Consider two economies, Home and Foreign. The DC/FC exchange is determined by the asset approach to the exchange rate. Both countries are identical in

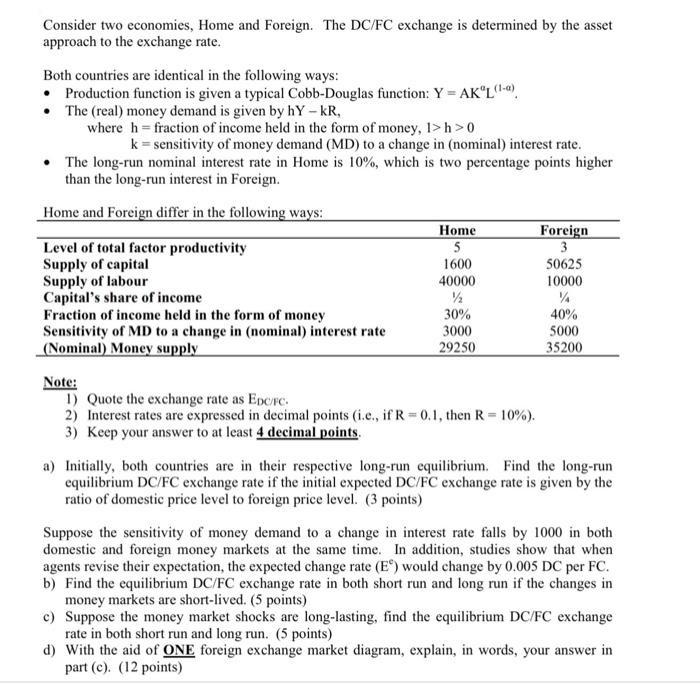

Consider two economies, Home and Foreign. The DC/FC exchange is determined by the asset approach to the exchange rate. Both countries are identical in the following ways: Production function is given a typical Cobb-Douglas function: Y = AK"L(-a) The (real) money demand is given by hY - KR, where h = fraction of income held in the form of money, 1>h >0 k = sensitivity of money demand (MD) to a change in (nominal) interest rate. The long-run nominal interest rate in Home is 10%, which is two percentage points higher than the long-run interest in Foreign. Home and Foreign differ in the following ways: Level of total factor productivity Supply of capital Supply of labour Capital's share of income Fraction of income held in the form of money Sensitivity of MD to a change in (nominal) interest rate (Nominal) Money supply Note: Home 5 1600 40000 30% 3000 29250 1) Quote the exchange rate as EDC/FC. 2) Interest rates are expressed in decimal points (i.e., if R = 0.1, then R = 10%). 3) Keep your answer to at least 4 decimal points. Foreign 3 50625 10000 40% 5000 35200 a) Initially, both countries are in their respective long-run equilibrium. Find the long-run equilibrium DC/FC exchange rate if the initial expected DC/FC exchange rate is given by the ratio of domestic price level to foreign price level. (3 points) Suppose the sensitivity of money demand to a change in interest rate falls by 1000 in both domestic and foreign money markets at the same time. In addition, studies show that when agents revise their expectation, the expected change rate (E) would change by 0.005 DC per FC. b) Find the equilibrium DC/FC exchange rate in both short run and long run if the changes in money markets are short-lived. (5 points) c) Suppose the money market shocks are long-lasting, find the equilibrium DC/FC exchange rate in both short run and long run. (5 points) d) With the aid of ONE foreign exchange market diagram, explain, in words, your answer in part (c). (12 points)

Step by Step Solution

3.31 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

a The long run DC FC exchange rate would be E P P 1600 50 625 1 2 30 40 5000 10000 1 0 1 1 0 08 0 0 ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started