Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The MP Organisation is an independent film production company. It has a number of potential films that it is considering producing, one of which

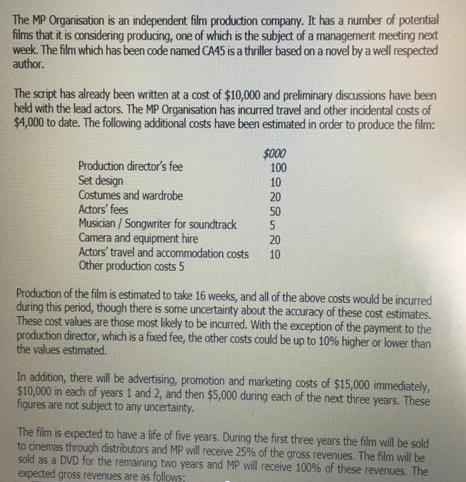

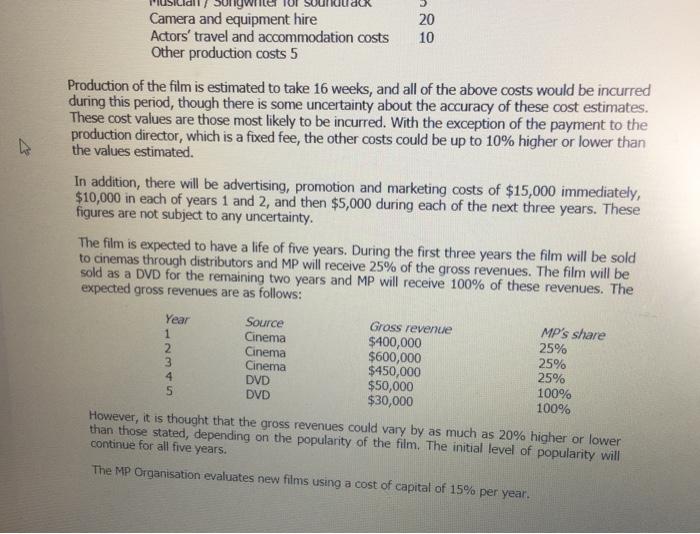

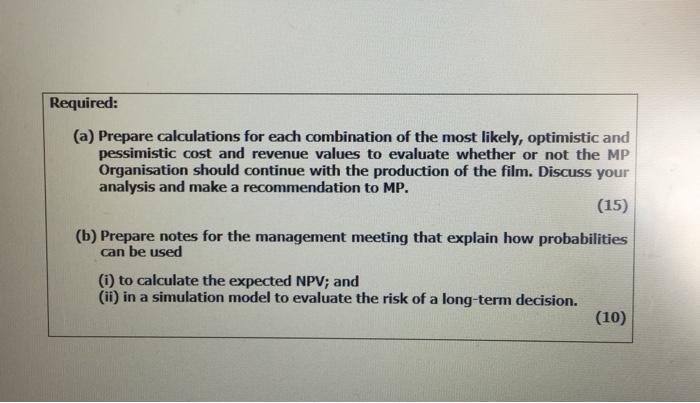

The MP Organisation is an independent film production company. It has a number of potential films that it is considering producing, one of which is the subject of a management meeting next week. The film which has been code named CA45 is a thriller based on a novel by a well respected author. The script has already been written at a cost of $10,000 and preliminary discussions have been held with the lead actors. The MP Organisation has incurred travel and other incidental costs of $4,000 to date. The following additional costs have been estimated in order to produce the film: Production director's fee Set design Costumes and wardrobe Actors' fees Musician/Songwriter for soundtrack Camera and equipment hire Actors' travel and accommodation costs Other production costs 5 $000 100 2222 10 20 50 20 10 Production of the film is estimated to take 16 weeks, and all of the above costs would be incurred during this period, though there is some uncertainty about the accuracy of these cost estimates. These cost values are those most likely to be incurred. With the exception of the payment to the production director, which is a fixed fee, the other costs could be up to 10% higher or lower than the values estimated. In addition, there will be advertising, promotion and marketing costs of $15,000 immediately, $10,000 in each of years 1 and 2, and then $5,000 during each of the next three years. These figures are not subject to any uncertainty. The film is expected to have a life of five years. During the first three years the film will be sold to cinemas through distributors and MP will receive 25% of the gross revenues. The film will be sold as a DVD for the remaining two years and MP will receive 100% of these revenues. The expected gross revenues are as follows: k Camera and equipment hire Actors' travel and accommodation costs Other production costs 5 Production of the film is estimated to take 16 weeks, and all of the above costs would be incurred during this period, though there is some uncertainty about the accuracy of these cost estimates. These cost values are those most likely to be incurred. With the exception of the payment to the production director, which is a fixed fee, the other costs could be up to 10% higher or lower than the values estimated. In addition, there will be advertising, promotion and marketing costs of $15,000 immediately, $10,000 in each of years 1 and 2, and then $5,000 during each of the next three years. These figures are not subject to any uncertainty. The film is expected to have a life of five years. During the first three years the film will be sold to cinemas through distributors and MP will receive 25% of the gross revenues. The film will be sold as a DVD for the remaining two years and MP will receive 100% of these revenues. The expected gross revenues are as follows: Year 1 20 10 2345 Source Cinema Cinema Cinema DVD DVD Gross revenue $400,000 $600,000 $450,000 $50,000 $30,000 MP's share 25% 25% 25% 100% 100% However, it is thought that the gross revenues could vary by as much as 20% higher or lower than those stated, depending on the popularity of the film. The initial level of popularity will continue for all five years. The MP Organisation evaluates new films using a cost of capital of 15% per year. Required: (a) Prepare calculations for each combination of the most likely, optimistic and pessimistic cost and revenue values to evaluate whether or not the MP Organisation should continue with the production of the film. Discuss your analysis and make a recommendation to MP. (15) (b) Prepare notes for the management meeting that explain how probabilities can be used (i) to calculate the expected NPV; and (ii) in a simulation model to evaluate the risk of a long-term decision. (10)

Step by Step Solution

★★★★★

3.34 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

a Expected relevant production costs 220000 Present value of expected relevant production costs 220000 x 0870 191400 But there could be a 10 variation ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started