Answered step by step

Verified Expert Solution

Question

1 Approved Answer

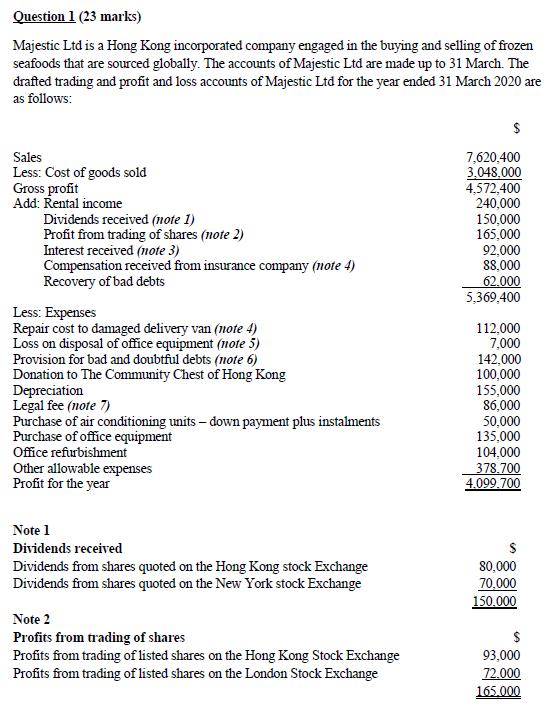

Question 1 (23 marks) Majestic Ltd is a Hong Kong incorporated company engaged in the buying and selling of frozen seafoods that are sourced

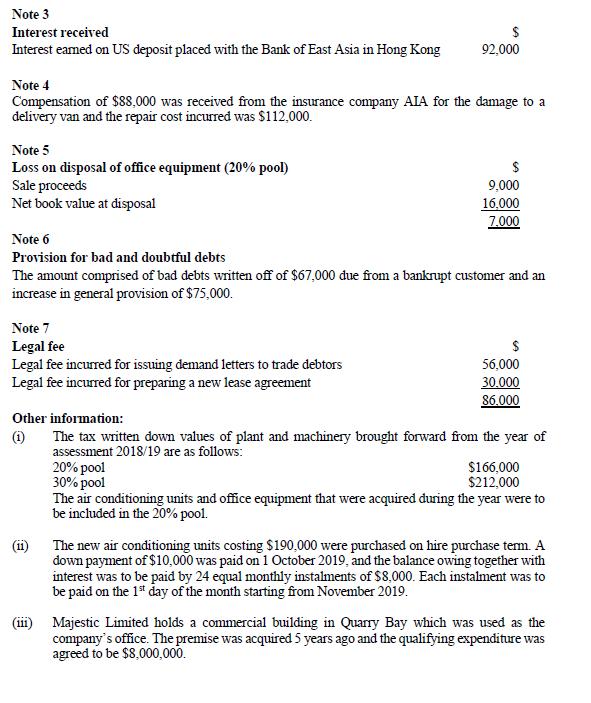

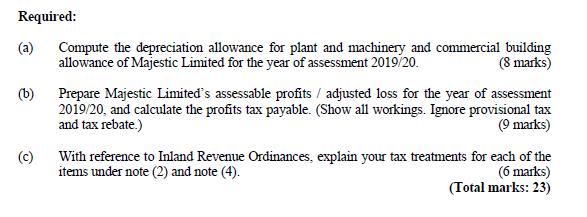

Question 1 (23 marks) Majestic Ltd is a Hong Kong incorporated company engaged in the buying and selling of frozen seafoods that are sourced globally. The accounts of Majestic Ltd are made up to 31 March. The drafted trading and profit and loss accounts of Majestic Ltd for the year ended 31 March 2020 are as follows: Sales Less: Cost of goods sold Gross profit Add: Rental income Dividends received (note 1) Profit from trading of shares (note 2) Interest received (note 3) Compensation received from insurance company (note 4) Recovery of bad debts Less: Expenses Repair cost to damaged delivery van (note 4) Loss on disposal of office equipment (note 5) Provision for bad and doubtful debts (note 6) Donation to The Community Chest of Hong Kong Depreciation Legal fee (note 7) Purchase of air conditioning units - down payment plus instalments Purchase of office equipment Office refurbishment Other allowable expenses Profit for the year Note 1 Dividends received Dividends from shares quoted on the Hong Kong stock Exchange Dividends from shares quoted on the New York stock Exchange Note 2 Profits from trading of shares Profits from trading of listed shares on the Hong Kong Stock Exchange Profits from trading of listed shares on the London Stock Exchange $ 7,620,400 3,048,000 4,572,400 240,000 150,000 165,000 92,000 88,000 62.000 5,369,400 112,000 7,000 142,000 100,000 155,000 86,000 50,000 135,000 104,000 378.700 4.099.700 80,000 70,000 150.000 $ 93,000 72.000 165.000 Note 3 Interest received Interest earned on US deposit placed with the Bank of East Asia in Hong Kong Note 4 Compensation of $88,000 was received from the insurance company AIA for the damage to a delivery van and the repair cost incurred was $112,000. Note 5 Loss on disposal of office equipment (20% pool) Sale proceeds Net book value at disposal 92,000 Note 7 Legal fee Legal fee incurred for issuing demand letters to trade debtors Legal fee incurred for preparing a new lease agreement $ 9,000 16,000 7.000 Note 6 Provision for bad and doubtful debts The amount comprised of bad debts written off of $67,000 due from a bankrupt customer and an increase in general provision of $75,000. 56,000 30.000 86.000 Other information: The tax written down values of plant and machinery brought forward from the year of assessment 2018/19 are as follows: $166,000 $212,000 20% pool 30% pool The air conditioning units and office equipment that were acquired during the year were to be included in the 20% pool. (11) The new air conditioning units costing $190,000 were purchased on hire purchase term. A down payment of $10,000 was paid on 1 October 2019, and the balance owing together with interest was to be paid by 24 equal monthly instalments of $8,000. Each instalment was to be paid on the 1st day of the month starting from November 2019. (111) Majestic Limited holds a commercial building in Quarry Bay which was used as the company's office. The premise was acquired 5 years ago and the qualifying expenditure was agreed to be $8,000,000. Required: (a) (b) (c) Compute the depreciation allowance for plant and machinery and commercial building allowance of Majestic Limited for the year of assessment 2019/20 (8 marks) Prepare Majestic Limited's assessable profits / adjusted loss for the year of assessment 2019/20, and calculate the profits tax payable. (Show all workings. Ignore provisional tax and tax rebate.) (9 marks) With reference to Inland Revenue Ordinances, explain your tax treatments for each of the items under note (2) and note (4). (6 marks) (Total marks: 23)

Step by Step Solution

★★★★★

3.37 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

aThe depreciation allowance for plant and machinery is 166000 212000 378700 The commerci...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started