Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTION 3: Sandra and Sandford have a 3 year old daughter and are expecting their 2nd child. They both are 30 years old. They

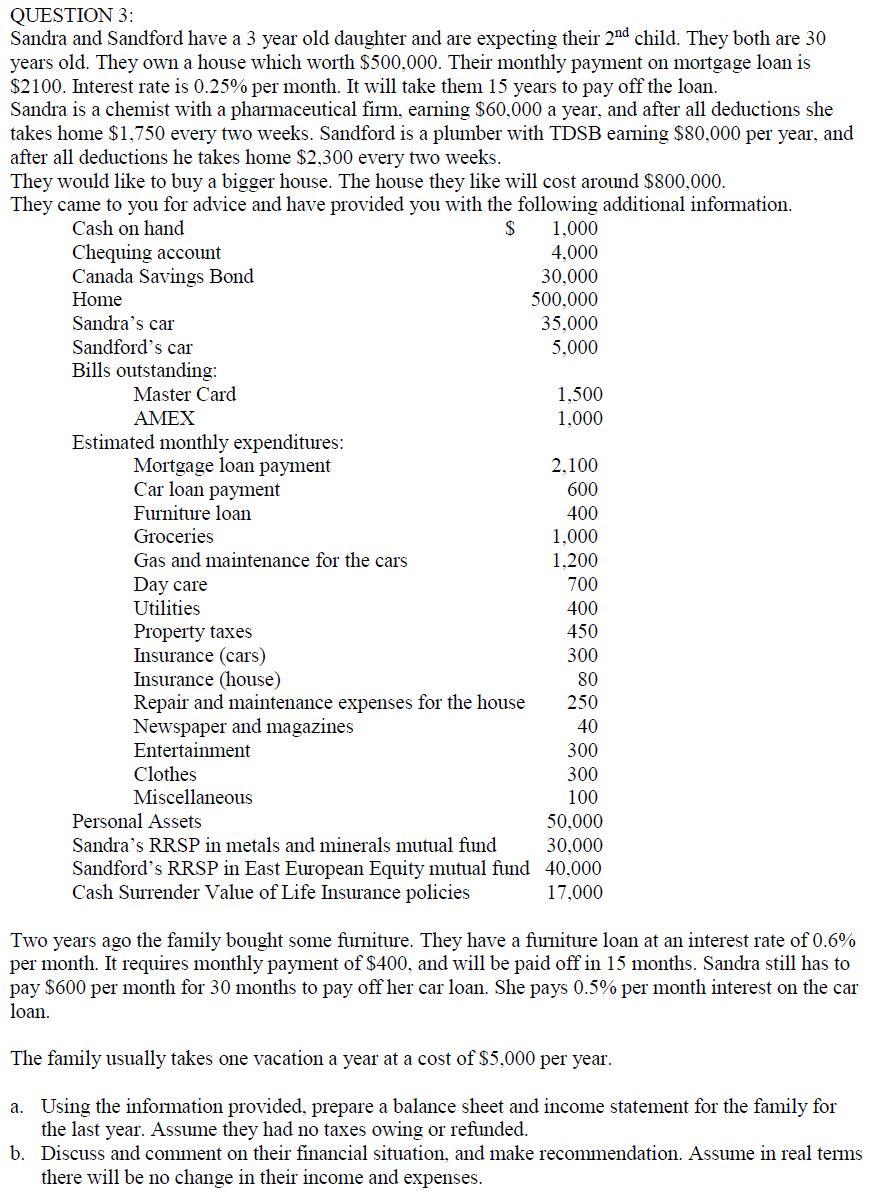

QUESTION 3: Sandra and Sandford have a 3 year old daughter and are expecting their 2nd child. They both are 30 years old. They own a house which worth $500,000. Their monthly payment on mortgage loan is $2100. Interest rate is 0.25% per month. It will take them 15 years to pay off the loan. Sandra is a chemist with a pharmaceutical firm, earning $60,000 a year, and after all deductions she takes home $1,750 every two weeks. Sandford is a plumber with TDSB earning $80,000 per year, and after all deductions he takes home $2,300 every two weeks. They would like to buy a bigger house. The house they like will cost around $800,000. They came to you for advice and have provided you with the following additional information. Cash on hand $ Chequing account Canada Savings Bond Home Sandra's car Sandford's car Bills outstanding: Master Card AMEX Estimated monthly expenditures: Mortgage loan payment Car loan payment Furniture loan Groceries Gas and maintenance for the cars Day care Utilities Property taxes Insurance (cars) Insurance (house) Repair and maintenance expenses for the house Newspaper and magazines Entertainment Clothes Miscellaneous Personal Assets Sandra's RRSP in metals and minerals mutual fund Sandford's RRSP in East European Equity mutual fund Cash Surrender Value of Life Insurance policies 1,000 4,000 30,000 500,000 35,000 5,000 1,500 1.000 2,100 600 400 1,000 1.200 700 400 450 300 80 250 40 300 300 100 50,000 30,000 40,000 17,000 Two years ago the family bought some furniture. They have a furniture loan at an interest rate of 0.6% per month. It requires monthly payment of $400, and will be paid off in 15 months. Sandra still has to pay $600 per month for 30 months to pay off her car loan. She pays 0.5% per month interest on the car loan. The family usually takes one vacation a year at a cost of $5,000 per year. a. Using the information provided, prepare a balance sheet and income statement for the family for the last year. Assume they had no taxes owing or refunded. b. Discuss and comment on their financial situation, and make recommendation. Assume in real terms there will be no change in their income and expenses.

Step by Step Solution

★★★★★

3.51 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Income Statement for family Incomes 1 Net Income from Sandras Pharmaceutical Firm 4550000 2 Net Inco...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started