Question

Use financial statements on that page for the most recent September fiscal year-end. Youll be using them to answer some questions. Requirements : Address each

Use financial statements on that page for the most recent September fiscal year-end. You’ll be using them to answer some questions.

Requirements:

Address each of the following five (5) requirements.

(NOTE: the most recent year-end numbers ("this year") are always in the left-hand column, closest to the account name, so it's easiest for users to read. The prior year-end numbers ("last year") are in the next column to the right, because it's less relevant).

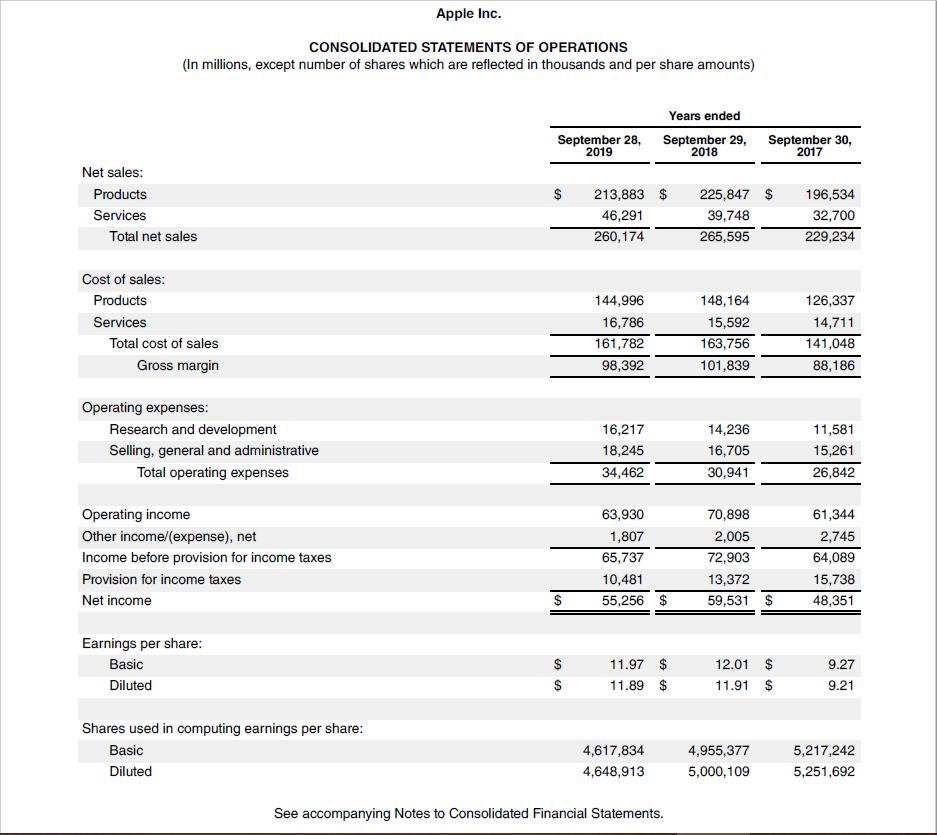

Requirement 1 - Statement of Operations (Income Statement) Summary: For the two most recent fiscal years, provide the following income statement amounts. (Review the multi-step income statement in chapter 3, if necessary):

- 1. Gross Margin

- 2. Net Income

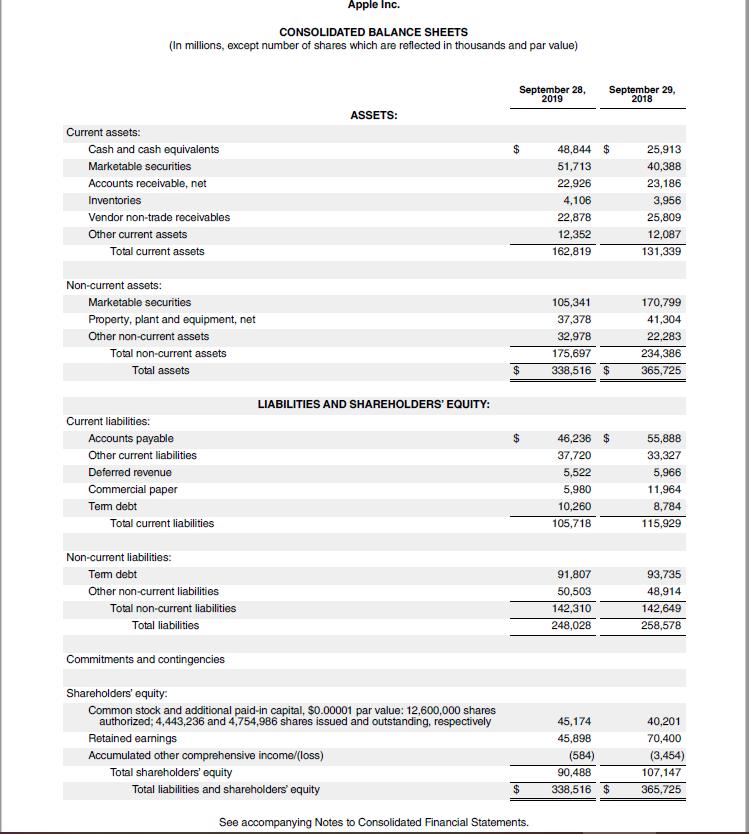

Requirement 2 - Basic Accounting Equation: Show that the total assets of the company are equal to its total liabilities plus its total stockholders’ equity as of the balance sheet date for the most recent fiscal year. Do not recreate the company’s balance sheet.

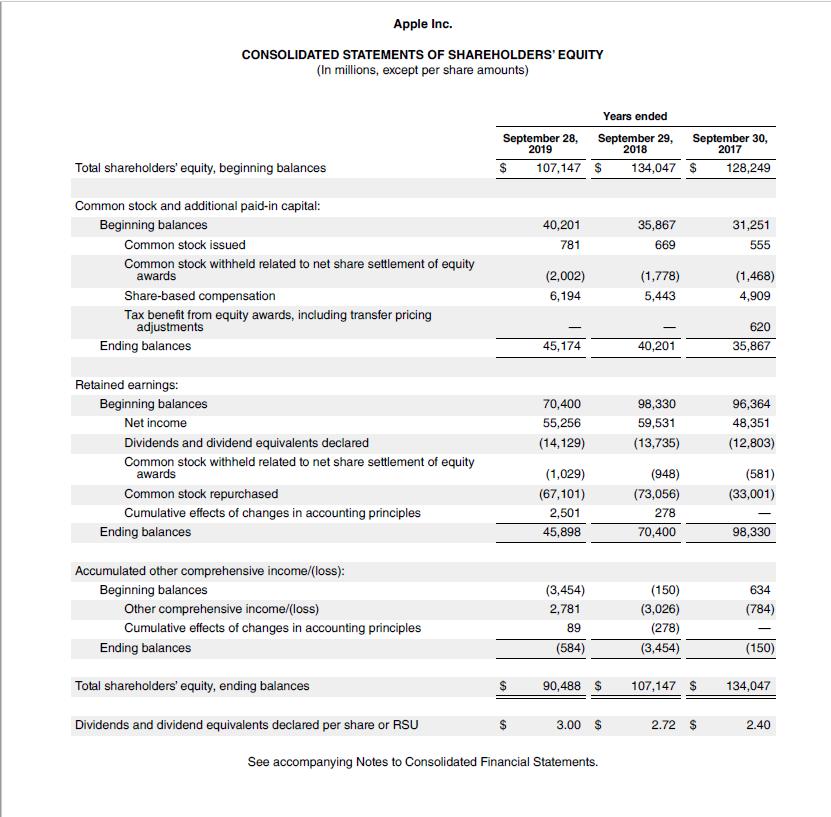

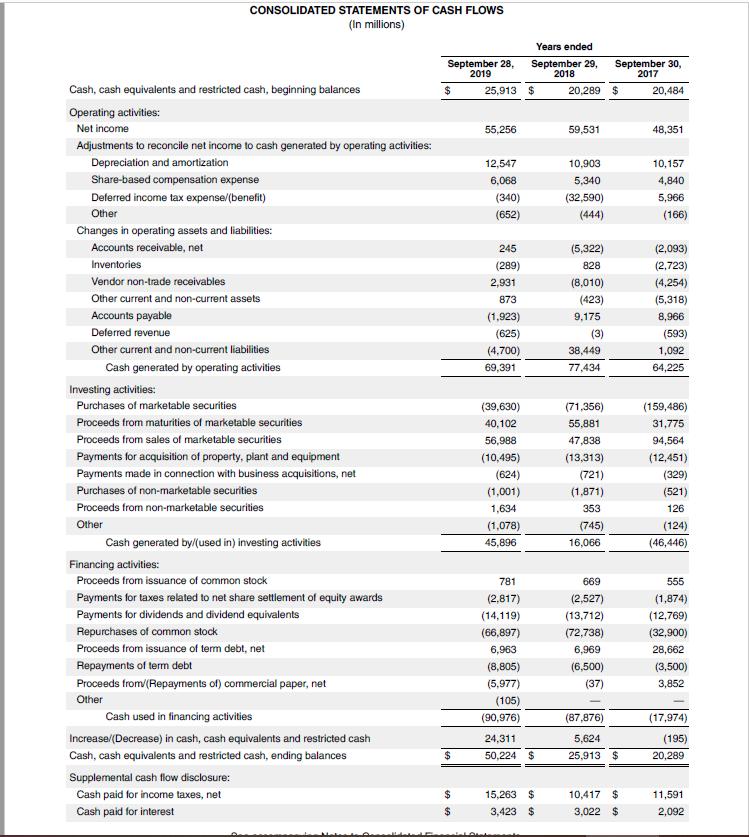

Requirement 3 - Statement of Cash Flows: Review the statement of cash flows for the most recent fiscal year, and identify following in your response:

- 1. Did more cash come in, or go out in the most recent year? State whether cash increased or decreased overall and by how much (dollars).

- 2. How much cash is generated by operating activities? Is it more or less than net income?

Requirement 4 - Financial Ratio Analysis: For the most recent fiscal year, compute the following ratios. (Ratios are explained in detail in your textbook, near the end of Chapter 13). Show your computations:

- 1. Working capital

- 2. Current ratio

- 3. Profit margin

- 4. Inventory Turnover (see Chapter 13, and my explanation in the Chapter 5 module).

- 5. Days Sales in Inventory (industry average is approx. 9 days)

The example response format for Requirements 1 - 4:

“…..I identified the following results during my review of Apple’s financial statements:

Rqmt. 1a) Gross Margin: $_______ (This year) $_________ (Last year)

Rqmt. 1b) Net Income $_______ (This year) $__________ (Last year)

Rqmt. 2) The accounting equation for Apple’s most recent year: $_______ = $_________+$_________

Rqmt. 3a) More cash came in/went out (pick one). Cash increased/decreased by $_______________

Rqmnt. 3b) Cash generated by operating activities in the current year was $__________. It was more/less (pick one) than net income of $____________

Rqmnt. 4a) Working capital = current assets - current liabilities = $________ - $________ = $________

Continue your responses for requirements (4b) to (4e)…..”

Requirement 5 - Reflect on your findings: What did you find interesting as you reviewed Apple’s financial results? What other approaches could you take to help you determine whether Apple is performing as well as its competitors? (Hint: Who could you talk to about the company, what comparisons can you make to measure performance, and where else can you find information about the company's industry and its prospects? Please also see your textbook, Chapter 13 – Financial Statement Analysis.)

Net sales: Products Services Total net sales Cost of sales: Products Apple Inc. CONSOLIDATED STATEMENTS OF OPERATIONS (In millions, except number of shares which are reflected in thousands and per share amounts) Services Total cost of sales Gross margin Operating expenses: Research and development Selling, general and administrative Total operating expenses Operating income Other income/(expense), net Income before provision for income taxes Provision for income taxes Net income Earnings per share: Basic Diluted Shares used in computing earnings per share: Basic Diluted September 28, 2019 $ SS $ 213,883 $ 46,291 260,174 144,996 16,786 161,782 98,392 16,217 18,245 34,462 Years ended September 29, 2018 63,930 1,807 65,737 10,481 55,256 $ 11.97 $ 11.89 $ 4,617,834 4,648,913 See accompanying Notes to Consolidated Financial Statements. 225,847 $ 39,748 265,595 148,164 15,592 163,756 101,839 14,236 16,705 30,941 September 30, 2017 70,898 2,005 72,903 13,372 59,531 $ 12.01 $ 11.91 $ 4,955,377 5,000, 109 196,534 32,700 229,234 126,337 14,711 141,048 88,186 11,581 15,261 26,842 61,344 2,745 64,089 15,738 48,351 9.27 9.21 5,217,242 5,251,692

Step by Step Solution

3.38 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

Question Note All the below figures are in millions Requirement 1a Gross Margin 98392 This year 1018...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started