Answered step by step

Verified Expert Solution

Question

1 Approved Answer

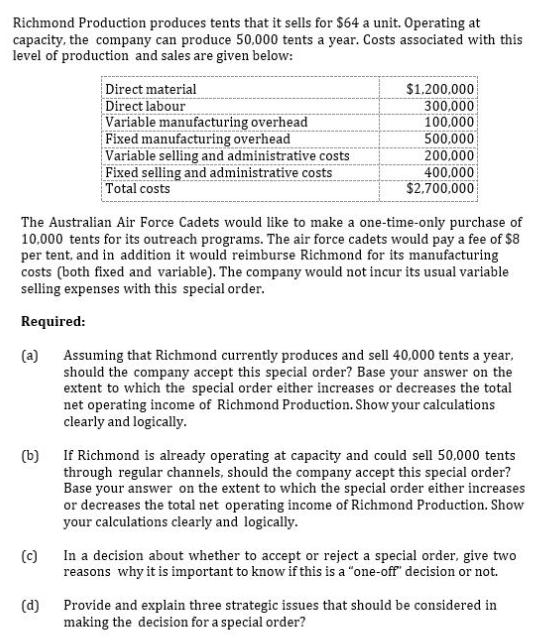

Richmond Production produces tents that it sells for $64 a unit. Operating at capacity, the company can produce 50,000 tents a year. Costs associated

Richmond Production produces tents that it sells for $64 a unit. Operating at capacity, the company can produce 50,000 tents a year. Costs associated with this level of production and sales are given below: Direct material Direct labour Variable manufacturing overhead Fixed manufacturing overhead Variable selling and administrative costs Fixed selling and administrative costs Total costs $1.200.000 300,000 100,000 500,000 200.000 400,000 $2.700,000 The Australian Air Force Cadets would like to make a one-time-only purchase of 10.000 tents for its outreach programs. The air force cadets would pay a fee of $8 per tent, and in addition it would reimburse Richmond for its manufacturing costs (both fixed and variable). The company would not incur its usual variable selling expenses with this special order. Required: (a) Assuming that Richmond currently produces and sell 40,000 tents a year, should the company accept this special order? Base your answer on the extent to which the special order either increases or decreases the total net operating income of Richmond Production. Show your calculations clearly and logically. If Richmond is already operating at capacity and could sell 50.000 tents through regular channels, should the company accept this special order? Base your answer on the extent to which the special order either increases or decreases the total net operating income of Richmond Production. Show your calculations clearly and logically. (b) (c) In a decision about whether to accept or reject a special order, give two reasons why it is important to know if this is a "one-off" decision or not. (d) Provide and explain three strategic issues that should be considered in making the decision for a special order?

Step by Step Solution

★★★★★

3.51 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Requirement A The company is currently producing 40000 tents the maximum capacity of the company is ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started