Answered step by step

Verified Expert Solution

Question

1 Approved Answer

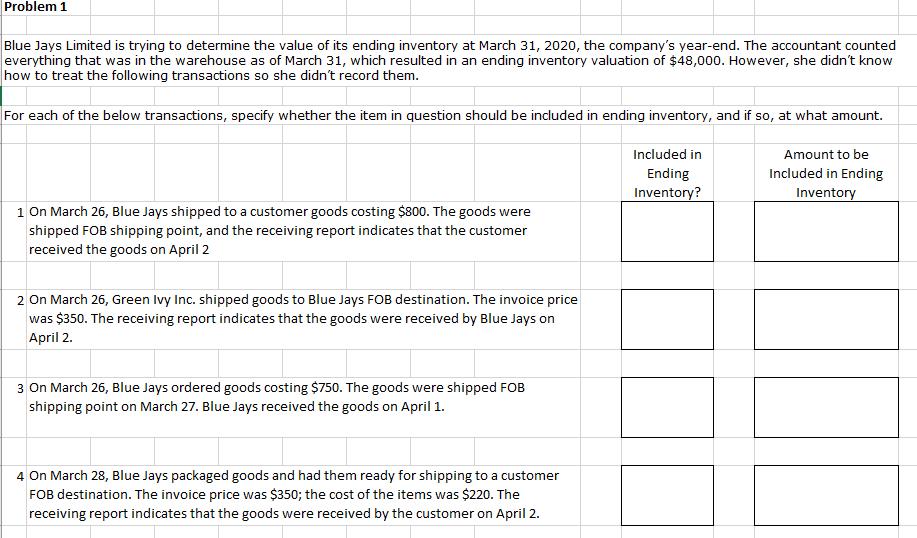

Problem 1 Blue Jays Limited is trying to determine the value of its ending inventory at March 31, 2020, the company's year-end. The accountant

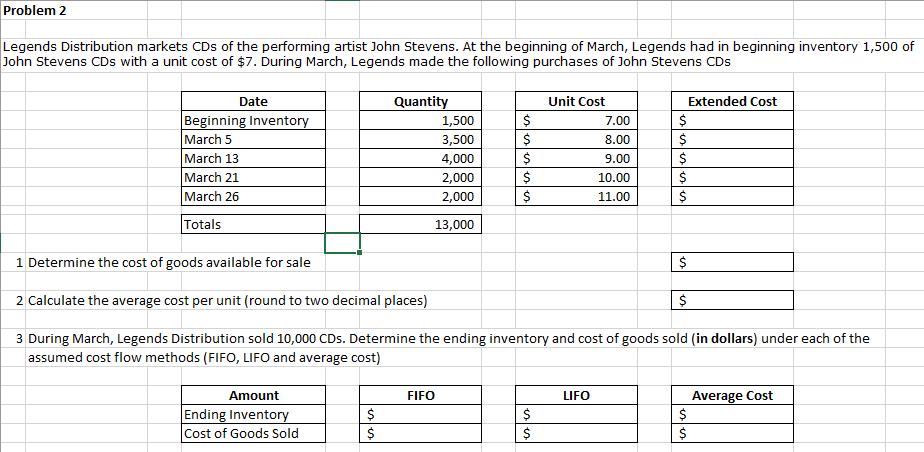

Problem 1 Blue Jays Limited is trying to determine the value of its ending inventory at March 31, 2020, the company's year-end. The accountant counted everything that was in the warehouse as of March 31, which resulted in an ending inventory valuation of $48,000. However, she didn't know how to treat the following transactions so she didn't record them. For each of the below transactions, specify whether the item in question should be included in ending inventory, and if so, at what amount. Included in Amount to be Included in Ending Inventory Ending Inventory? 1 On March 26, Blue Jays shipped to a customer goods costing $800. The goods were shipped FOB shipping point, and the receiving report indicates that the customer received the goods on April 2 2 On March 26, Green Ivy Inc. shipped goods to Blue Jays FOB destination. The invoice price was $350. The receiving report indicates that the goods were received by Blue Jays on April 2. 3 On March 26, Blue Jays ordered goods costing $750. The goods were shipped FOB shipping point on March 27. Blue Jays received the goods on April 1. 4 On March 28, Blue Jays packaged goods and had them ready for shipping to a customer FOB destination. The invoice price was $350; the cost of the items was $220. The receiving report indicates that the goods were received by the customer on April 2. Problem 2 Legends Distribution markets CDs of the performing artist John Stevens. At the beginning of March, Legends had in beginning inventory 1,500 of John Stevens CDs with a unit cost of $7. During March, Legends made the following purchases of John Stevens CDs Quantity 1,500 Unit Cost Extended Cost Date Beginning Inventory March 5 March 13 March 21 $ $ $ $4 $ 7.00 3,500 8.00 4,000 9.00 $ 2,000 10.00 March 26 2,000 11.00 Totals 13,000 1 Determine the cost of goods available for sale 2 Calculate the average cost per unit (round to two decimal places) 3 During March, Legends Distribution sold 10,000 CDs. Determine the ending inventory and cost of goods sold (in dollars) under each of the assumed cost flow methods (FIFO, LIFO and average cost) Average Cost $ Amount FIFO LIFO Ending Inventory Cost of Goods Sold $ $

Step by Step Solution

★★★★★

3.38 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Problem 1 1 Under FOB shipping point title transfers as soon as the seller delivers the item to a co...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started