Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Andrew, aged 53, approached you to assist with his risk planning. Andrew is married out of community of property to his wife, June; she

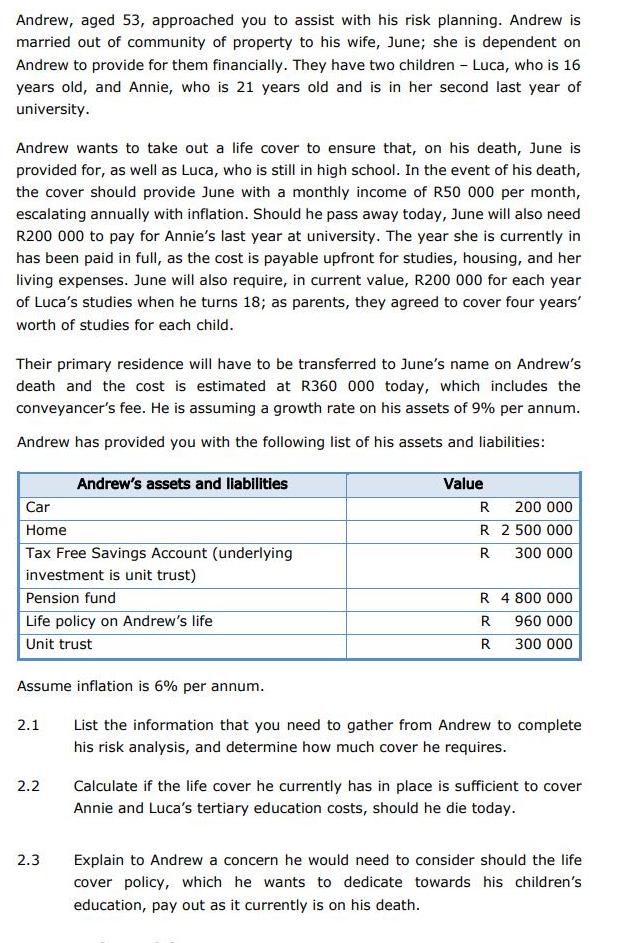

Andrew, aged 53, approached you to assist with his risk planning. Andrew is married out of community of property to his wife, June; she is dependent on Andrew to provide for them financially. They have two children - Luca, who is 16 years old, and Annie, who is 21 years old and is in her second last year of university. Andrew wants to take out a life cover to ensure that, on his death, June is provided for, as well as Luca, who is still in high school. In the event of his death, the cover should provide June with a monthly income of R50 000 per month, escalating annually with inflation. Should he pass away today, June will also need R200 000 to pay for Annie's last year at university. The year she is currently in has been paid in full, as the cost is payable upfront for studies, housing, and her living expenses. June will also require, in current value, R200 000 for each year of Luca's studies when he turns 18; as parents, they agreed to cover four years' worth of studies for each child. Their primary residence will have to be transferred to June's name on Andrew's death and the cost is estimated at R360 000 today, which includes the conveyancer's fee. He is assuming a growth rate on his assets of 9% per annum. Andrew has provided you with the following list of his assets and liabilities: Andrew's assets and liabilities Value Car R 200 000 Home R 2 500 000 Tax Free Savings Account (underlying investment is unit trust) R 300 000 Pension fund R 4 800 000 Life policy on Andrew's life 960 000 R Unit trust R 300 000 Assume inflation is 6% per annum. 2.1 List the information that you need to gather from Andrew to complete his risk analysis, and determine how much cover he requires. 2.2 Calculate if the life cover he currently has in place is sufficient to cover Annie and Luca's tertiary education costs, should he die today. 2.3 Explain to Andrew a concern he would need to consider should the life cover policy, which he wants to dedicate towards his children's education, pay out as it currently is on his death.

Step by Step Solution

★★★★★

3.44 Rating (144 Votes )

There are 3 Steps involved in it

Step: 1

21 Further information required from Andrew is 1 Whether June would continue to live in the same hou...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started