Kathy, an accrual basis taxpayer, operates a gym. She sells memberships that entitle the member to use the facilities at any time. A one-year

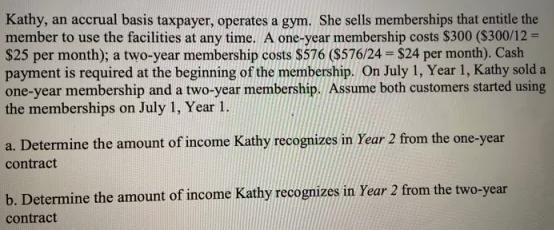

Kathy, an accrual basis taxpayer, operates a gym. She sells memberships that entitle the member to use the facilities at any time. A one-year membership costs $300 ($300/12 = $25 per month); a two-year membership costs $576 ($576/24 = $24 per month). Cash payment is required at the beginning of the membership. On July 1, Year 1, Kathy sold a one-year membership and a two-year membership. Assume both customers started using the memberships on July 1, Year 1. a. Determine the amount of income Kathy recognizes in Year 2 from the one-year contract b. Determine the amount of income Kathy recognizes in Year 2 from the two-year contract

Step by Step Solution

3.46 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Total gross income of kathy If Kathy is a cash basis taxpayer her gross income from the contracts ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started