6. On August 31, 2022, you would like to hedge a long physical oil position that you plan to sell on November 23, 2022.

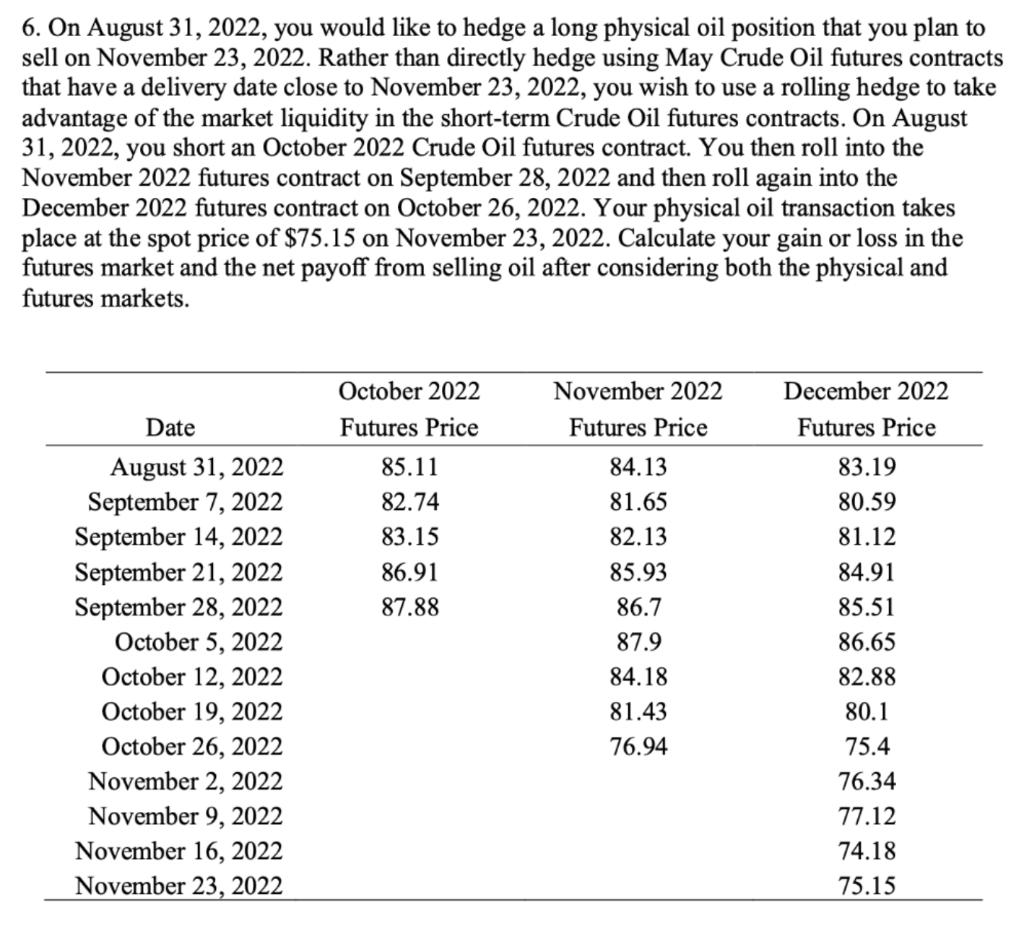

6. On August 31, 2022, you would like to hedge a long physical oil position that you plan to sell on November 23, 2022. Rather than directly hedge using May Crude Oil futures contracts that have a delivery date close to November 23, 2022, you wish to use a rolling hedge to take advantage of the market liquidity in the short-term Crude Oil futures contracts. On August 31, 2022, you short an October 2022 Crude Oil futures contract. You then roll into the November 2022 futures contract on September 28, 2022 and then roll again into the December 2022 futures contract on October 26, 2022. Your physical oil transaction takes place at the spot price of $75.15 on November 23, 2022. Calculate your gain or loss in the futures market and the net payoff from selling oil after considering both the physical and futures markets. Date August 31, 2022 September 7, 2022 September 14, 2022 September 21, 2022 September 28, 2022 October 5, 2022 October 12, 2022 October 19, 2022 October 26, 2022 November 2, 2022 November 9, 2022 November 16, 2022 November 23, 2022 October 2022 Futures Price 85.11 82.74 83.15 86.91 87.88 November 2022 Futures Price 84.13 81.65 82.13 85.93 86.7 87.9 84.18 81.43 76.94 December 2022 Futures Price 83.19 80.59 81.12 84.91 85.51 86.65 82.88 80.1 75.4 76.34 77.12 74.18 75.15

Step by Step Solution

3.43 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER Your gain or loss in the futures market would be 996 The net payoff from ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started