Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Melissa has a second home that she uses as a vacation home. She rents out the home part of the time when she

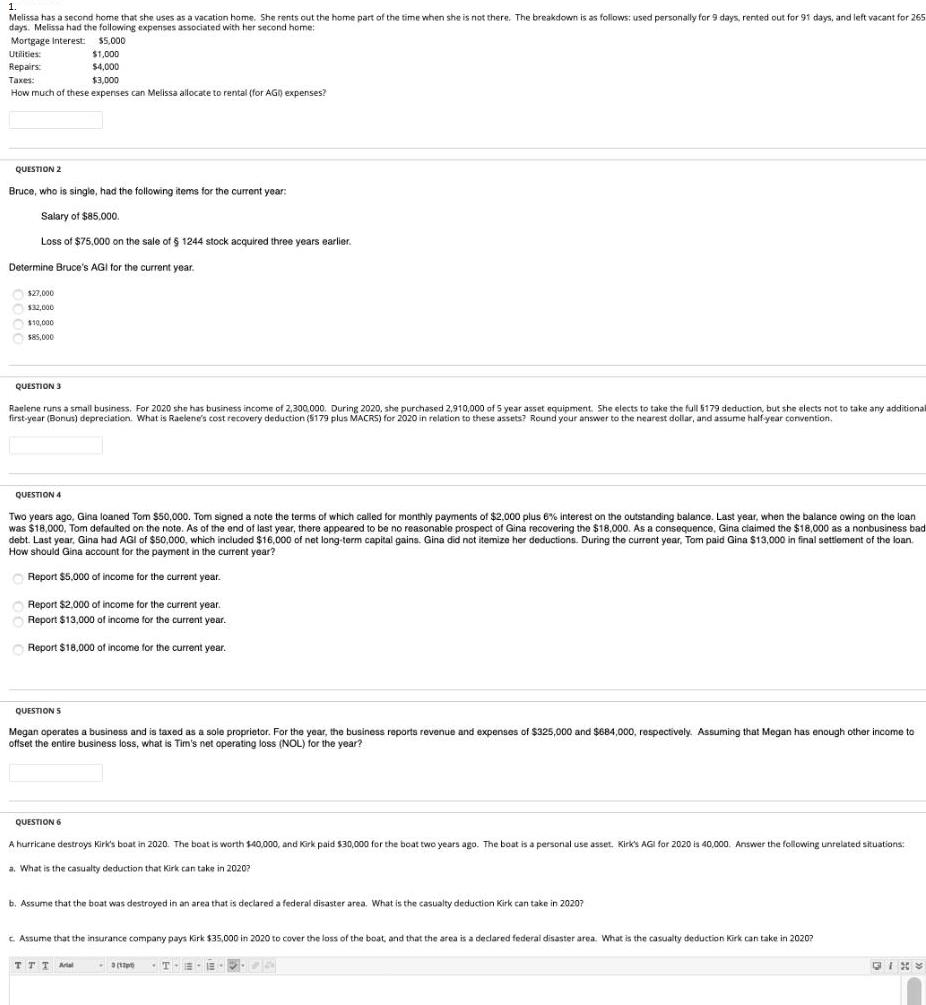

1. Melissa has a second home that she uses as a vacation home. She rents out the home part of the time when she is not there. The breakdown is as follows: used personally for 9 days, rented out for 91 days, and left vacant for 265 days. Melissa had the foilowing expenses associated with her second home: Mortgage Interest: $5,000 Utilities: $1,000 Repairs: $4,000 Taxes: $3,000 How much of these expenses can Melissa allocate to rental (for AG) expenses? QUESTION 2 Bruce, who is single, had the following items for the current year: Salary of $85.000. Loss of $75,000 on the sale of 5 1244 stock acquired three years earlier. Determine Bruce's AGI for the current year. O $27,000 $32,000 $10,000 $85,000 QUESTION 3 Raelene runs a small business. For 2020 she has business income of 2,300.000. During 2020, she purchased 2,910,000 of 5 year asset equipment. She elects to take the full 5179 deduction, but she elects not to take any additional first-year (Bonus) depreciation. What is Raelene's cost recovery deduction (5179 plus MACRS) for 2020 in relation to these assets? Round your answer to the nearest dollar, and assume half year convention. QUESTION 4 Two years ago, Gina loaned Tom $50,000. Tom signed a note the terms of which called for monthly payments of $2,000 plus 6% interest on the outstanding balance. Last year, when the balance owing on the loan was $18,000, Tom defaulted on the note. As of the end of last year, there appeared to be no reasonabie prospect of Gina recovering the $18,000. As a consequence, Gina ciaimed the $18,000 as a nonbusiness bad debt. Last year, Gina had AGI of $50,000, which included $16,000 of net long-term capital gains. Gina did not itemize her deductions. During the current year, Tom paid Gina $13,000 in final settiement of the loan. How should Gina account for the payment in the current year? Report $5,000 of income for the current year. Report $2.000 of income for the current year. Report $13,000 of income for the current year. O Report $18,000 of income for the current year. QUESTION S Megan operates a business and is taxed as a sole proprietor. For the year, the business reports revenue and expenses of $325,000 and $684,000, respectively. Assuming that Megan has enough other income to offset the entire business loss, what is Tim's net operating loss (NOL) for the year? QUESTION 6 A hurricane destroys Kirk's boat in 2020. The boat is worth $40,000, and Kirk paid $30,000 for the boat two years ago. The boat is a personal use asset. Kirk's AGI for 2020 is 40,000. Answer the following unrelated situations: a. What is the casualty deduction that Kirk can take in 2020? b. Assume that the boat was destroyed in an area that is declared a federal disaster area. What is the casualty deduction Kirk can take in 2020? c Assume that the insurance company pays Kirk $35,000 in 2020 to cover the loss of the boat, and that the area is a declared federai disaster area. What is the casualty deduction Kirk can take in 2020? TTT M T-E- E

Step by Step Solution

★★★★★

3.49 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

PUESTION 1 Rented days Expenser pr Seed hime Ma...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started