Answered step by step

Verified Expert Solution

Question

1 Approved Answer

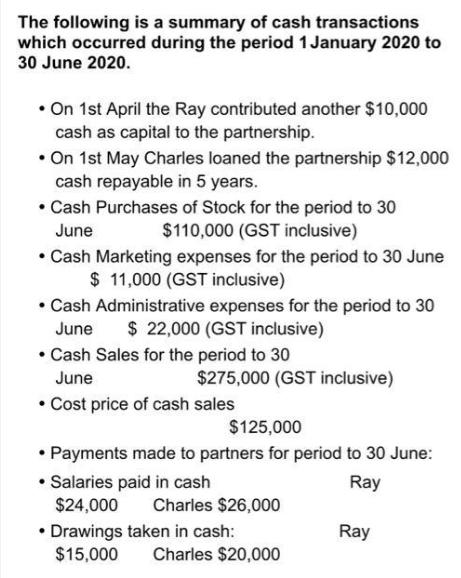

The following is a summary of cash transactions which occurred during the period 1 January 2020 to 30 June 2020. On 1st April the

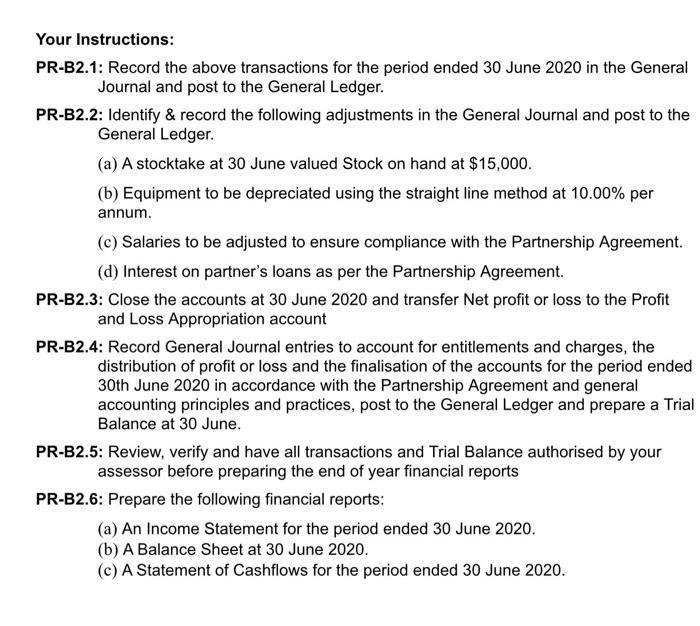

The following is a summary of cash transactions which occurred during the period 1 January 2020 to 30 June 2020. On 1st April the Ray contributed another $10,000 cash as capital to the partnership. On 1st May Charles loaned the partnership $12,000 cash repayable in 5 years. Cash Purchases of Stock for the period to 30 June $110,000 (GST inclusive) Cash Marketing expenses for the period to 30 June $ 11,000 (GST inclusive) Cash Administrative expenses for the period to 30 June $ 22,000 (GST inclusive) Cash Sales for the period to 30 June Cost price of cash sales $275,000 (GST inclusive) $125,000 Payments made to partners for period to 30 June: Ray Salaries paid in cash $24,000 Charles $26,000 Drawings taken in cash: $15,000 Charles $20,000 Ray Your Instructions: PR-B2.1: Record the above transactions for the period ended 30 June 2020 in the General Journal and post to the General Ledger. PR-B2.2: Identify & record the following adjustments in the General Journal and post to the General Ledger. (a) A stocktake at 30 June valued Stock on hand at $15,000. (b) Equipment to be depreciated using the straight line method at 10.00% per annum. (c) Salaries to be adjusted to ensure compliance with the Partnership Agreement. (d) Interest on partner's loans as per the Partnership Agreement. PR-B2.3: Close the accounts at 30 June 2020 and transfer Net profit or loss to the Profit and Loss Appropriation account PR-B2.4: Record General Journal entries to account for entitlements and charges, the distribution of profit or loss and the finalisation of the accounts for the period ended 30th June 2020 in accordance with the Partnership Agreement and general accounting principles and practices, post to the General Ledger and prepare a Trial Balance at 30 June. PR-B2.5: Review, verify and have all transactions and Trial Balance authorised by your assessor before preparing the end of year financial reports PR-B2.6: Prepare the following financial reports: (a) An Income Statement for the period ended 30 June 2020. (b) A Balance Sheet at 30 June 2020. (c) A Statement of Cashflows for the period ended 30 June 2020.

Step by Step Solution

★★★★★

3.37 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

journal entries for the transactions and adjustments as well as the financial statements Journal Entries PRB21 DateAccountDebitCreditDescription 20200...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started