Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Project B Manorang Hijau Plantation (MIHP) will run a parallel Plantation Optimization program, at their site. Scale of CPO mill at MIHP is significantly

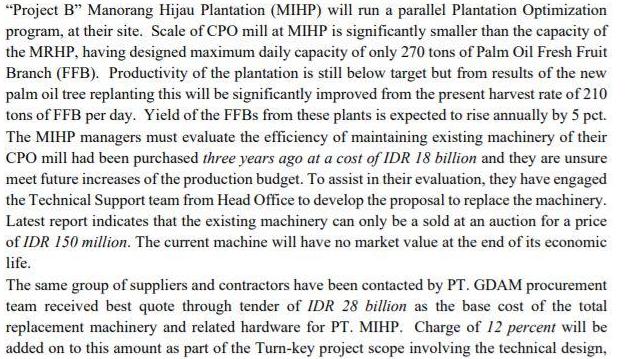

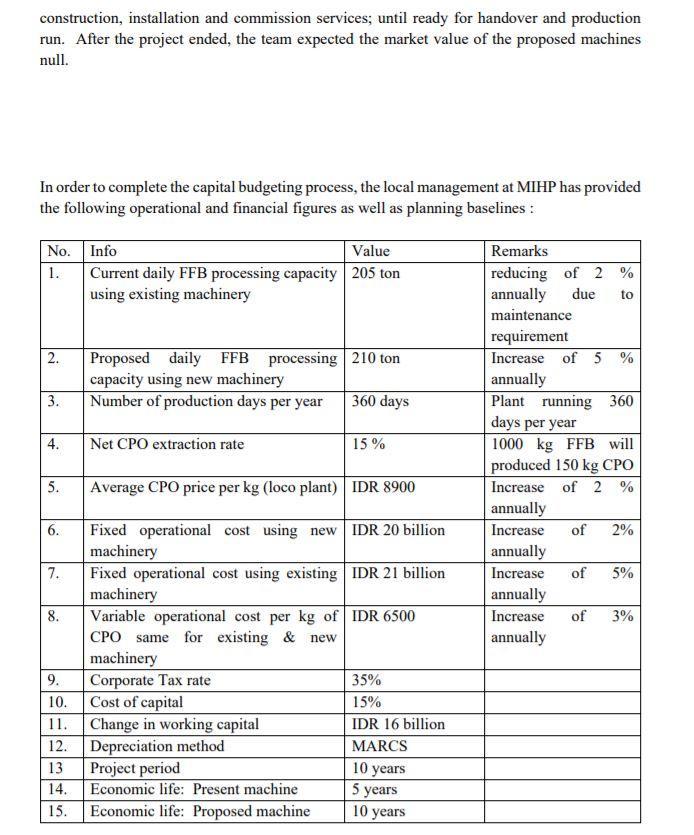

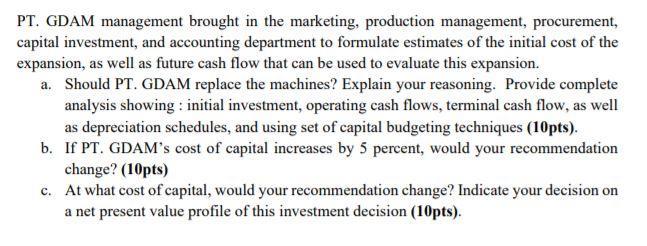

"Project B" Manorang Hijau Plantation (MIHP) will run a parallel Plantation Optimization program, at their site. Scale of CPO mill at MIHP is significantly smaller than the capacity of the MRHP, having designed maximum daily capacity of only 270 tons of Palm Oil Fresh Fruit Branch (FFB). Productivity of the plantation is still below target but from results of the new palm oil tree replanting this will be significantly improved from the present harvest rate of 210 tons of FFB per day. Yield of the FFBs from these plants is expected to rise annually by 5 pct. The MIHP managers must evaluate the efficiency of maintaining existing machinery of their CPO mill had been purchased three years ago at a cost of IDR 18 billion and they are unsure meet future increases of the production budget. To assist in their evaluation, they have engaged the Technical Support team from Head Office to develop the proposal to replace the machinery. Latest report indicates that the existing machinery can only be a sold at an auction for a price of IDR 150 million. The current machine will have no market value at the end of its economic life. The same group of suppliers and contractors have been contacted by PT. GDAM procurement team received best quote through tender of IDR 28 billion as the base cost of the total replacement machinery and related hardware for PT. MIHP. Charge of 12 percent will be added on to this amount as part of the Turn-key project scope involving the technical design, construction, installation and commission services; until ready for handover and production run. After the project ended, the team expected the market value of the proposed machines null. In order to complete the capital budgeting process, the local management at MIHP has provided the following operational and financial figures as well as planning baselines: No. Info 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13 14. 15. Value Current daily FFB processing capacity 205 ton using existing machinery Proposed daily FFB processing 210 ton capacity using new machinery Number of production days per year 360 days Net CPO extraction rate Average CPO price per kg (loco plant) Fixed operational cost using new machinery Fixed operational cost using existing machinery Variable operational cost per kg of CPO same for existing & new machinery Corporate Tax rate Cost of capital Change in working capital Depreciation method Project period Economic life: Present machine Economic life: Proposed machine 15% IDR 8900 IDR 20 billion IDR 21 billion IDR 6500 35% 15% IDR 16 billion MARCS 10 years 5 years 10 years Remarks reducing of 2% annually due to maintenance requirement Increase of 5% annually Plant running 360 days per year 1000 kg FFB will produced 150 kg CPO Increase of 2% annually Increase of 2% annually Increase of 5% annually Increase of 3% annually PT. GDAM management brought in the marketing, production management, procurement, capital investment, and accounting department to formulate estimates of the initial cost of the expansion, as well as future cash flow that can be used to evaluate this expansion. a. Should PT. GDAM replace the machines? Explain your reasoning. Provide complete analysis showing: initial investment, operating cash flows, terminal cash flow, as well as depreciation schedules, and using set of capital budgeting techniques (10pts). If PT. GDAM's cost of capital increases by 5 percent, would your recommendation change? (10pts) b. c. At what cost of capital, would your recommendation change? Indicate your decision on a net present value profile of this investment decision (10pts).

Step by Step Solution

★★★★★

3.41 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

A Should PT GDAM replace the machines Explain your reasoning Provide complete analysis showing initial investment operating cash flows terminal cash f...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started