Question: Richard McCarthy (born 2/14/64; Social Security number 100-10-9090) and Christine McCarthy (born 6/1/1966; Social security number 101-21- 3434) have a 19-year-old son (born 10/2/99

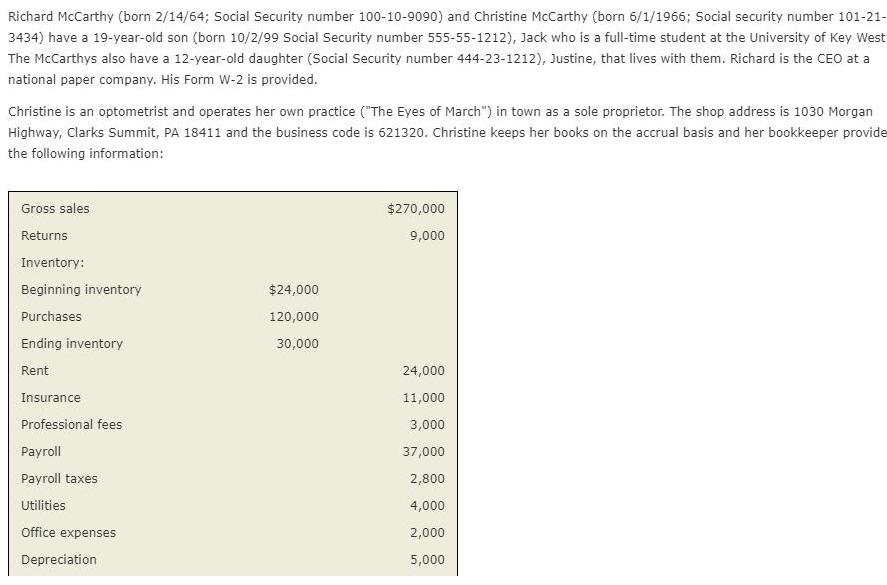

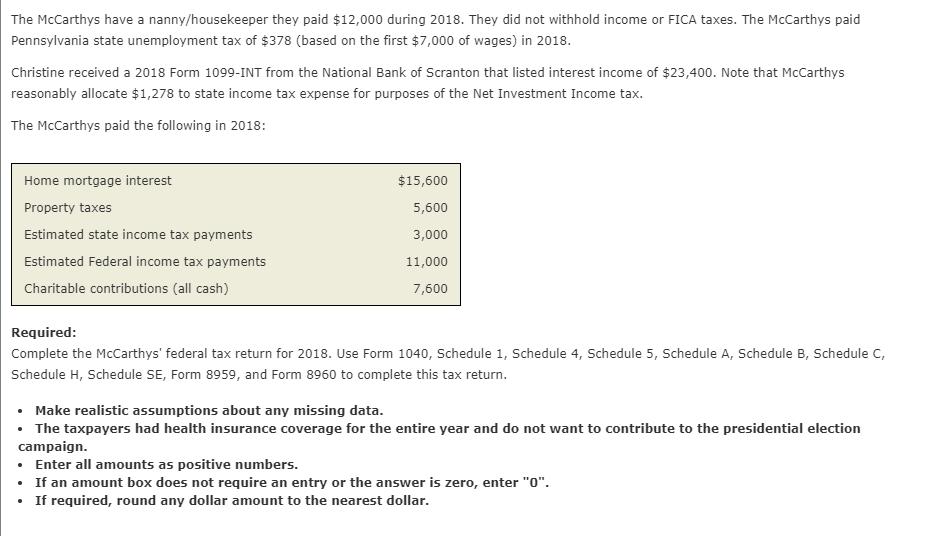

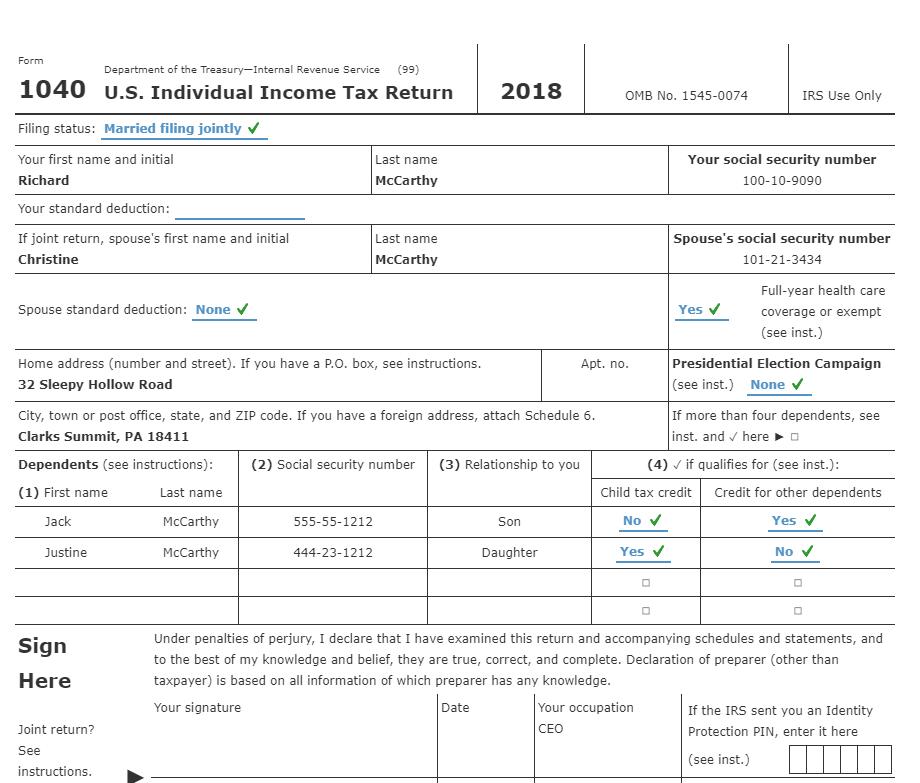

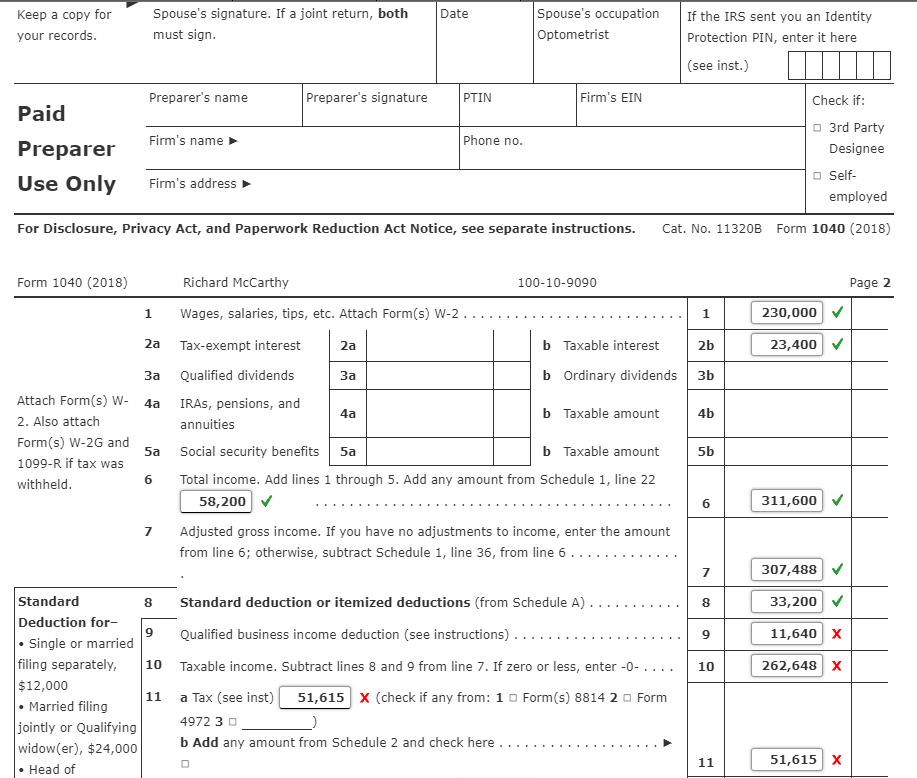

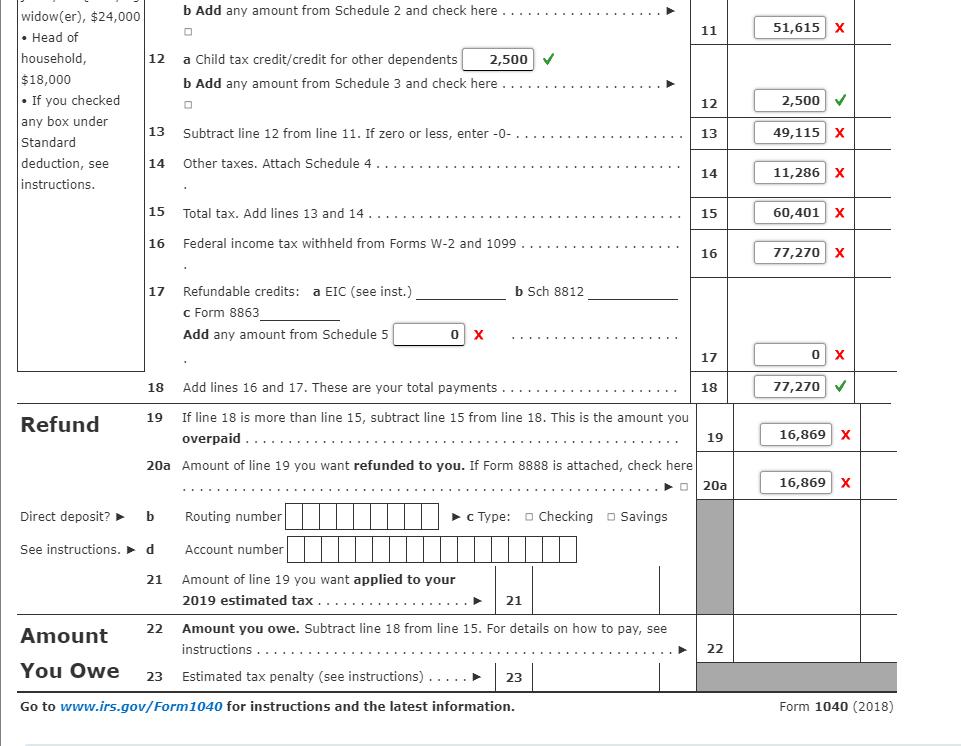

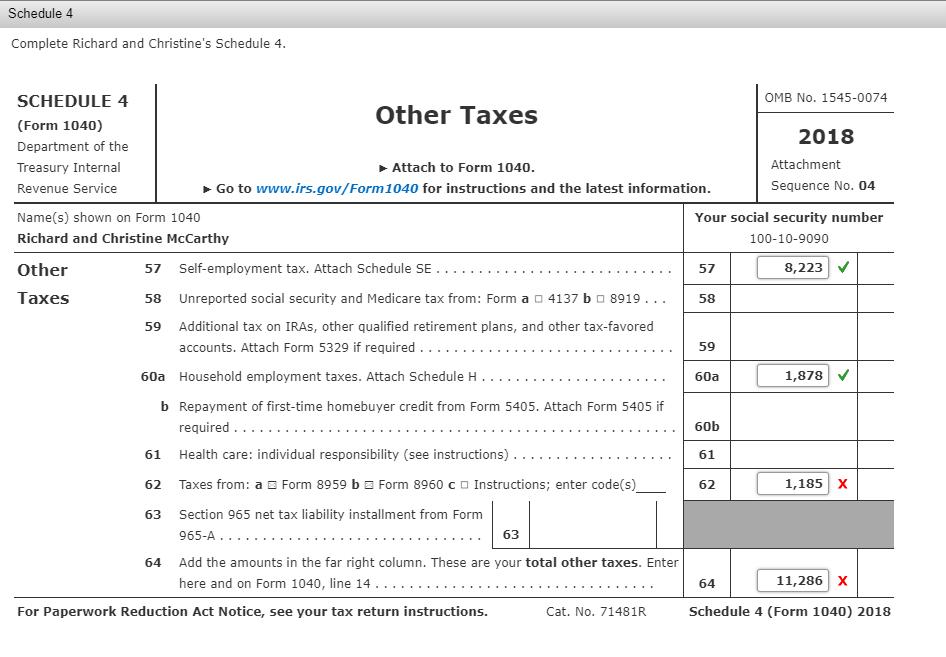

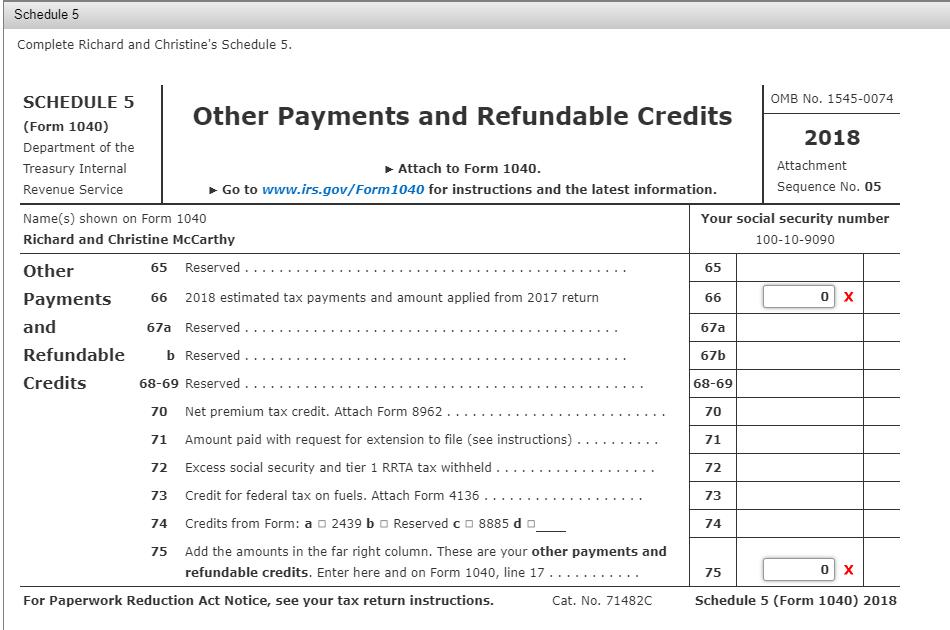

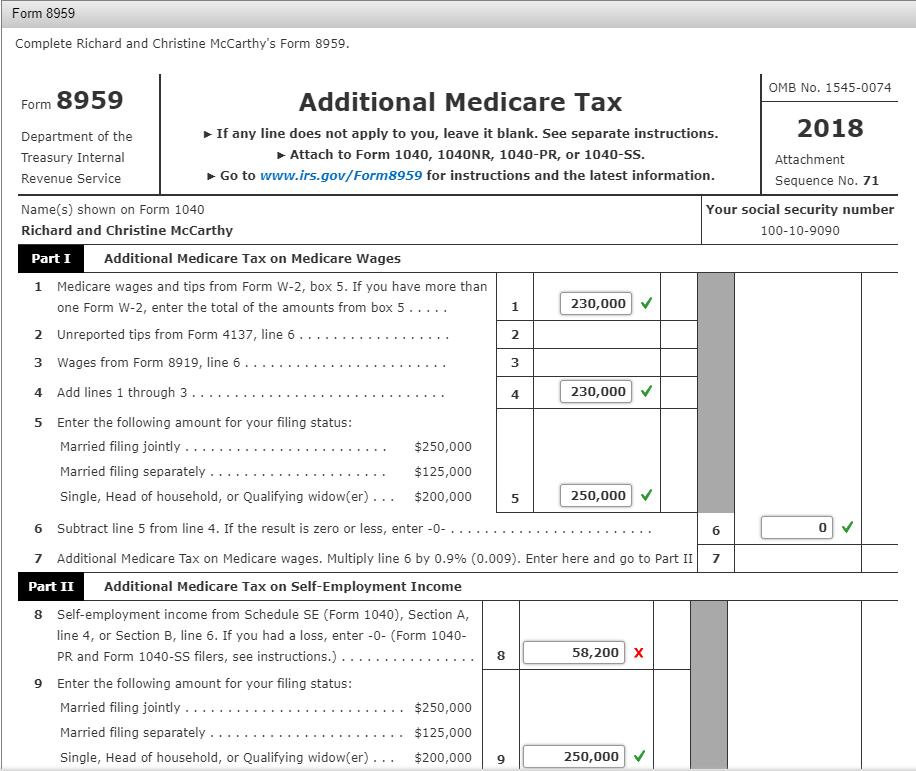

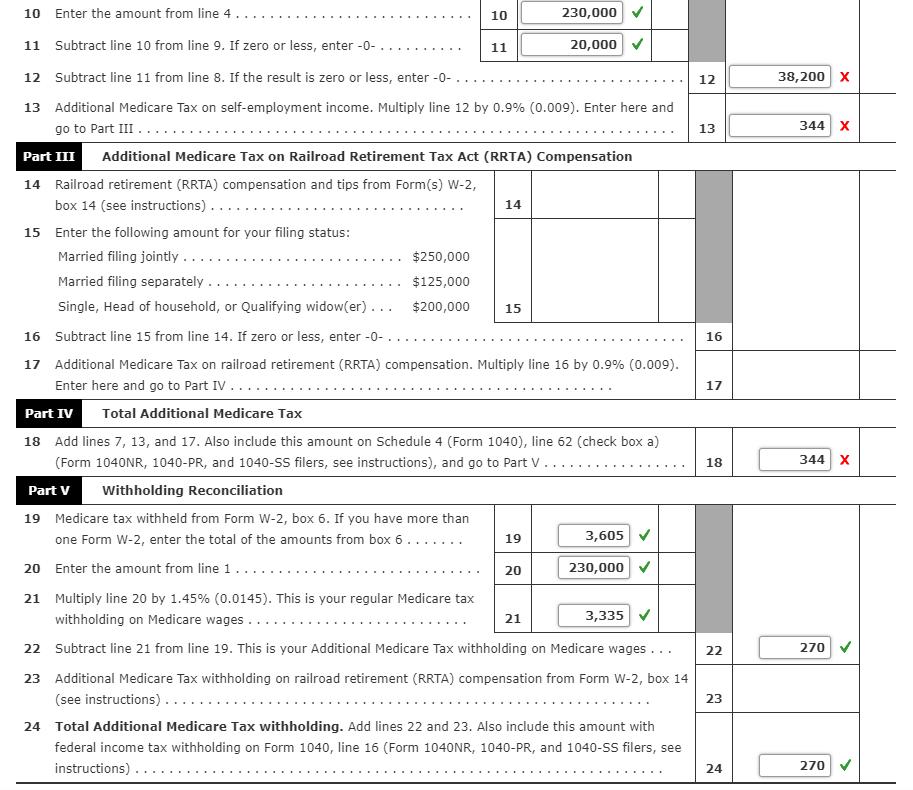

Richard McCarthy (born 2/14/64; Social Security number 100-10-9090) and Christine McCarthy (born 6/1/1966; Social security number 101-21- 3434) have a 19-year-old son (born 10/2/99 Social Security number 555-55-1212), Jack who is a full-time student at the University of Key West The McCarthys also have a 12-year-old daughter (Social Security number 444-23-1212), Justine, that lives with them. Richard is the CEO at a national paper company. His Form W-2 is provided. Christine is an optometrist and operates her own practice ("The Eyes of March") in town as a sole proprietor. The shop address is 1030 Morgan Highway, Clarks Summit, PA 18411 and the business code is 621320. Christine keeps her books on the accrual basis and her bookkeeper provide the following information: Gross sales $270,000 Returns 9,000 Inventory: Beginning inventory $24,000 Purchases 120,000 Ending inventory 30,000 Rent 24,000 Insurance 11,000 Professional fees 3,000 Payroll 37,000 Payroll taxes 2,800 Utilities 4,000 Office expenses 2,000 Depreciation 5,000 The McCarthys have a nanny/housekeeper they paid $12,000 during 2018. They did not withhold income or FICA taxes. The McCarthys paid Pennsylvania state unemployment tax of $378 (based on the first $7,000 of wages) in 2018. Christine received a 2018 Form 1099-INT from the National Bank of Scranton that listed interest income of $23,400. Note that McCarthys reasonably allocate $1,278 to state income tax expense for purposes of the Net Investment Income tax. The McCarthys paid the following in 2018: Home mortgage interest $15,600 Property taxes 5,600 Estimated state income tax payments 3,000 Estimated Federal income tax payments 11,000 Charitable contributions (all cash) 7,600 Required: Complete the McCarthys' federal tax return for 2018. Use Form 1040, Schedule 1, Schedule 4, Schedule 5, Schedule A, Schedule B, Schedule C, Schedule H, Schedule SE, Form 8959, and Form 8960 to complete this tax return. Make realistic assumptions about any missing data. The taxpayers had health insurance coverage for the entire year and do not want to contribute to the presidential election campaign. Enter all amounts as positive numbers. If an amount box does not require an entry or the answer is zero, enter "o". If required, round any dollar amount to the nearest dollar. Form Department of the Treasury-Internal Revenue Service (99) 1040 U.S. Individual Income Tax Return 2018 OMB No. 1545-0074 IRS Use Only Filing status: Married filing jointly Your first name and initial Last name Your social security number Richard McCarthy 100-10-9090 Your standard deduction: If joint return, spouse's first name and initial Last name Spouse's social security number Christine McCarthy 101-21-3434 Full-year health care Spouse standard deduction: None v Yes v coverage or exempt (see inst.) Presidential Election Campaign (see inst.) None v Home address (number and street). If you have a P.O. box, see instructions. Apt. no. 32 Sleepy Hollow Road If more than four dependents, see inst. and v here O City, town or post office, state, and ZIP code. If you have a foreign address, attach Schedule 6. Clarks Summit, PA 18411 Dependents (see instructions): (2) Social security number (3) Relationship to you (4) v if qualifies for (see inst.): (1) First name Child tax credit Credit for other dependents Last name Jack McCarthy 555-55-1212 Son No v Yes Justine McCarthy 444-23-1212 Daughter Yes v No v Under penalties of perjury, I declare that I have examined this return and accompanying schedules and statements, and to the best of my knowledge and belief, they are true, correct, and complete. Declaration of preparer (other than Sign Here taxpayer) is based on all information of which preparer has any knowledge. Your signature Your occupation Date If the IRS sent you an Identity Joint return? CEO Protection PIN, enter it here See (see inst.) instructions. Spouse's signature. If a joint return, both Spouse's occupation Keep a copy for Date If the IRS sent you an Identity your records. must sign. Optometrist Protection PIN, enter it here (see inst.) Preparer's name Preparer's signature Firm's EIN PTIN Check if: Paid O 3rd Party Firm's name Phone no. Preparer Designee Use Only o Self- Firm's address employed For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, see separate instructions. Cat. No. 11320B Form 1040 (2018) Form 1040 (2018) Richard McCarthy 100-10-9090 Page 2 Wages, salaries, tips, etc. Attach Form(s) W-2. 230,000 V 1 1 b Taxable interest 23,400 V 2a Tax-exempt interest 2a 2b Qualified dividends b Ordinary dividends 3b Attach Form(s) W- 4a IRAS, pensions, and 4a b Taxable amount 4b 2. Also attach annuities Form(s) W-2G and 5a b Taxable amount Social security benefits 5a 5b 1099-R if tax was withheld. 6 Total income. Add lines 1 through 5. Add any amount from Schedule 1, line 22 58,200 311,600 v 7 Adjusted gross income. If you have no adjustments to income, enter the amount from line 6; otherwise, subtract Schedule 1, line 36, from line 6. 7 307,488 V Standard Standard deduction or itemized deductions (from Schedule A). 33,200 V 8. Deduction for- Single or married filing separately, Qualified business income deduction (see instructions).. 11,640 x Taxable income. Subtract lines 8 and 9 from line 7. If zero or less, enter -0-.... 262,648 x 10 10 $12,000 a Tax (see inst) 51,615 x (check if any from: 10 Form(s) 8814 2 0 Form 11 Married filing jointly or Qualifying widow(er), $24,000 4972 3 0 b Add any amount from Schedule 2 and check here . 11 51,615 X Head of CO widow(er), $24,000 b Add any amount from Schedule 2 and check here. 11 51,615 X Head of 12 a Child tax credit/credit for other dependents b Add any amount from Schedule 3 and check here .. household, 2,500 $18,000 If you checked any box under 12 2,500 V 13 Subtract line 12 from line 11. If zero or less, enter -0- . 49,115 x 13 Standard deduction, see Other taxes. Attach Schedule 4. 14 14 11,286 X instructions. 15 Total tax. Add lines 13 and 14... 60,401 x 15 16 Federal income tax withheld from Forms W-2 and 1099 16 77,270 x 17 Refundable credits: a EIC (see inst.) c Form 8863 b Sch 8812 Add any amount from Schedule 5 17 18 Add lines 16 and 17. These are your total payments... 77,270 V 18 19 If line 18 is more than line 15, subtract line 15 from line 18. This is the amount you Refund overpaid .. 16,869 X 19 20a Amount of line 19 you want refunded to you. If Form 8888 is attached, check here O 20a 16,869 X |||| Direct deposit? > b Routing number > C Type: o Checking o Savings See instructions. > d Account number 21 Amount of line 19 you want applied to your 2019 estimated tax. 21 22 Amount you owe. Subtract line 18 from line 15. For details on how to pay, see Amount instructions .. 22 You Owe Estimated tax penalty (see instructions)..... 23 Go to www.irs.gov/Form1040 for instructions and the latest information. Form 1040 (2018) Schedule 4 Complete Richard and Christine's Schedule 4. SCHEDULE 4 OMB No. 1545-0074 Other Taxes (Form 1040) 2018 Department of the Attach to Form 1040. Go to www.irs.gov/Form1040 for instructions and the latest information. Treasury Internal Attachment Revenue Service Sequence No. 04 Name(s) shown on Form 1040 Your social security number Richard and Christine McCarthy 100-10-9090 Other 57 Self-employment tax. Attach Schedule SE .. 8,223 V 57 xes 58 Unreported social security and Medicare tax from: Form a o 4137 bo 8919... 58 59 Additional tax on IRAS, other qualified retirement plans, and other tax-favored accounts. Attach Form 5329 if required .... 59 60a Household employment taxes. Attach Schedule H.. 1,878 V 60a b Repayment of first-time homebuyer credit from Form 5405. Attach Form 5405 if required..... 60b 61 Health care: individual responsibility (see instructions)... 61 62 Taxes from: a o Form 8959 b a Form 8960 co Instructions; enter code(s) 62 1,185 x 63 Section 965 net tax liability installment from Form 965-A... 63 64 Add the amounts in the far right column. These are your total other taxes. Enter here and on Form 1040, line 14..... 11,286 x 64 For Paperwork Reduction Act Notice, see your tax return instructions. Cat. No. 71481R Schedule 4 (Form 1040) 2018 Schedule 5 Complete Richard and Christine's Schedule 5. SCHEDULE 5 OMB No. 1545-0074 Other Payments and Refundable Credits (Form 1040) 2018 Department of the Attach to Form 1040. Go to www.irs.gov/Form1040 for instructions and the latest information. Treasury Internal Attachment Revenue Service Sequence No. 05 Name(s) shown on Form 1040 Your social security number Richard and Christine McCarthy 100-10-9090 Other 65 Reserved . 65 Payments 66 2018 estimated tax payments and amount applied from 2017 return 66 and 67a Reserved . 67a Refundable b Reserved . 67b Credits 68-69 Reserved . 68-69 70 Net premium tax credit. Attach Form 8962. 70 Amount paid with request for extension to file (see instructions). 71 71 72 Excess social security and tier 1 RRTA tax withheld . 72 73 Credit for federal tax on fuels. Attach Form 4136 .. 73 74 Credits from Form: a o 2439 b O Reserved co 8885 d o 74 75 Add the amounts in the far right column. These are your other payments and refundable credits. Enter here and on Form 1040, line 17 75 ..... For Paperwork Reduction Act Notice, see your tax return instructions. Cat. No. 71482C Schedule 5 (Form 1040) 2018 Form 8959 Complete Richard and Christine McCarthy's Form 8959. OMB No. 1545-0074 Form 8959 Additional Medicare Tax 2018 If any line does not apply to you, leave it blank. See separate instructions. Attach to Form 1040, 1040NR, 1040-PR, or 1040-ss. Go to www.irs.gov/Form8959 for instructions and the latest information. Department of the Treasury Internal Attachment Revenue Service Sequence No. 71 Name(s) shown on Form 1040 Your social security number Richard and Christine McCarthy 100-10-9090 Part I Additional Medicare Tax on Medicare Wages 1 Medicare wages and tips from Form W-2, box 5. If you have more than one Form W-2, enter the total of the amounts from box 5..... 2 Unreported tips from Form 4137, line 6. 230,000 v 3 Wages from Form 8919, line 6 3. 4 Add lines 1 through 3..... 230,000 v 4 5 Enter the following amount for your filing status: Married filing jointly.... Married filing separately... Single, Head of household, or Qualifying widow(er)... $200,000 $250,000 $125,000 5 250,000 V 6 Subtract line 5 from line 4. If the result is zero or less, enter -0- 6. 7 Additional Medicare Tax on Medicare wages. Multiply line 6 by 0.9% (0.009). Enter here and go to Part II 7 Part II Additional Medicare Tax on Self-Employment Income 8 Self-employment income from Schedule SE (Form 1040), Section A, line 4, or Section B, line 6. If you had a loss, enter -0- (Form 1040- PR and Form 1040-ss filers, see instructions.). 58,200 X 9 Enter the following amount for your filing status: Married filing jointly.... Married filing separately .... Single, Head of household, or Qualifying widow(er)... $250,000 $125,000 $200,000 250,000 2. CO 10 Enter the amount from line 4. 10 230,000 11 Subtract line 10 from line 9. If zero or less, enter -0- 20,000 v 11 12 Subtract line 11 from line 8. If the result is zero or less, enter -0-. .... 12 38,200 x 13 Additional Medicare Tax on self-employment income. Multiply line 12 by 0.9% (0.009). Enter here and go to Part III ... 13 344 X Part III Additional Medicare Tax on Railroad Retirement Tax Act (RRTA) Compensation 14 Railroad retirement (RRTA) compensation and tips from Form(s) W-2, box 14 (see instructions).... 14 15 Enter the following amount for your filing status: Married filing jointly... $250,000 Married filing separately . $125,000 Single, Head of household, or Qualifying widow(er)... $200,000 15 16 Subtract line 15 from line 14. If zero or less, enter -0-. 16 17 Additional Medicare Tax on railroad retirement (RRTA) compensation. Multiply line 16 by 0.9% (0.009). Enter here and go to Part IV.... 17 Part IV Total Additional Medicare Tax 18 Add lines 7, 13, and 17. Also include this amount on Schedule 4 (Form 1040), line 62 (check box a) (Form 1040NR, 1040-PR, and 1040-SS filers, see instructions), and go to Part V 18 344 X Part V Withholding Reconciliation 19 Medicare tax withheld from Form W-2, box 6. If you have more than one Form W-2, enter the total of the amounts from box 6... 3,605 V 19 20 Enter the amount from line 1. 230,000 V 20 21 Multiply line 20 by 1.45% (0.0145). This is your regular Medicare tax withholding on Medicare wages . 3,335 V 21 22 Subtract line 21 from line 19. This is your Additional Medicare Tax withholding on Medicare wages... 22 270 V 23 Additional Medicare Tax withholding on railroad retirement (RRTA) compensation from Form W-2, box 14 (see instructions).. 23 24 Total Additional Medicare Tax withholding. Add lines 22 and 23. Also include this amount with federal income tax withholding on Form 1040, line 16 (Form 1040NR, 1040-PR, and 1040-S filers, see instructions)... 24 270

Step by Step Solution

3.53 Rating (160 Votes )

There are 3 Steps involved in it

Based on the provided images and their contents I will analyze and verify the McCarthy familys tax return calculations and provide answers to any possible discrepancies or questions that may arise Ana... View full answer

Get step-by-step solutions from verified subject matter experts