Answered step by step

Verified Expert Solution

Question

1 Approved Answer

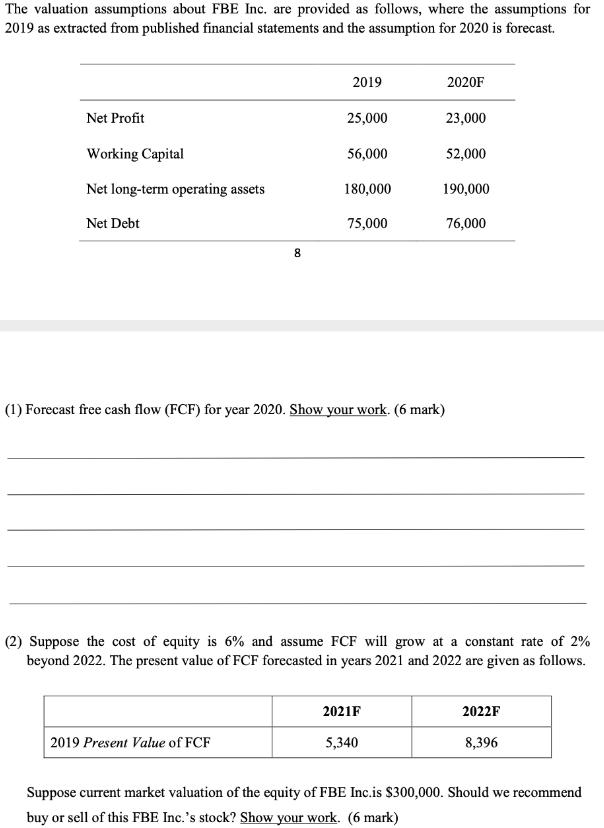

The valuation assumptions about FBE Inc. are provided as follows, where the assumptions for 2019 as extracted from published financial statements and the assumption

The valuation assumptions about FBE Inc. are provided as follows, where the assumptions for 2019 as extracted from published financial statements and the assumption for 2020 is forecast. 2019 2020F Net Profit 25,000 23,000 Working Capital 56,000 52,000 Net long-term operating assets 180,000 190,000 Net Debt 75,000 76,000 8. (1) Forecast free cash flow (FCF) for year 2020. Show your work. (6 mark) (2) Suppose the cost of equity is 6% and assume FCF will grow at a constant rate of 2% beyond 2022. The present value of FCF forecasted in years 2021 and 2022 are given as follows. 2021F 2022F 2019 Present Value of FCF 5,340 8,396 Suppose current market valuation of the equity of FBE Inc.is $300,000. Should we recommend buy or sell of this FBE Inc.'s stock? Show your work. (6 mark)

Step by Step Solution

★★★★★

3.31 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

Free cashflow is the cash a company produces through its operations xxx Less The cost of expenditure ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started