Question

Geoffrey Adams Inc. sells canned fruit and vegetables in the state of Florida. GA uses the weighted average cost flow method for internal reporting

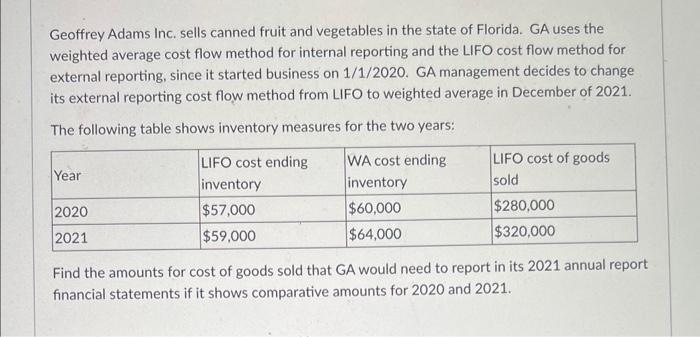

Geoffrey Adams Inc. sells canned fruit and vegetables in the state of Florida. GA uses the weighted average cost flow method for internal reporting and the LIFO cost flow method for external reporting, since it started business on 1/1/2020. GA management decides to change its external reporting cost flow method from LIFO to weighted average in December of 2021. The following table shows inventory measures for the two years: Year 2020 2021 LIFO cost ending inventory $57,000 $59,000 WA cost ending inventory $60,000 $64,000 LIFO cost of goods sold $280,000 $320,000 Find the amounts for cost of goods sold that GA would need to report in its 2021 annual report financial statements if it shows comparative amounts for 2020 and 2021.

Step by Step Solution

3.47 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Step 1 Exp...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Accounting What the Numbers Mean

Authors: David Marshall, Wayne McManus, Daniel Viele

11th edition

1259535312, 978-1259535314

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App