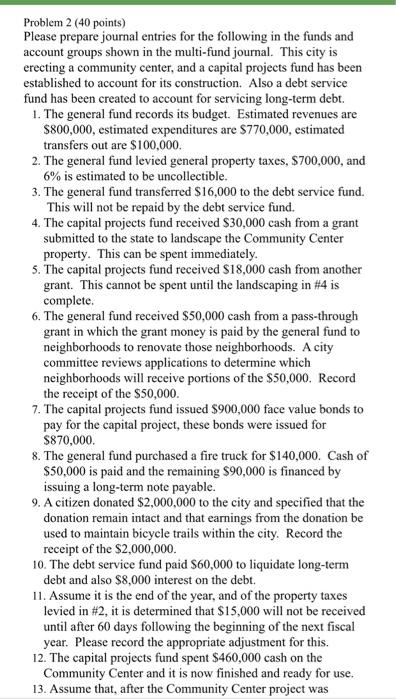

Question: Problem 2 (40 points) Please prepare journal entries for the following in the funds and account groups shown in the multi-fund journal. This city

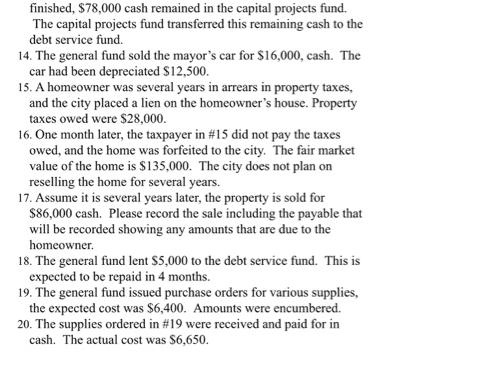

Problem 2 (40 points) Please prepare journal entries for the following in the funds and account groups shown in the multi-fund journal. This city is erecting a community center, and a capital projects fund has been established to account for its construction. Also a debt service fund has been created to account for servicing long-term debt. 1. The general fund records its budget. Estimated revenues are $800,000, estimated expenditures are $770,000, estimated transfers out are $100,000. 2. The general fund levied general property taxes, $700,000, and 6% is estimated to be uncollectible. 3. The general fund transferred $16,000 to the debt service fund. This will not be repaid by the debt service fund. 4. The capital projects fund received $30,000 cash from a grant submitted to the state to landscape the Community Center property. This can be spent immediately. 5. The capital projects fund received $18,000 cash from another grant. This cannot be spent until the landscaping in #4 is complete. 6. The general fund received $50,000 cash from a pass-through grant in which the grant money is paid by the general fund to neighborhoods to renovate those neighborhoods. A city committee reviews applications to determine which neighborhoods will receive portions of the $50,000. Record the receipt of the $50,000. 7. The capital projects fund issued $900,000 face value bonds to pay for the capital project, these bonds were issued for $870,000. 8. The general fund purchased a fire truck for $140,000. Cash of $50,000 is paid and the remaining $90,000 is financed by issuing a long-term note payable. 9. A citizen donated $2,000,000 to the city and specified that the donation remain intact and that earnings from the donation be used to maintain bicycle trails within the city. Record the receipt of the $2,000,000. 10. The debt service fund paid $60,000 to liquidate long-term debt and also $8,000 interest on the debt. 11. Assume it is the end of the year, and of the property taxes levied in #2, it is determined that $15,000 will not be received until after 60 days following the beginning of the next fiscal year. Please record the appropriate adjustment for this. 12. The capital projects fund spent $460,000 cash on the Community Center and it is now finished and ready for use. 13. Assume that, after the Community Center project was finished, $78,000 cash remained in the capital projects fund. The capital projects fund transferred this remaining cash to the debt service fund. 14. The general fund sold the mayor's car for $16,000, cash. The car had been depreciated $12,500. 15. A homeowner was several years in arrears in property taxes, and the city placed a lien on the homeowner's house. Property taxes owed were $28,000. 16. One month later, the taxpayer in #15 did not pay the taxes owed, and the home was forfeited to the city. The fair market value of the home is $135,000. The city does not plan on reselling the home for several years. 17. Assume it is several years later, the property is sold for $86,000 cash. Please record the sale including the payable that will be recorded showing any amounts that are due to the homeowner. 18. The general fund lent $5,000 to the debt service fund. This is expected to be repaid in 4 months. 19. The general fund issued purchase orders for various supplies, the expected cost was $6,400. Amounts were encumbered. 20. The supplies ordered in # 19 were received and paid for in cash. The actual cost was $6,650.

Step by Step Solution

There are 3 Steps involved in it

p 2 3 4 5 6 17 8 19 Sr No 10 11 12 13 14 15 16 17 18 19 20 Description No entry required as it is a ... View full answer

Get step-by-step solutions from verified subject matter experts