Answered step by step

Verified Expert Solution

Question

1 Approved Answer

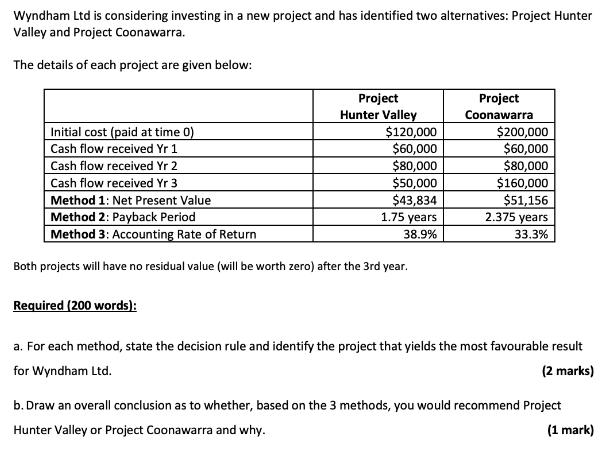

Wyndham Ltd is considering investing in a new project and has identified two alternatives: Project Hunter Valley and Project Coonawarra. The details of each

Wyndham Ltd is considering investing in a new project and has identified two alternatives: Project Hunter Valley and Project Coonawarra. The details of each project are given below: Project Hunter Valley Project Coonawarra $120,000 $60,000 $80,000 $50,000 $43,834 $200,000 $60,000 $80,000 $160,000 $51,156 2.375 years Initial cost (paid at time 0) Cash flow received Yr 1 Cash flow received Yr 2 Cash flow received Yr 3 Method 1: Net Present Value Method 2: Payback Period Method 3: Accounting Rate of Return 1.75 years 38.9% 33.3% Both projects will have no residual value (will be worth zero) after the 3rd year. Required (200 words): a. For each method, state the decision rule and identify the project that yields the most favourable result for Wyndham Ltd. (2 marks) b. Draw an overall conclusion as to whether, based on the 3 methods, you would recommend Project Hunter Valley or Project Coonawarra and why. (1 mark)

Step by Step Solution

★★★★★

3.43 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Part a i Method 1 Net Present Value NPV As per net present ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started