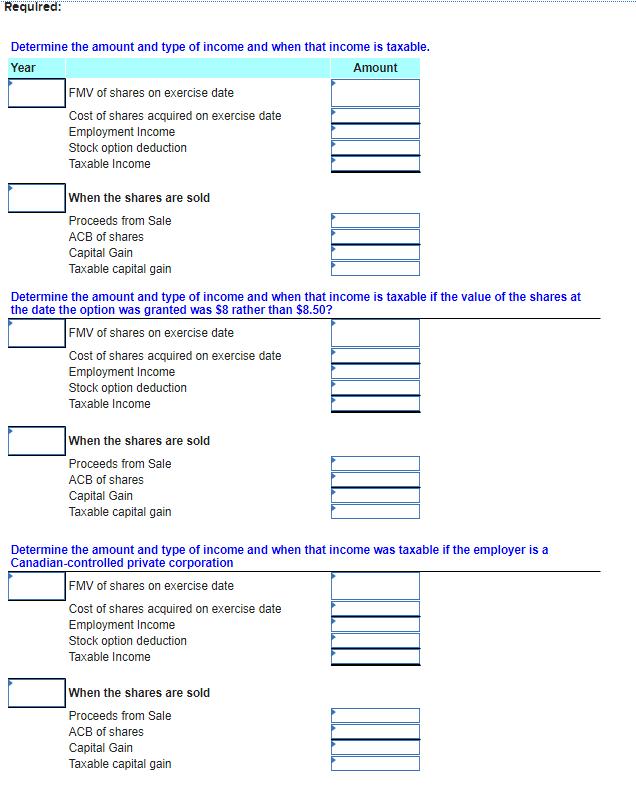

Requlred: Determine the amount and type of income and when that income is taxable. Year Amount FMV of shares on exercise date Cost of shares acquired on exercise date Employment Income Stock option deduction Taxable Income When the shares are sold Proceeds from Sale ACB of shares Capital Gain Taxable capital gain Determine the amount and type of income and when that income is taxable if the value of the shares at the date the option was granted was $8 rather than $8.50? FMV of shares on exercise date Cost of shares acquired on exercise date Employment Income Stock option deduction Taxable Income When the shares are sold Proceeds from Sale ACB of shares Capital Gain Taxable capital gain Determine the amount and type of income and when that income was taxable if the employer is a Canadian-controlled private corporation FMV of shares on exercise date Cost of shares acquired on exercise date Employment Income Stock option deduction Taxable Income When the shares are sold Proceeds from Sale ACB of shares Capital Gain Taxable capital gain

Step by Step Solution

3.47 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

solution Selling price 1000 x 14 14000 Value of shares at purchase date 1000 x 10 10000 Capital Gain ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started