accounting principles (answers are below but I want to know how I can get these answers)

Answer is below but I want to know how I can get these answers

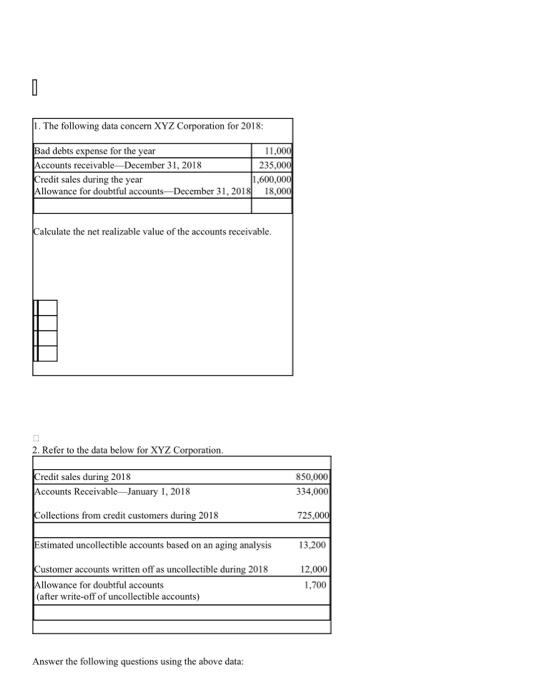

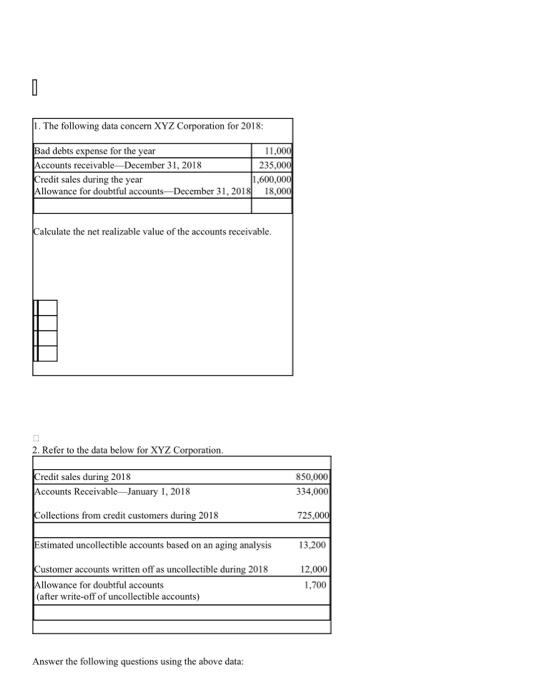

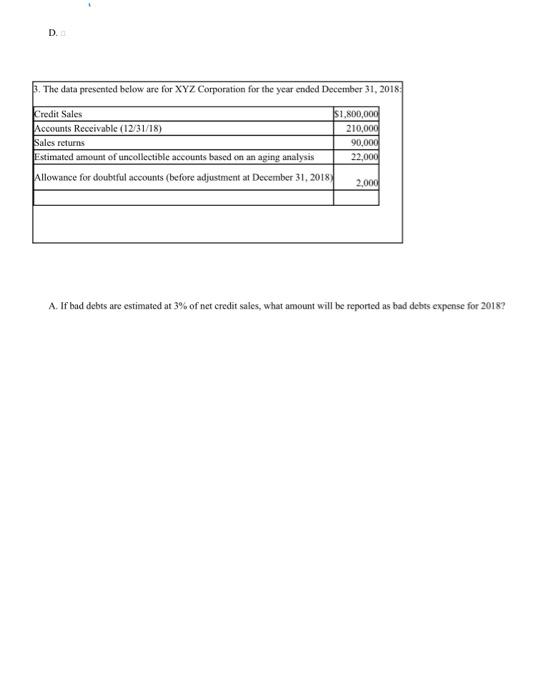

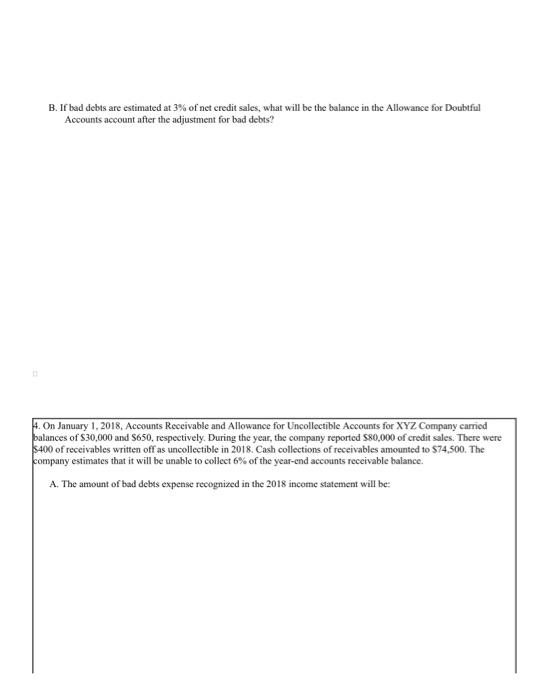

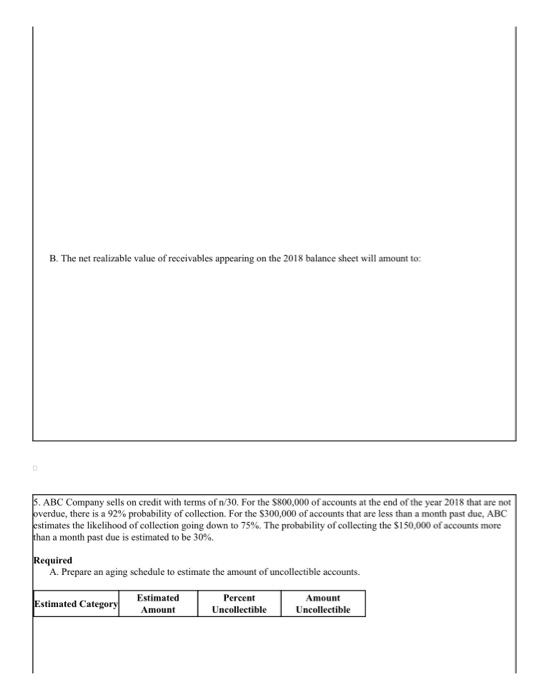

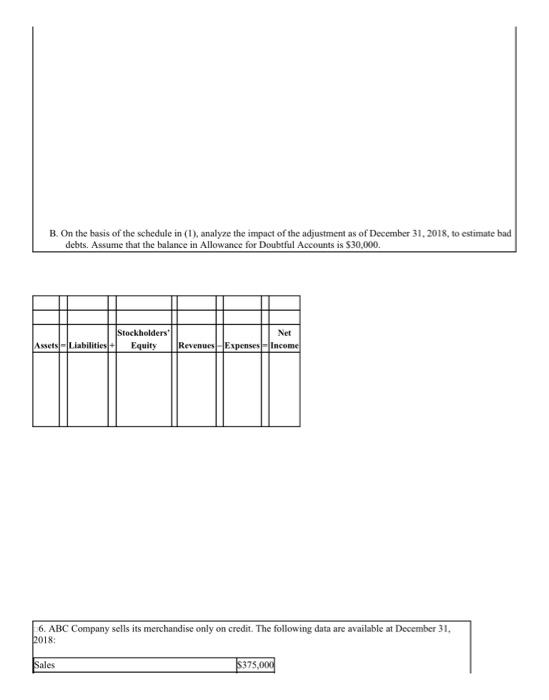

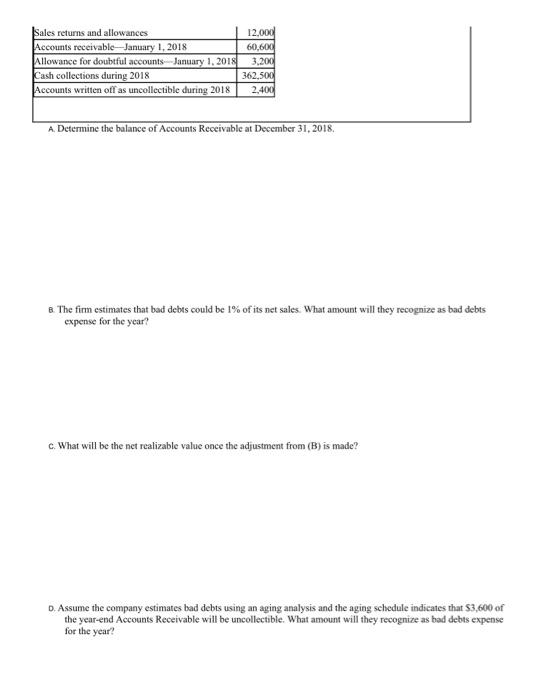

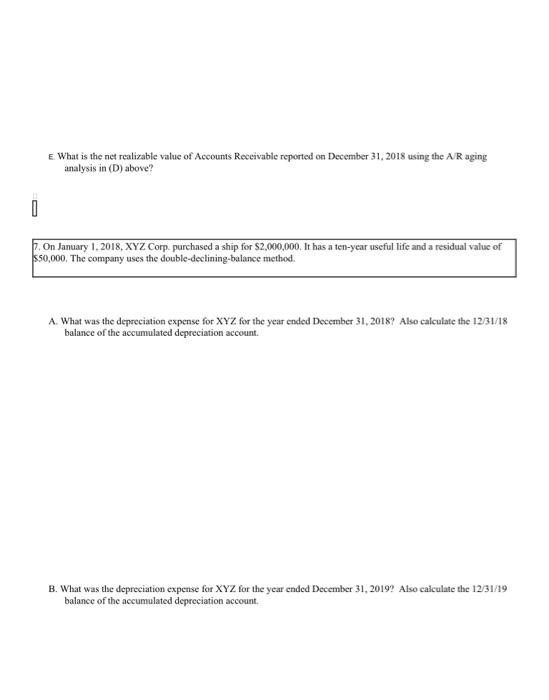

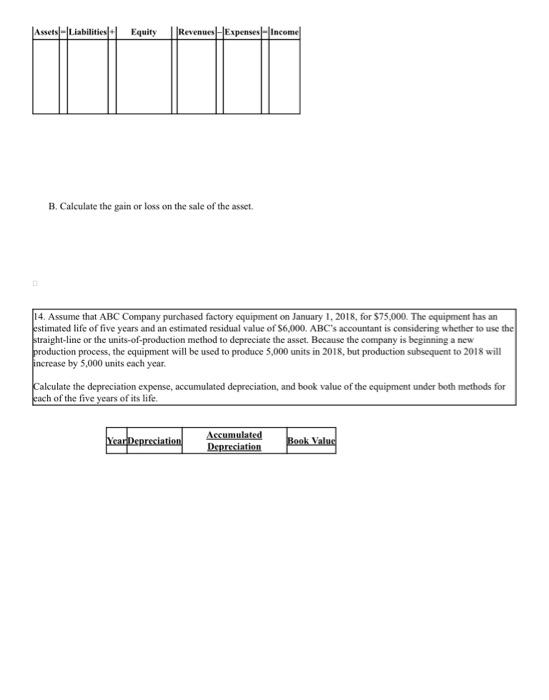

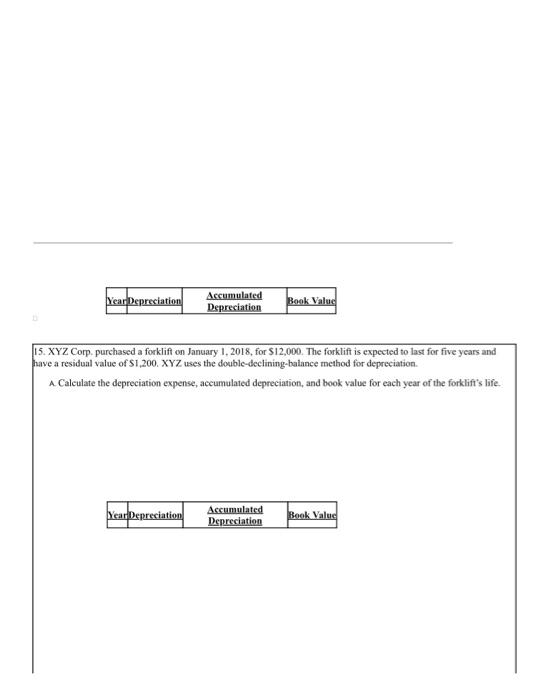

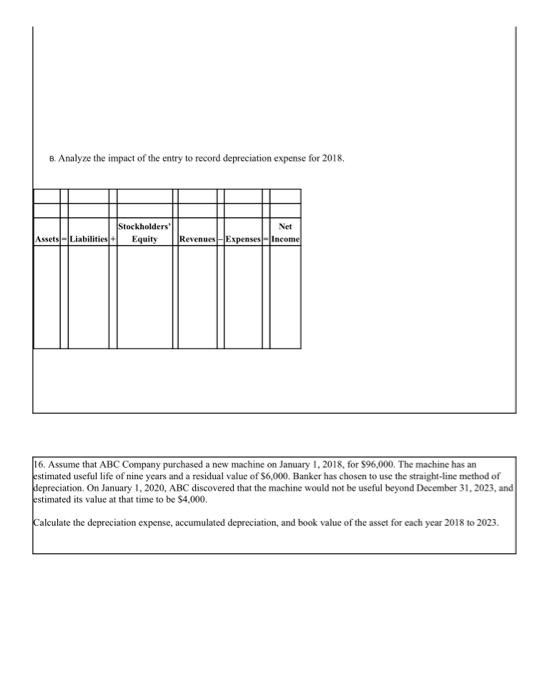

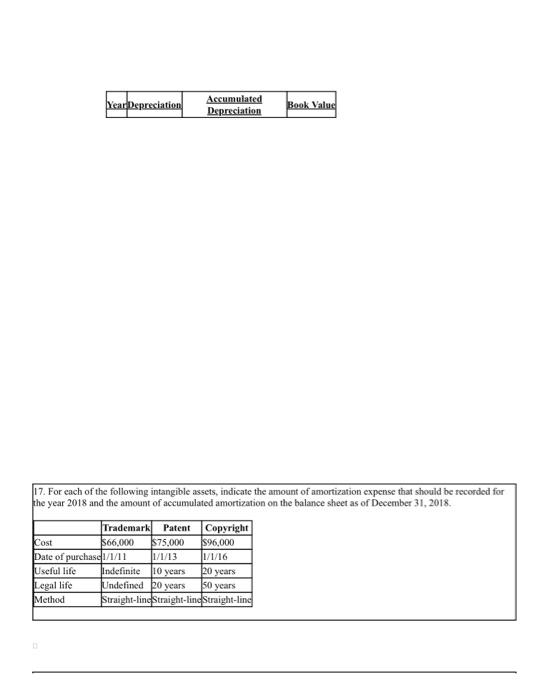

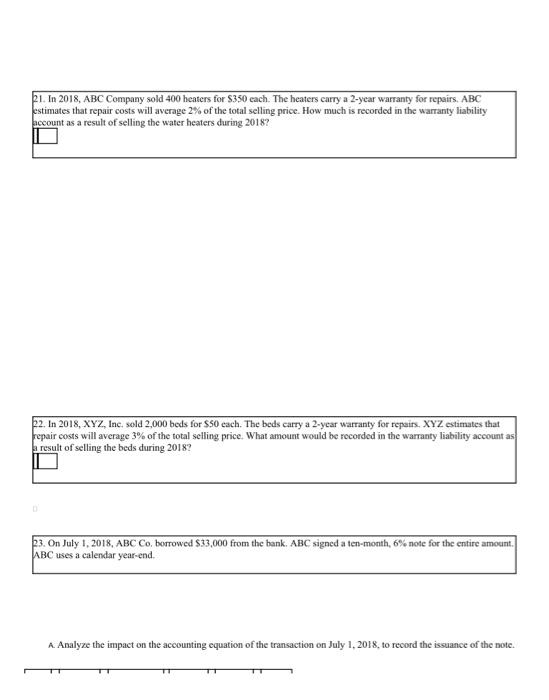

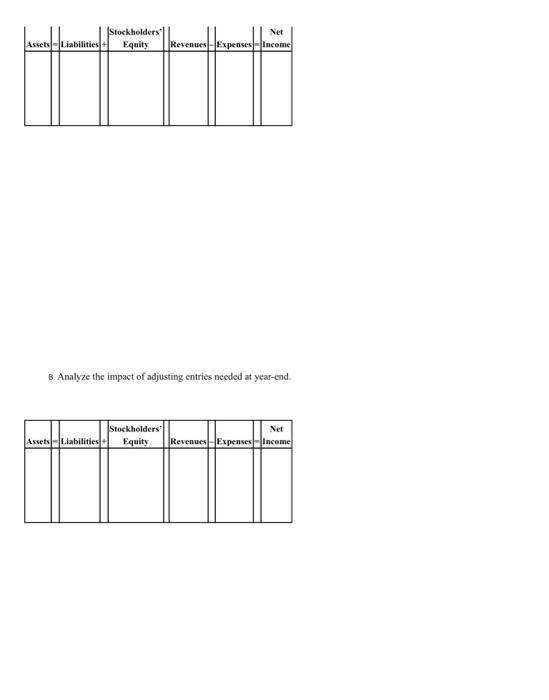

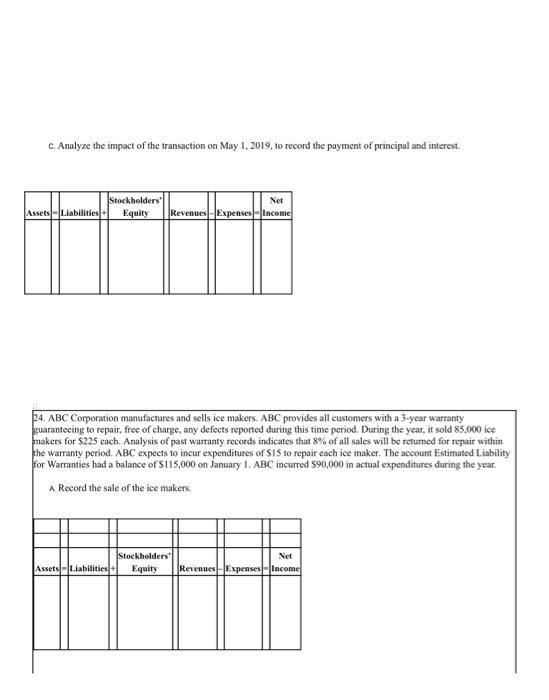

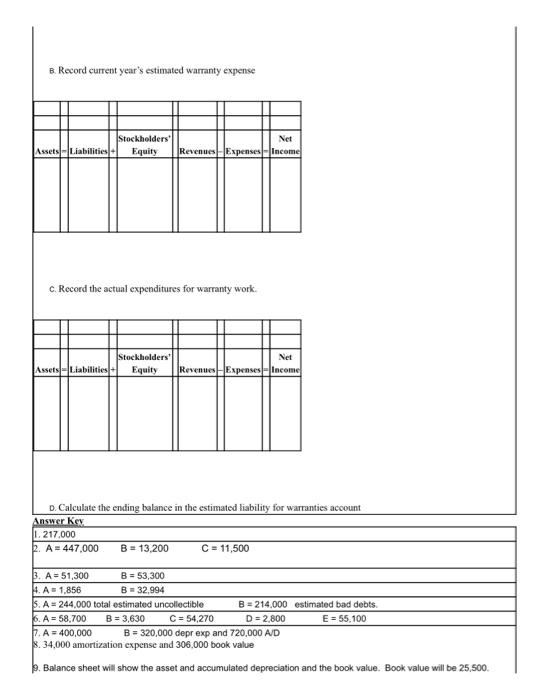

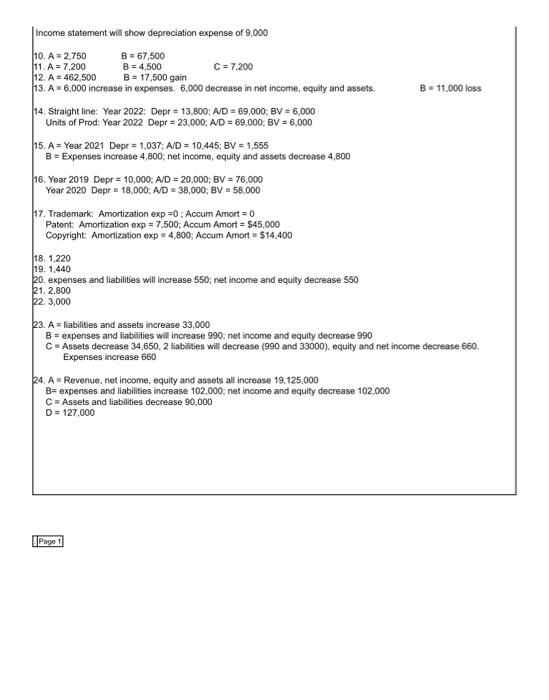

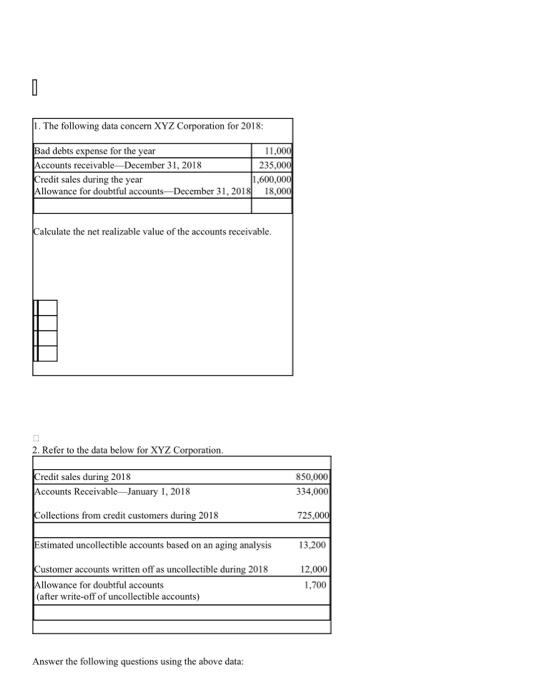

2. Refer to the data below for XYZ Corporation. Answer the following questions using the above data: A. What is the balance of Aceounts Receivable at December 31, 2018? B. If the aging approach is used to estimate bad debts, what should the balance in Allowance for Doubtfiul Accounts be after the bad debts adjustment? C. If the aging approach is used to estimate bad debts, what amount should be recorded as bed debts expense for 2018? 3. The data presented below are for XYZ Corporation for the year ended December 31, 2018: A. If bad debts are estimated at 3% of net credit sales, what amount will be reported as bad debts expense for 2018 ? B. If bad debis are estimated at 3% of net credit sales, what will be the balance in the Allowance for Doubtfu] Accounts account after the adjustment for bad debts? 4. On January 1, 2018, Accounts Receivable and Allowance for Uncollectible Accounrs for XYZ Company carned balances of $30,000 and $650, respectively. During the year, the company reported 580,000 of credit sales. There were 5400 of receivables written off as uncollectible in 2018 . Cash collections of receivables amounted to $74,500. The company estimates that it will be unable to collect 6% of the year-cnd accounts receivable balance. A. The amount of bad debts expense recognized in the 2018 income statement will be: B. The net realiable value of receivables appearing on the 2018 balance sheet will amount to: 5. ABC Company sells on credit with terms of n/30. For the $800,000 of accounts at the end of the year 2018 that are not overduc, there is a 92% probability of collection. For the $300,000 of accounts that are less than a month past due, ABC estimates the likelihood of collection going down to 75%. The probability of collecting the $150,0000 of accoumts more than a month past due is estimated to be 30%. Required A. Prepare an aging sehedule to estimate the amount of uncollectible accounts. 6. ABC Company sells its merchandise only on credit. The following data are available at December 31 . 2018 A. Determine the balance of Accounts Receivable at December 31, 2018. 8. The firm estimates that bad debts could be 1% of its net sales. What amount will they recognize as bad debts expense for the year? c. What will be the net realizable value once the adjustment from ( B ) is made? D. Assume the company estimates bad debts using an aging analysis and the aging schedule indicates that 53,600 of the year-end Accounts Receivable will be uncollectible. What amount will they recognize as bad debts expense for the year? E. What is the net realizable value of Accounts Receivable reported on December 31,2018 using the AR aging analysis in (D) above? 7, On January 1, 2018, XYZ Corp. purchased a ship for $2,000,000, It has a ten-year useful life and a residual value of 550,000 . The company uses the double-declining-balance method. A. What was the depreciation expense for XYZ for the year ended December 31,2018 ? Also calculate the 12/31/18 balance of the accumulated depreciation account. B. What was the depreciation expense for XYZ for the year ended December 31,2019 ? Also calculate the 12/31/19 balance of the accumulated depreciation account. 8. ABC Stores perchased a trademark at the beginning of 2018 for $340,000. Ecoaomic benefits were expected for ten years, but the trademark's legal life was 20 years. Also, during 2018, ABC incurred research and development costs of 5200,000. Calculare the amortization expense and the book value of the trademarks at December 31,2018. 9. XYZ Co. purchased a truck on January 1,2016 , for $48,000. The company decided to depreciate the truck over a fiveyear period using the straight-line method. The company estimated its residual value at $3,000. $how how the costs should be presented on the balance sheet and income statement for the full year ended June 30, 2018. Label the statements properly. 10. ABC Corp. purchased machinery with a cost of $70,0000 at the beginning of 2018 . The machinery has an estimated life of 25 years or 25,000 units of product. The estimated residual value is 57,500 . During 2018, 1,100 units of product were produced with this machinery. A. Using units of production depreciation, calculate the total accumulated depreciation at 12/31/18. B. Using straight line depreciation, calculate the book value of the machine at the end of 2018 . 11. DEF, Inc. purchased slot machines at the beginning of 2018 for $20,000. The machines have an estimated residual value of $2,000 and an estimated life of five years or 20,000 hours of operation. A. Using straight line depreciation, calculate the total accumulated depreciation at 12/31/19. B. Using units of production depreciation, calculate depreciation expense for 2018. Assume the machines operate at 5,000 ours in 2018 . C. Using double declining balance depreciation, calculate the book value of the machine at 12/31/19. 12. XYZ Co, purchased new trucks at the beginning of 2018 for $600,000. The trucks had an estimated life of four years and an estimated residual value of 550,000 . They use straight-line depreciation. At the beginning of 2019,XYZ sold the rucks for $480,000 and purchased new trucks for $700,000. A. Calculate book value of the trucks at the end of 2018 . B. Calculate the gain (loss) on the sale of the trucks at the beginning of 2019. Calculate the amount and indicate if it is a gain or a loss. 13. ABC Inc, purchased a truck on Janwary 1, 2018 for $40,000. The truck had an estimated life of six years and an estimated salvage value of $4,000. ABC uses the straight-line method to depreciate the asse. On July 1, 2020, the tnuck was sold for $14,000 cash. A. Determine the effect on the accounting equation upon recording the depreciation for 2018. B. Calculate the gain or loss on the sale of the asset. 14. Assume that ABC Company purchased factory equipment on January 1, 2018, for $75,000. The equipment has an estimated life of five years and an estimated residual value of $6,000.ABC 's accountant is considering whether to use the straight-line or the units-of-production method to depreciate the asset. Because the company is beginning a new production process, the equipment will be used to produce 5,000 units in 2018 , but production subsequent to 2018 will increase by 5,000 units each year. Calculate the depreciation expense, accumulated depreciation, and book value of the equipment under both methods for cach of the five years of its life. 15. XYZ Corp. purchased a forklift on January 1,2018 , for $12,000. The forklift is expected to last for five years and have a residual value of $1,200.XYZ uses the double-dechining balance method for depreciation. A. Calculate the depreciation expense, aceumulated depreciation, and book value for each year of the forklift's life. B. Analyze the impact of the entry to record depreciation expense for 2018 . 16. Assume that ABC Company purchased a new machine on January 1, 2018, for $96,000. The machine has an estimated useful life of nine years and a residual value of $6,000. Banker has chosen to use the straight-line method of depreciation. On January 1, 2020, ABC discovered that the machine would not be useful beyond December 31 , 2023, and estimated its value at that time to be $4.000. Calculate the depreciation expense, accumulated depreciation, and book value of the asset for each year 2018 to 2023. 17. For each of the following intangible assets, indicate the amount of amortization expense that should be recorded for the year 2018 and the amount of accumulated amortization on the balance sheet as of December 31,2018. 18. ABC Company purchased an asset on January 1,2016, for $10,000. The asset was expected to have a ten-year life and a $1,000 salvage value. The company uses the straight-line method of depreciation. On January 1, 2018, the company made a major repair to the asset of $5,000, extending its life. The asset is expected to last ten years from January 1,2018 . Calculate the amount of depreciation for 2018 . 19. XYZ Company purchased an asset on January 1, 2016, for $10,000. The asset was expected to have a ten-year life and a $1,000 salvage value. The company uses the straight-line method of depreciation. On January 1, 2018, the company determines that the asset will last only five more years. Calculate the amount of depreciation for 2018 . 20. On November 1, ABC Corporation borrowed $55,000 from a bank and signed a 12\%, 90-day note payable in the amount of $55,000. If you assume 360 days in year, the November 30 adjustment will 21. In 2018, ABC Company sold 400 heaters for $350 each. The heaters carry a 2-year warranty for repairs. ABC estimates that repair costs will average 2% of the total selling price. How much is recorded in the warranty liability account as a result of selling the water heaters during 2018 ? 22. In 2018, XYZ, Inc. sold 2,000 beds for $50 each. The beds carry a 2-year warranty for repairs. XYZ estimates that repair costs will average 3% of the total selling price. What amount would be rocorded in the warranty liability account as result of selling the beds during 2018 ? 23. On July 1, 2018, ABC Co, borrowed $33,000 from the bank. ABC signed a ten-month, 6% note for the entire amount. ABC uses a calendar year-end. A. Analyze the impact on the accounting equation of the transaction on July 1,2018 , to record the issuance of the note. B. Analyze the impact of adjusting entries needed at year-end. C. Analyze the impact of the transaction on May 1, 2019, to record the payment of principal and interest. 24. ABC Corporation manufactures and sells ice makers. ABC provides all customers with a 3-year warranty guarantecing to repair, free of charge, any defects reported during this time period. During the year, it sold 85,000 ice makers for $225 cach. Analysis of past warranty records indicates that 8% of all sales will be returned for repair within the warranty period. ABC expects to incur expenditures of $15 to repair each ice maker. The account Estimated Liability for Warranties had a balance of $115,000 on January 1. ABC incurred 590,000 in actual expenditures during the year. A. Record the sale of the ice makers. B. Record current year's estimated warranty expense c. Record the actual expenditures for warranty work. D. Calculate the ending balance in the estimated liability Income statement will show depreciation expense of 9,000 10. A=2,750 B=67,500 11. A=7,200 B=4,500 C=7,200 12. A=462,500B=17,500 gain 13. A=6,000 increase in expenses. 6,000 decrease in net income, equily and assets. B=11.000loss 14. Straight line: Year 2022: Depr =13,800;AD=69,000;BV=6,000 Units of Prod: Year 2022 Dopr =23,000;AD=69,000;BV=6,000 15. A= Year 2021 Depr =1,037;AVD=10,445;BV=1,555 B = Expenses increase 4,800 ; net income, equity and assets decrease 4,800 16. Year 2019Depr=10,000;AV=20,000;BV=76,000 Year 2020 Depr =18,000;AD=38,000;BV=58,000 17. Trademark: Amortization exp =0 : Accum Amort =0 Patent: Amortization exp =7.500; Accum Amort =$45.000 Copyright: Amortization exp =4,800; Accum Amort =$14,400 18. 1,220 19. 1,440 20. expenses and liabilities will increase 550; net income and equily decrease 550 21. 2,800 22,3,000 23. A= liabilities and assets increase 33,000 B= expenses and liabilities will increase 990 ; net income and equity decrease 990 C= Assets decrease 34,650, 2 liabilties will decrease (990 and 33000), equity and net income decrease 660. Expenses increase 660 24. A= Revenue, net income, equity and assets all increase 19,125,000 B= expenses and liabilities increase 102,000 ; net income and equity decrease 102,000 C= Assets and liabilities decrease 90,000 D=127,000