Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PROBLEM On October 1, 2016, S Co. acquired 25,000 shares of the 100,000 outstanding ordinary shares of M Inc. for a total cost of

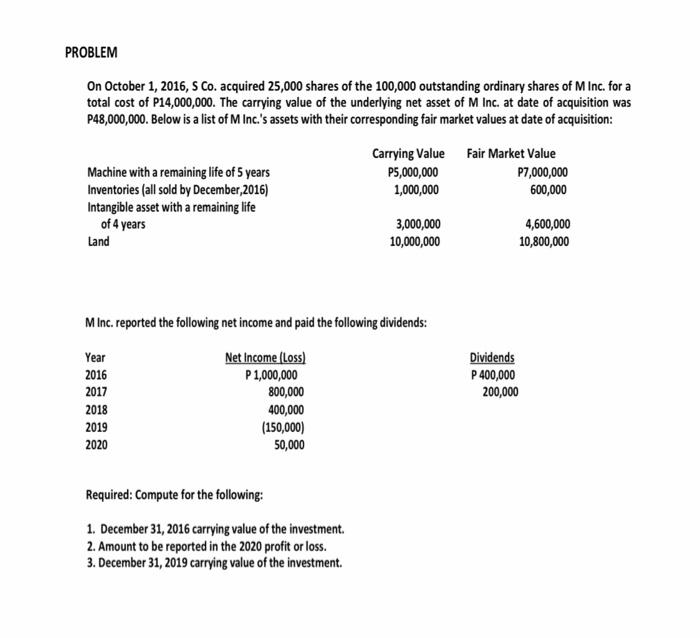

PROBLEM On October 1, 2016, S Co. acquired 25,000 shares of the 100,000 outstanding ordinary shares of M Inc. for a total cost of P14,000,000. The carrying value of the underlying net asset of M Inc. at date of acquisition was P48,000,000. Below is a list of M Inc.'s assets with their corresponding fair market values at date of acquisition: Machine with a remaining life of 5 years Inventories (all sold by December,2016) Intangible asset with a remaining life of 4 years Land Year 2016 2017 2018 2019 2020 M Inc. reported the following net income and paid the following dividends: Net Income (Loss) P 1,000,000 800,000 400,000 (150,000) 50,000 Carrying Value Fair Market Value P7,000,000 600,000 Required: Compute for the following: 1. December 31, 2016 carrying value of the investment. 2. Amount to be reported in the 2020 profit or loss. 3. December 31, 2019 carrying value of the investment. P5,000,000 1,000,000 3,000,000 10,000,000 Dividends P 400,000 200,000 4,600,000 10,800,000

Step by Step Solution

★★★★★

3.25 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

1Assuming profit of 9 month is not included in net assets Total net assets P48000000 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started