Answered step by step

Verified Expert Solution

Question

1 Approved Answer

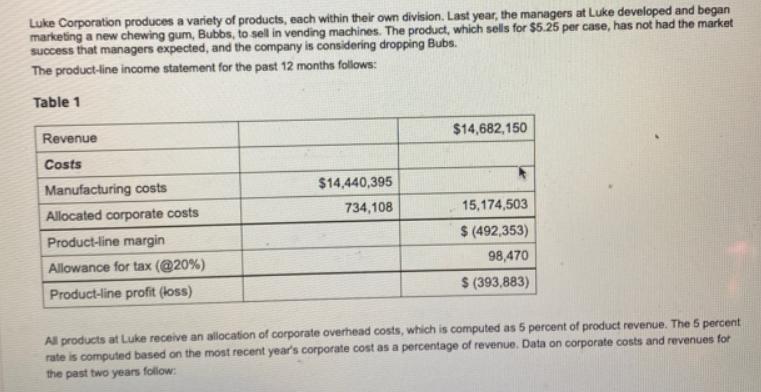

Luke Corporation produces a variety of products, each within their own division. Last year, the managers at Luke developed and began marketing a new

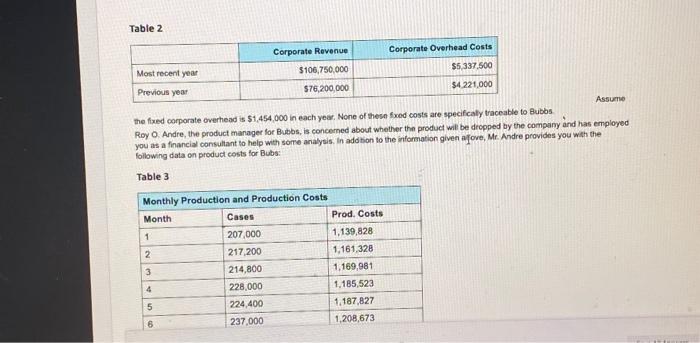

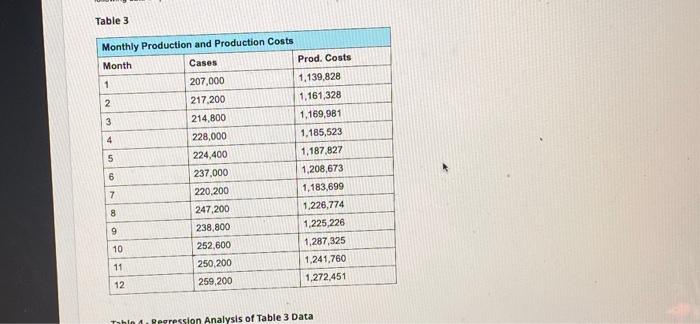

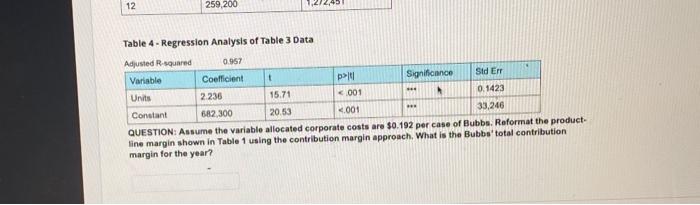

Luke Corporation produces a variety of products, each within their own division. Last year, the managers at Luke developed and began marketing a new chewing gum, Bubbs, to sell in vending machines. The product, which sells for $5.25 per case, has not had the market success that managers expected, and the company is considering dropping Bubs. The product-line income statement for the past 12 months follows: Table 1 Revenue $14,682,150 Costs Manufacturing costs $14,440,395 Allocated corporate costs 734,108 15,174,503 Product-line margin $ (492,353) Allowance for tax (@20%) 98,470 Product-line profit (loss) $ (393,883) All products at Luke receive an allocation of corporate overhead costs, which is computed as 5 percent of product revenue. The 5 percent rate is computed based on the most recent year's corporate cost as a percentage of revenue. Data on corporate costs and revenues for the past two years follow: Table 2 Corporate Revenue Corporate Overhead Costs $5,337.500 Most recent year $106,750,000 S76,200,000 $4.221,000 Previous year Assume the fixed corporate overhead is $1,454,000 in each year. None of these fxed costs are specificaly traceable to Bubbs Roy O. Andre, the product manager for Bubbs, is concemed about whether the product will be dropped by the company and has employed you as a financial consultant to help with some analysis. In addtion to the information given afove, Mr. Andre provides you with the following data on product costs for Bubs: Table 3 Monthly Production and Production Costs Cases Prod. Costs Month 207,000 1,139,828 217,200 1,161,328 214,800 1,169,981 3 228,000 1,185,523 4 224,400 1.187,827 237,000 1,208,673 6. Table 3 Monthly Production and Production Costs Month Cases Prod. Costs 207,000 1,139,828 2 217,200 1,161,328 3 214,800 1,169,981 4 228,000 1,185,523 224,400 1,187.827 237,000 1,208,673 220,200 1,183,699 247,200 1,226,774 9. 238,800 1,225,226 10 252,600 1,287,325 11 250,200 1,241,760 12 259,200 1,272,451 Table 4.Peeression Analysis of Table 3 Data 12 259,200 Table 4- Regression Analysis of Table 3 Data Adjusted R-squared 0.957 Significance Std Err Variable Coefficient 0.1423 Units 2.236 15.71

Step by Step Solution

There are 3 Steps involved in it

Step: 1

46 47 48 Total Revenue A Selling Price Per Unit B N...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started