Answered step by step

Verified Expert Solution

Question

1 Approved Answer

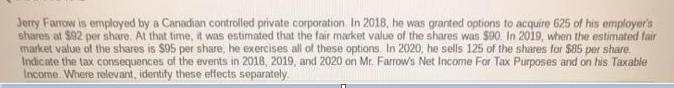

Jerry Farrow is employed by a Canadian controlled private corporation In 2018, he was granted options to acquire 625 of his employer's shares at

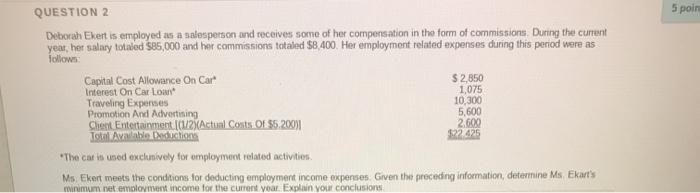

Jerry Farrow is employed by a Canadian controlled private corporation In 2018, he was granted options to acquire 625 of his employer's shares at $92 per share. At that time, it was estimated that the fair market value of the shares was $90. In 2019, when the estimiated fair market value of the shares is $95 per share, he exercises all of these options. In 2020, he sells 125 of the shares for $85 per share. Indicate the tax consequences of the events in 2018, 2019, and 2020 on Mr. Farrow's Net Income For Tax Purposes and on his Taxable Income. Where relevant, identity these effects separately. 5 poin QUESTION 2 Deborah Ekert is employed as a salesperson and receives some of her compensation in the form of commissions. During the curent year, her salary totaled S85,000 and her commissions totaled $8.400. Her employment related expenses during this period were as follown Capital Cost Allowance On Car Interest On Car Loan Traveling Expenses Promotion And Advertising Chent Entertainment (1/2)(Actual Costs OF $5.200) Total Avalable eductions $2,850 1,075 10,300 5,600 2.600 $22 425 *The car is uned exclunively for employment related activities. Ms. Ekert meets the conditions for deducting employment income expenses. Grven the proceding information, determine Ms. Ekart's minimum net emolovment income for the current yoar. Explain your conciusions

Step by Step Solution

★★★★★

3.42 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Question 1 A When options were granted Grant of the options in 2018 doesnt affect Net Income For Tax Purposes orTaxable Income B When options were exc...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started