Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Precious Metals Traders, owned by three businesswomen, acquired mining rights from the Department of Minerals and Energy. The current financial year of Precious Metals

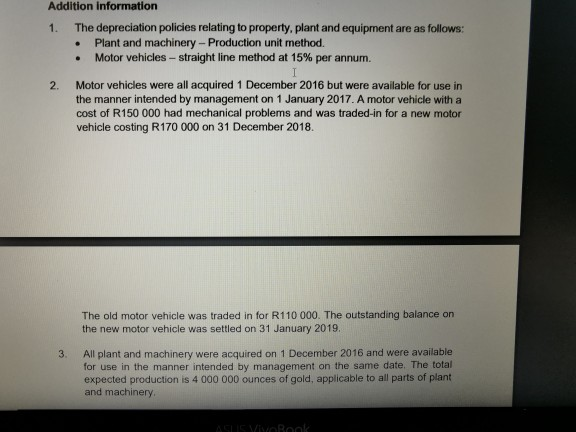

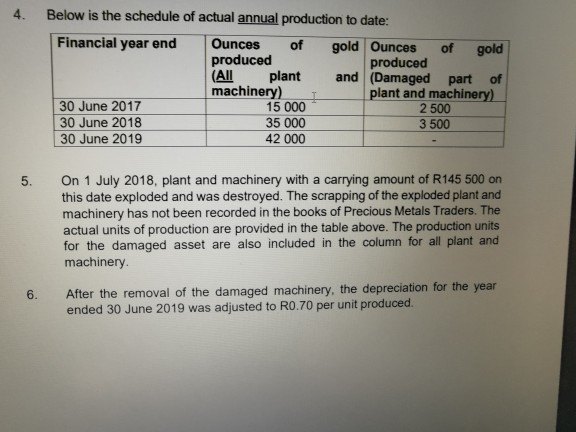

Precious Metals Traders, owned by three businesswomen, acquired mining rights from the Department of Minerals and Energy. The current financial year of Precious Metals Traders ends on 30 June 2019. Precious Metal Traders is not a VAT vendor. The entity makes use of a control system for its debtors and creditors. Note: Round the depreciation off to two decimls when calculating cost per unit according to the production unit method. Final answer should be rounded to the nearest Rand, REQUIRED a. b. Prepare the asset realisation account in the general ledger of Precious Metal Traders to account for the motor vehicle that was traded in on 31 December 2018. (8) Prepare only the plant and machinery column in the property, plant and equipment note of Precious Metal Traders for the year ended 30 June 2019, in accordance with International Financial Reporting Standards. (7) INFORMATION The following extract of the trial balance was provided to you: Precious Metals Traders Extract of the pre-adjustment trial balance on 30 June 2019 Debit R 3 000 000 Plant and machinery Accumulated depreciation on plant and machinery (1 Jul 2018) Credit R 37 500 Addition information 1. The depreciation policies relating to property, plant and equipment are as follows: Plant and machinery- Production unit method. Motor vehicles - straight line method at 15% per annum. 2. 3. . Motor vehicles were all acquired 1 December 2016 but were available for use in the manner intended by management on 1 January 2017. A motor vehicle with a cost of R150 000 had mechanical problems and was traded-in for a new motor vehicle costing R170 000 on 31 December 2018. The old motor vehicle was traded in for R110 000. The outstanding balance on the new motor vehicle was settled on 31 January 2019. All plant and machinery were acquired on 1 December 2016 and were available for use in the manner intended by management on the same date. The total expected production is 4 000 000 ounces of gold, applicable to all parts of plant and machinery. 4. 5. 6. Below is the schedule of actual annual production to date: Financial year end of gold Ounces of gold produced and (Damaged part of plant and machinery) 30 June 2017 30 June 2018 30 June 2019 Ounces produced (All machinery) plant 15 000 35 000 42 000 2 500 3 500 On 1 July 2018, plant and machinery with a carrying amount of R145 500 on this date exploded and was destroyed. The scrapping of the exploded plant and machinery has not been recorded in the books of Precious Metals Traders. The actual units of production are provided in the table above. The production units for the damaged asset are also included in the column for all plant and machinery. After the removal of the damaged machinery, the depreciation for the year ended 30 June 2019 was adjusted to R0.70 per unit produced.

Step by Step Solution

★★★★★

3.31 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started