Answered step by step

Verified Expert Solution

Question

1 Approved Answer

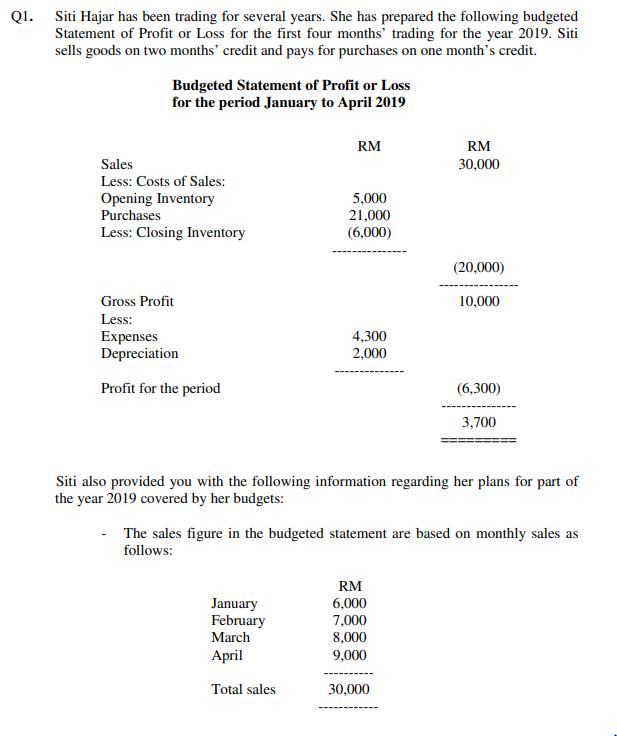

Ql. Siti Hajar has been trading for several years. She has prepared the following budgeted Statement of Profit or Loss for the first four

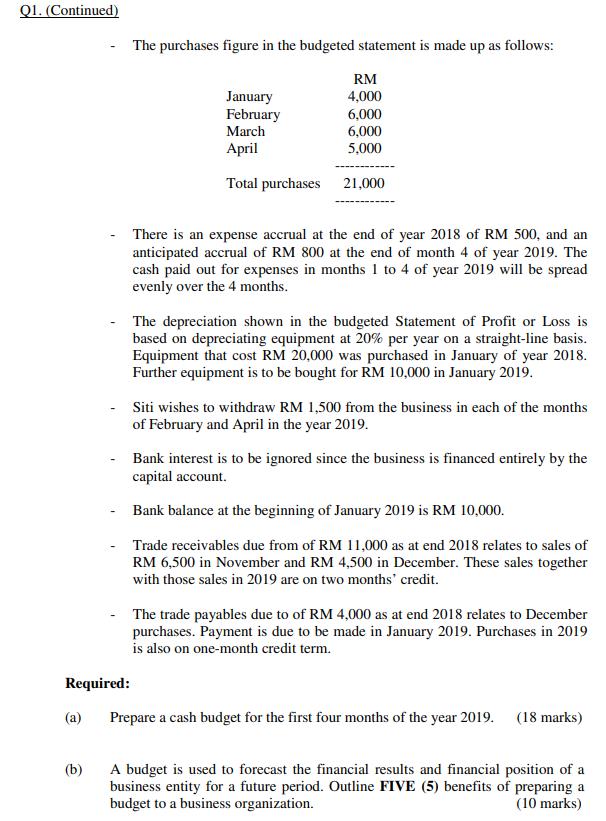

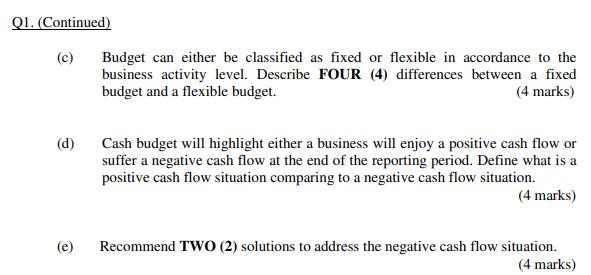

Ql. Siti Hajar has been trading for several years. She has prepared the following budgeted Statement of Profit or Loss for the first four months' trading for the year 2019. Siti sells goods on two months' credit and pays for purchases on one month's credit. Budgeted Statement of Profit or Loss for the period January to April 2019 RM RM Sales 30,000 Less: Costs of Sales: 5,000 21,000 (6,000) Opening Inventory Purchases Less: Closing Inventory (20,000) Gross Profit 10,000 Less: Expenses Depreciation 4,300 2,000 Profit for the period (6,300) 3,700 Siti also provided you with the following information regarding her plans for part of the year 2019 covered by her budgets: The sales figure in the budgeted statement are based on monthly sales as follows: RM January February 6,000 7,000 8,000 March April 9,000 Total sales 30,000 Q1. (Continued) The purchases figure in the budgeted statement is made up as follows: RM January February March April 4,000 6,000 6,000 5,000 Total purchases 21,000 There is an expense accrual at the end of year 2018 of RM 500, and an anticipated accrual of RM 800 at the end of month 4 of year 2019. The cash paid out for expenses in months 1 to 4 of year 2019 will be spread evenly over the 4 months. The depreciation shown in the budgeted Statement of Profit or Loss is based on depreciating equipment at 20% per year on a straight-line basis. Equipment that cost RM 20,000 was purchased in January of year 2018. Further equipment is to be bought for RM 10,000 in January 2019. Siti wishes to withdraw RM 1,500 from the business in each of the months of February and April in the year 2019. Bank interest is to be ignored since the business is financed entirely by the capital account. Bank balance at the beginning of January 2019 is RM 10,000. Trade receivables due from of RM I1,000 as at end 2018 relates to sales of RM 6,500 in November and RM 4,500 in December. These sales together with those sales in 2019 are on two months' credit. The trade payables due to of RM 4,000 as at end 2018 relates to December purchases. Payment is due to be made in January 2019. Purchases in 2019 is also on one-month credit term. Required: (a) Prepare a cash budget for the first four months of the year 2019. (18 marks) A budget is used to forecast the financial results and financial position of a business entity for a future period. Outline FIVE (5) benefits of preparing a budget to a business organization. (b) (10 marks) Q1. (Continued) (c) Budget can either be classified as fixed or flexible in accordance to the business activity level. Describe FOUR (4) differences between a fixed budget and a flexible budget. (4 marks) (d) Cash budget will highlight either a business will enjoy a positive cash flow or suffer a negative cash flow at the end of the reporting period. Define what is a positive cash flow situation comparing to a negative cash flow situation. (4 marks) Recommend TwO (2) solutions to address the negative cash flow situation. (4 marks) (e)

Step by Step Solution

★★★★★

3.47 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

b 5 reasons to prepare a budget for a business organisation are 1 preparing budget gives an organisation a systematic approach to mange money effectiv...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started