Answered step by step

Verified Expert Solution

Question

1 Approved Answer

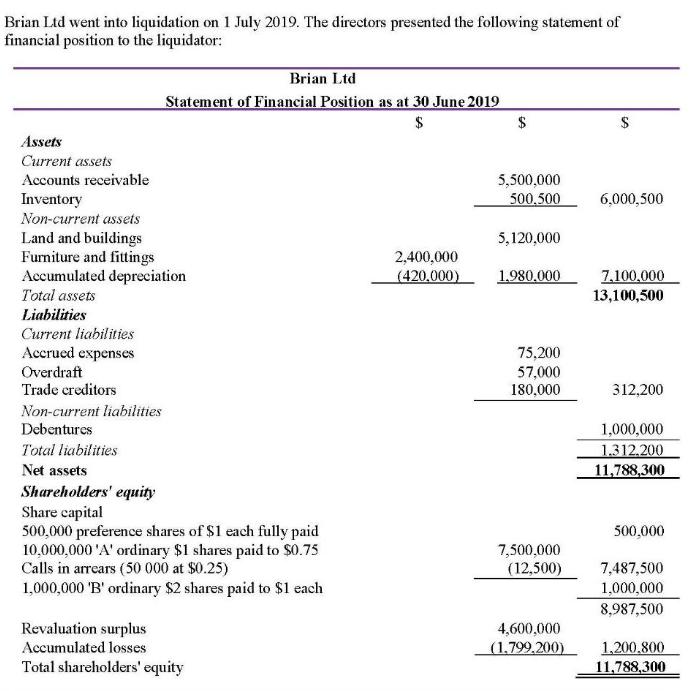

Brian Ltd went into liquidation on 1 July 2019. The directors presented the following statement of financial position to the liquidator: Brian Ltd Statement

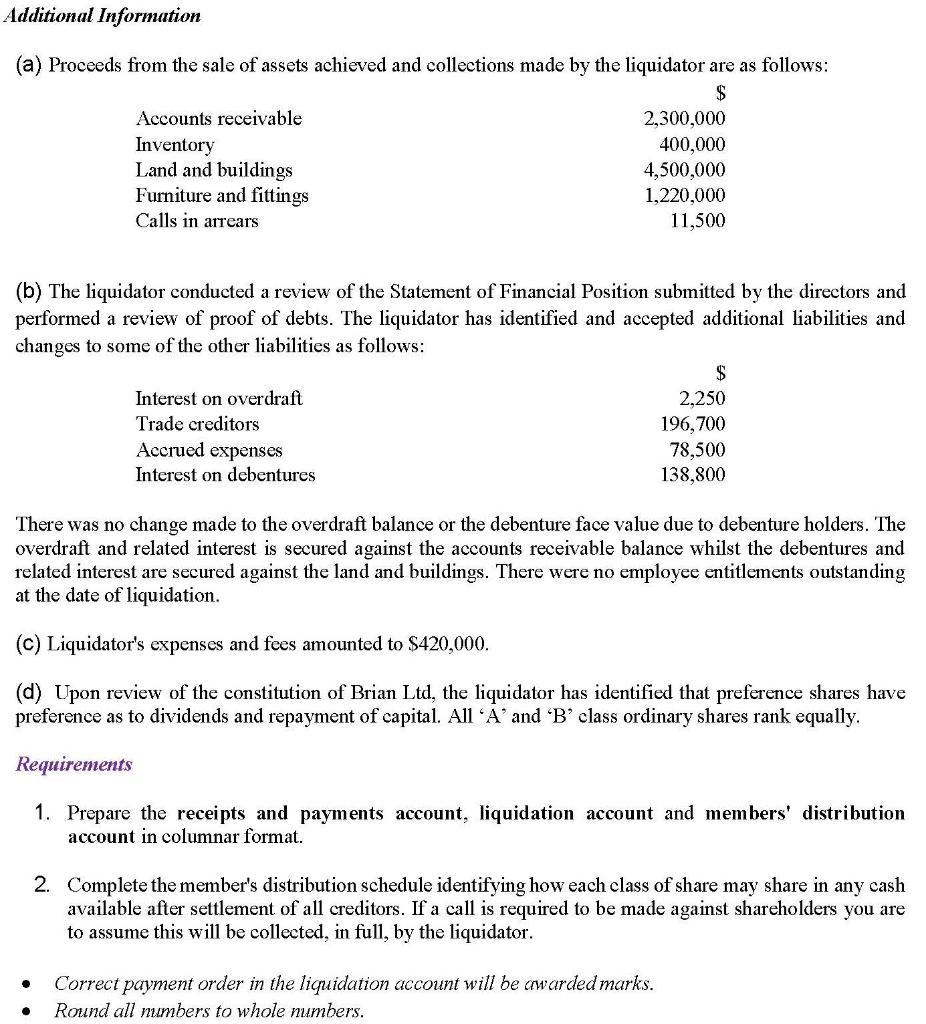

Brian Ltd went into liquidation on 1 July 2019. The directors presented the following statement of financial position to the liquidator: Brian Ltd Statement of Financial Position as at 30 June 2019 2$ 2$ Assets Current assets Accounts receivable 5,500,000 500,500 Inventory Non-current assets 6,000,500 Land and buildings Fumiture and fittings Accumulated depreciation Total assets 5,120,000 2,400,000 (420,000) 7.100,000 13,100,500 1.980.000 Liabilities Current liabilities 75,200 Accrued expenses Overdraft Trade creditors 57,000 180,000 312,200 Non-current liabilities Debentures 1,000,000 Total liabilities 1.312.200 11,788,300 Net assets Shareholders' equity Share capital 500,000 preference shares of $1 each fully paid 10,000,000 'A' ordinary $1 shares paid to $0.75 Calls in arrears (50 000 at $0.25) 1,000,000 'B' ordinary $2 shares paid to $1 each 500,000 7,500,000 (12,500) 7,487,500 1,000,000 8,987,500 Revaluation surplus Accumulated losses 4,600,000 1,200.800 11,788,300 (1,799.200) Total shareholders' equity Additional Information (a) Proceeds from the sale of assets achieved and collections made by the liquidator are as follows: $ Accounts receivable 2,300,000 Inventory Land and buildings Furniture and fittings Calls in arrears 400,000 4,500,000 1,220,000 11,500 (b) The liquidator conducted a review of the Statement of Financial Position submitted by the directors and performed a review of proof of debts. The liquidator has identified and accepted additional liabilities and changes to some of the other liabilities as follows: Interest on overdraft 2,250 Trade creditors 196,700 78,500 138,800 Accrued expenses Interest on debentures There was no change made to the overdraft balance or the debenture face value due to debenture holders. The overdraft and related interest is secured against the accounts receivable balance whilst the debentures and related interest are secured against the land and buildings. There were no employee entitlements outstanding at the date of liquidation. (c) Liquidator's expenses and fees amounted to $420,000. (d) Upon review of the constitution of Brian Ltd, the liquidator has identified that preference shares have preference as to dividends and repayment of capital. All 'A' and B' class ordinary shares rank equally. Requirements 1. Prepare the receipts and payments account, liquidation account and members' distribution account in columnar format. 2. Complete the member's distribution schedule identifying how each class of share may share in any cash available after settlement of all creditors. If a call is required to be made against shareholders you are to assume this will be collected, in full, by the liquidator. Correct payment order in the liquidation account will be awarded marks. Round all mumbers to whole mumbers.

Step by Step Solution

★★★★★

3.29 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started