Answered step by step

Verified Expert Solution

Question

1 Approved Answer

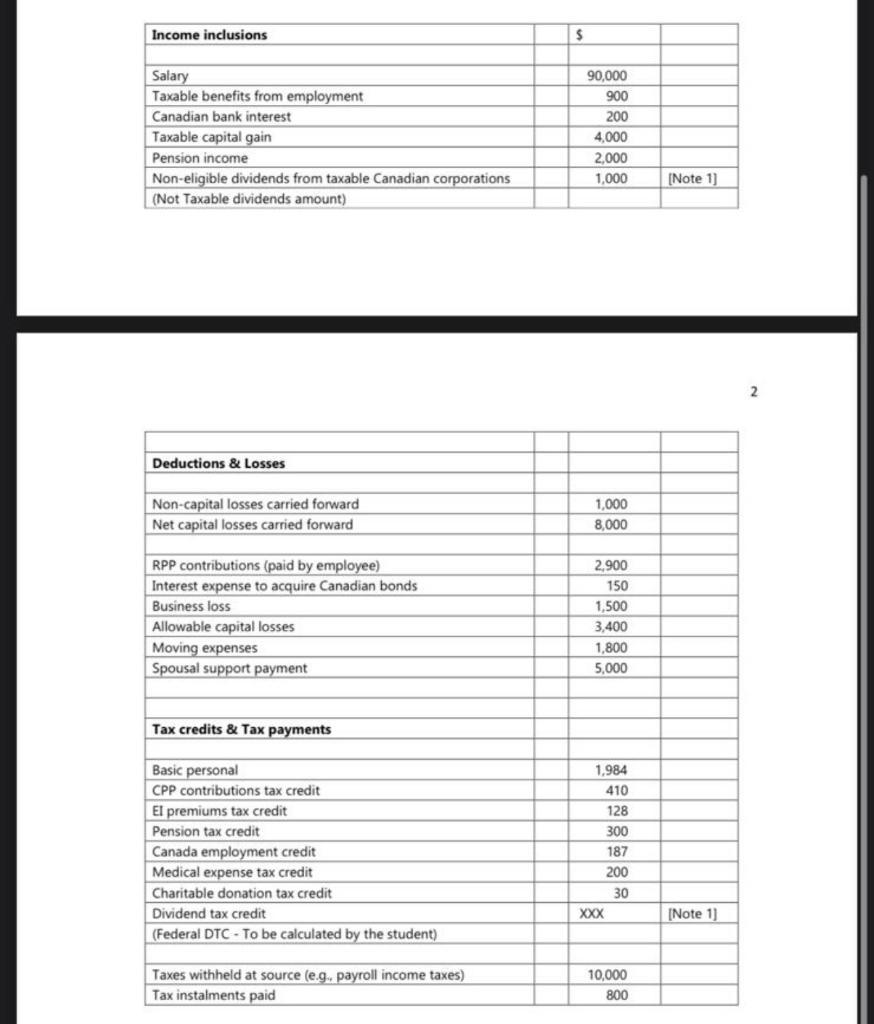

Determine the Net Income For Tax Purposes of Mr. Hope pursuant to ITA para. Use the appropriate dividend amount and related DTC calculated. So grossed

Determine the Net Income For Tax Purposes of Mr. Hope pursuant to ITA para. Use the appropriate dividend amount and related DTC calculated.

So grossed up dividend amount (i.e. taxable dividend ) is $ 1,150 and related federal dividend tax credit amount is $ 103.85 (Note 1)

Income inclusions Salary Taxable benefits from employment Canadian bank interest Taxable capital gain Pension income Non-eligible dividends from taxable Canadian corporations (Not Taxable dividends amount) Deductions & Losses Non-capital losses carried forward Net capital losses carried forward RPP contributions (paid by employee) Interest expense to acquire Canadian bonds Business loss Allowable capital losses Moving expenses Spousal support payment Tax credits & Tax payments Basic personal CPP contributions tax credit El premiums tax credit Pension tax credit Canada employment credit Medical expense tax credit Charitable donation tax credit Dividend tax credit (Federal DTC-To be calculated by the student) Taxes withheld at source (e.g., payroll income taxes) Tax instalments paid $ 90,000 900 200 4,000 2.000 1,000 1,000 8,000 2,900 150 1,500 3,400 1,800 5,000 1,984 410 128 300 187 200 30 XXX 10,000 800 [Note 1] [Note 1] 2

Step by Step Solution

★★★★★

3.40 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

So the Mr Hopes taxable income is 98410 The tax payable on that taxable income is 1217...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started