Answered step by step

Verified Expert Solution

Question

1 Approved Answer

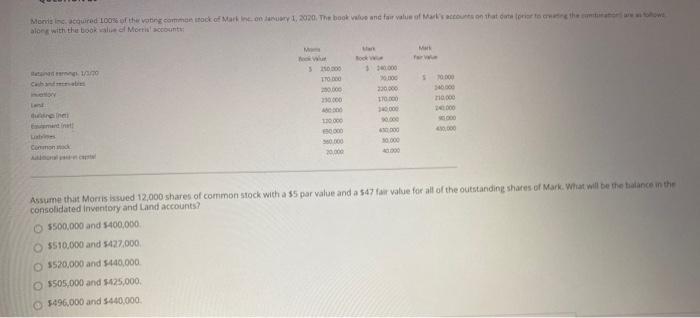

Monis inc. acouired 100% ofthe votng common srock of Mark Inc on January 1, 2020. The book value and fair value of Mark's accounts

Monis inc. acouired 100% ofthe votng common srock of Mark Inc on January 1, 2020. The book value and fair value of Mark's accounts on that date lorior to creating the umtato a toow along with the book value of Morris accounts: Mark ewut Rock fair v etanan eernng 1/0 31000 3000 Cah and abi 20.000 240000 20.000 metoy 200.000 220000 Land 230.000 10.000 dne Inei 000 p000 Emint inet! 120.000 0.000 S.000 Labins 4 00 40000 Common ack 10.000 A ol n ct 20.000 4.000 Assume that Morris issued 12,000 shares of common stock with a $5 par value and a $47 fair value for all of the outstanding shares of Mark. What will be the balance in the consolidated inventory and Land accounts? O $500,000 and $400,000. O S510,000 and $427,000. O 5520,000 and $440,000. O S505,000 and $425,000. O $496,000 and $440,000.

Step by Step Solution

★★★★★

3.38 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

OPTION c520000 and 440000 Since i...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started