Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Pretty-Fast Company Limited (PF) is a Hong Kong company operating online stores for fashion and footwear. PF wholly owns two garment manufacturing companies, Company

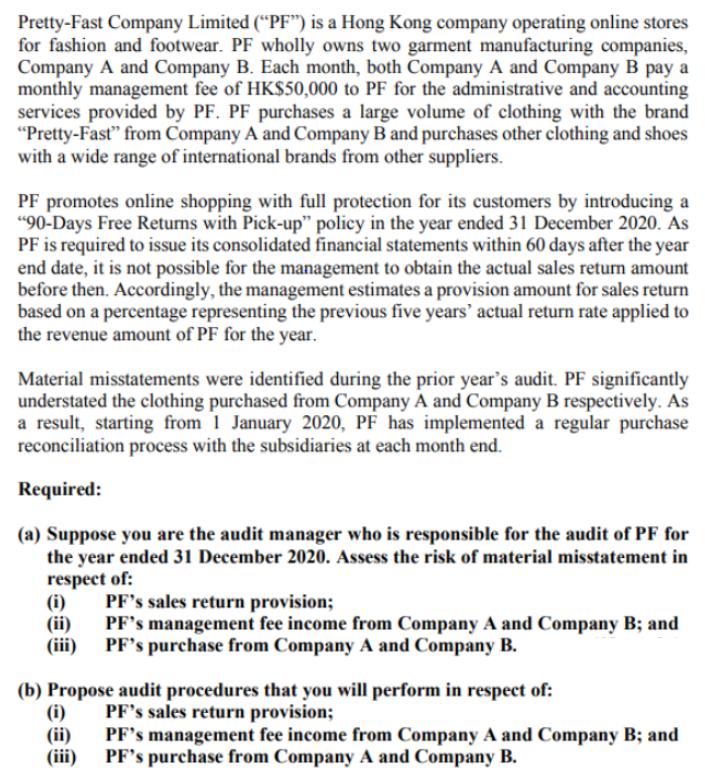

Pretty-Fast Company Limited ("PF") is a Hong Kong company operating online stores for fashion and footwear. PF wholly owns two garment manufacturing companies, Company A and Company B. Each month, both Company A and Company B pay a monthly management fee of HK$50,000 to PF for the administrative and accounting services provided by PF. PF purchases a large volume of clothing with the brand "Pretty-Fast" from Company A and Company B and purchases other clothing and shoes with a wide range of international brands from other suppliers. PF promotes online shopping with full protection for its customers by introducing a "90-Days Free Returns with Pick-up" policy in the year ended 31 December 2020. As PF is required to issue its consolidated financial statements within 60 days after the year end date, it is not possible for the management to obtain the actual sales return amount before then. Accordingly, the management estimates a provision amount for sales return based on a percentage representing the previous five years' actual return rate applied to the revenue amount of PF for the year. Material misstatements were identified during the prior year's audit. PF significantly understated the clothing purchased from Company A and Company B respectively. As a result, starting from 1 January 2020, PF has implemented a regular purchase reconciliation process with the subsidiaries at each month end. Required: (a) Suppose you are the audit manager who is responsible for the audit of PF for the year ended 31 December 2020. Assess the risk of material misstatement in respect of: (i) (ii) (iii) PF's sales return provision; PF's management fee income from Company A and Company B; and PF's purchase from Company A and Company B. (b) Propose audit procedures that you will perform in respect of: (i) (ii) (iii) PF's sales return provision; PF's management fee income from Company A and Company B; and PF's purchase from Company A and Company B.

Step by Step Solution

★★★★★

3.48 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Facts of The case PURCHASES 1 PF wholly owns two garment manufacturing companiesCompany A and Company B 2 PF purchases a large volume of clothing with ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started