Answered step by step

Verified Expert Solution

Question

1 Approved Answer

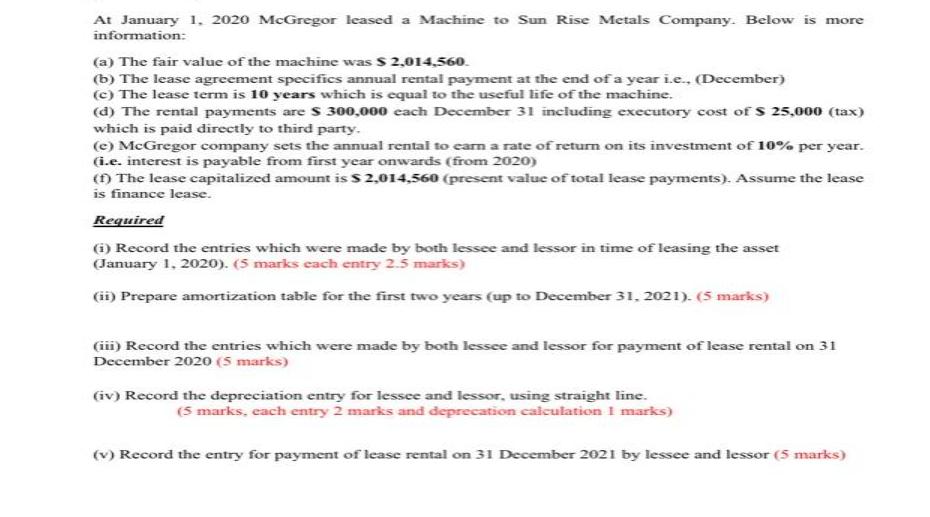

At January 1, 2020 McGregor leased a Machine to Sun Rise Metals Company. Below is more nformation: (a) The fair value of the machine

At January 1, 2020 McGregor leased a Machine to Sun Rise Metals Company. Below is more nformation: (a) The fair value of the machine was $ 2,014,560. (b) The lease agreement specifics annual rental payment at the end of a year i.e., (December) (c) The lease term is 10 years which is equal to the useful life of the machine. (d) The rental payments are S 300,000 cach December 31 including executory cost of S 25,000 (tax) which is paid directly to third party. (e) McGregor company sets the annual rental to earn a rate of return on its investment of 10% per year. (i.e. interest is payable from first year onwards (from 2020) () The lease capitalized amount is $ 2,014,560 (present value of total lease payments). Assume the lease is finance lease. Required 6) Record the entries which were made by both lessee and lessor in time of leasing the asset (January 1, 2020). (5 marks each entry 2.5 marks) (ii) Prepare amortization table for the first two years (up to December 31, 2021). (5 marks) (iii) Record the entries which were made by both lessee and lessor for payment of lease rental on 31 December 2020 (5 marks) (iv) Record the depreciation entry for lessee and lessor, using straight line. (5 marks, each entry 2 marks and deprecation calculation I marks) (v) Record the entry for payment of lease rental on 31 December 2021 by lessee and lessor (5 marks)

Step by Step Solution

★★★★★

3.48 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

i Please not present value of minimum lease payment after calculating was 1843370 but as given in qu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started