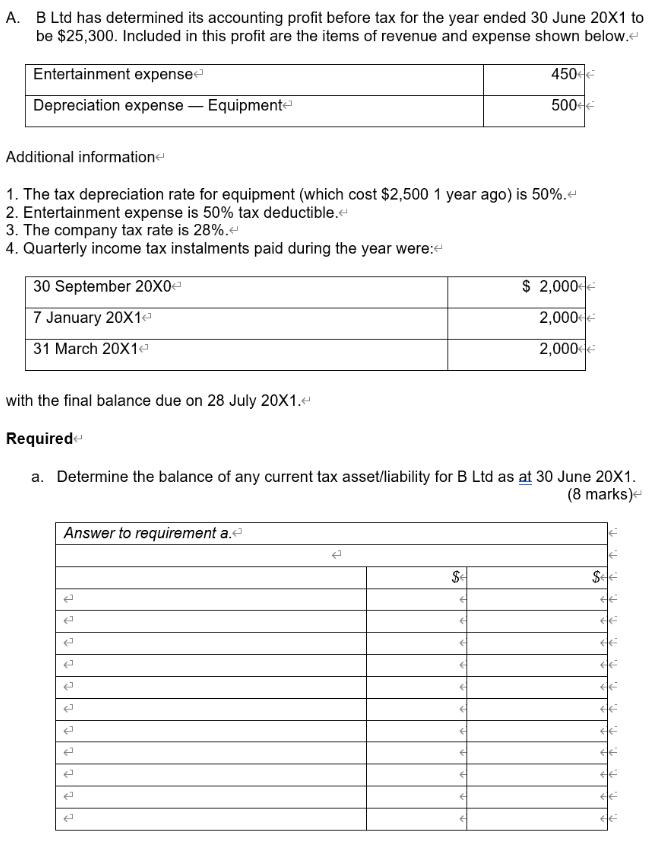

A. B Ltd has determined its accounting profit before tax for the year ended 30 June 20X1 to be $25,300. Included in this profit

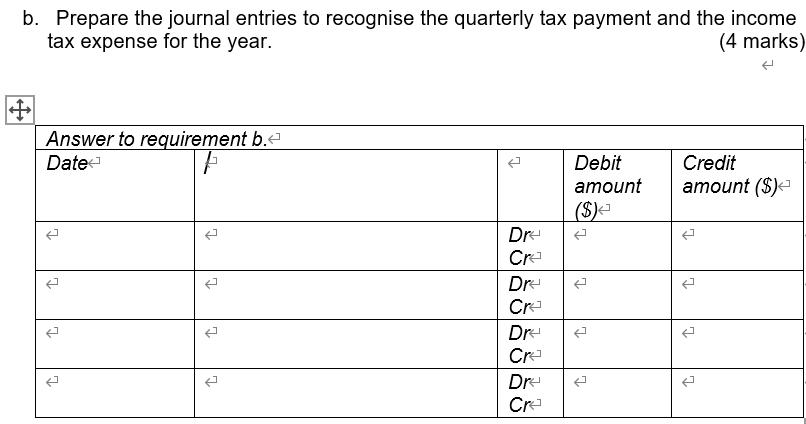

A. B Ltd has determined its accounting profit before tax for the year ended 30 June 20X1 to be $25,300. Included in this profit are the items of revenue and expense shown below.e Entertainment expensee 450 Depreciation expense - Equipmente 500 Additional informatione 1. The tax depreciation rate for equipment (which cost $2,500 1 year ago) is 50%. 2. Entertainment expense is 50% tax deductible. 3. The company tax rate is 28%. 4. Quarterly income tax instalments paid during the year were: 30 September 20X0- $ 2,000e 7 January 20X1e 2,000 31 March 20X1a 2,000 with the final balance due on 28 July 20X1. Requirede a. Determine the balance of any current tax asset/liability for B Ltd as at 30 June 20X1. (8 marks)- Answer to requirement a. b. Prepare the journal entries to recognise the quarterly tax payment and the income tax expense for the year. (4 marks) Answer to requirement b.e Date Debit Credit amount amount ($) ($)= Dr- Cra Dr- Cr- Dr- Cra Dr Cra

Step by Step Solution

3.36 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Journal Date Particulars Debit Credit 30 September 20X0 Income ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started