Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Parent bought all of the shares of Subsidiary as indicated below on December 31, 20X0. Sub's balance sheet at that time is shown below,

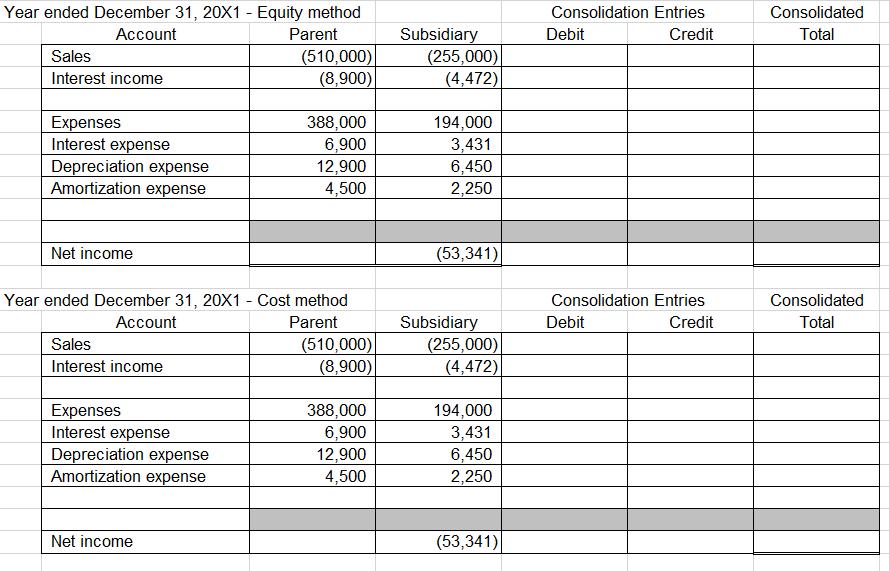

Parent bought all of the shares of Subsidiary as indicated below on December 31, 20X0. Sub's balance sheet at that time is shown below, along with the fair value (FV) of Sub's assets and liabilities at the date of acquisition. Cash Equipment Accumulated depreciation Other assets Patent Note receivable Goodwill Total Liabilities Note payable Common stock ($1 par) APIC Retain Earn Total Subsidiary Company Balance Sheet as of December 31, 20X0 NBV FMV Shares acquired Market value per share Useful life of equipment Useful life of patent Life of note receivable Interest rate of note receivable Interest rate on note payable Life of note payable Subsidiary's dividends 71,000 86,500 (22,000) 195,000 18,000 104,000 452,500 212,500 73,000 40,000 46,000 81,000 452,500 $ 71,000 85,000 195,000 24,000 109,200 79,500 563,700 212,500 75,200 276,000 563,700 36,000 6.90 10 8 4 4.30% 4.70% 4 16,000 Difference 20,500 6,000 5,200 79,500 111,200 2,200 109,000 111,200 Year ended December 31, 20X1 - Equity method Account Parent Sales Interest income Expenses Interest expense Depreciation expense Amortization expense Net income Sales Interest income Year ended December 31, 20X1 - Cost method Account Parent Expenses Interest expense Depreciation expense Amortization expense (510,000) (8,900) Net income 388,000 6,900 12,900 4,500 (510,000) (8,900) 388,000 6,900 12,900 4,500 Subsidiary (255,000) (4,472) 194,000 3,431 6,450 2,250 (53,341) Subsidiary (255,000) (4,472) 194,000 3,431 6,450 2,250 (53,341) Consolidation Entries Credit Debit Consolidation Entries Credit Debit Consolidated Total Consolidated Total

Step by Step Solution

★★★★★

3.38 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

LHS972 a 71d 5d 71d ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started