Answered step by step

Verified Expert Solution

Question

1 Approved Answer

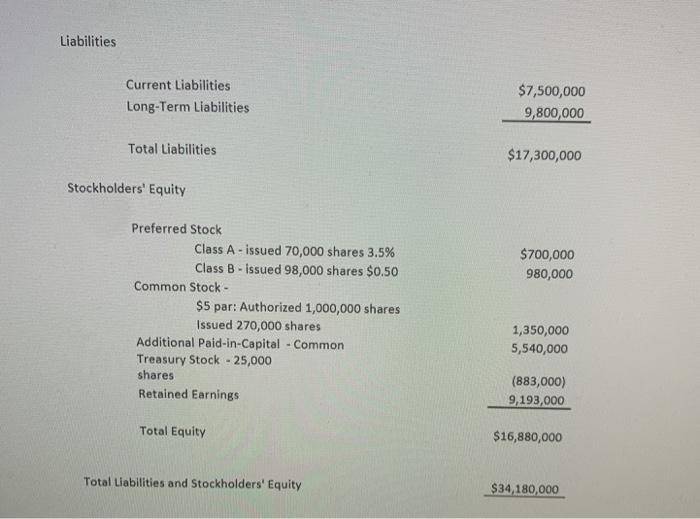

Liabilities Current Liabilities $7,500,000 Long-Term Liabilities 9,800,000 Total Liabilities $17,300,000 Stockholders' Equity Preferred Stock Class A - issued 70,000 shares 3.5% $700,000 Class B

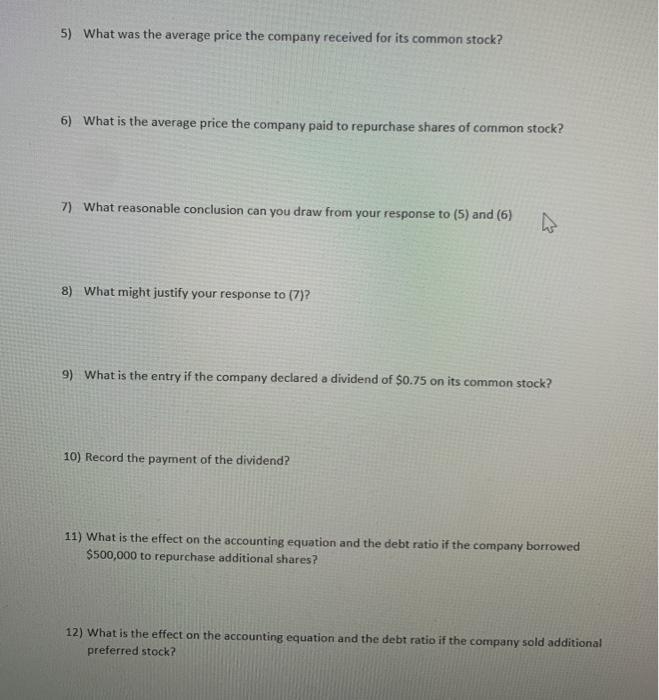

Liabilities Current Liabilities $7,500,000 Long-Term Liabilities 9,800,000 Total Liabilities $17,300,000 Stockholders' Equity Preferred Stock Class A - issued 70,000 shares 3.5% $700,000 Class B - issued 98,000 shares $0.50 980,000 Common Stock - $5 par: Authorized 1,000,000 shares Issued 270,000 shares 1,350,000 5,540,000 Additional Paid-in-Capital - Common Treasury Stock - 25,000 shares (883,000) Retained Earnings 9,193,000 Total Equity $16,880,000 Total Liabilities and Stockholders' Equity $34,180,000 5) What was the average price the company received for its common stock? 6) What is the average price the company paid to repurchase shares of common stock? 7) What reasonable conclusion can you draw from your response to (5) and (6) 8) What might justify your response to (7)? 9) What is the entry if the company declared a dividend of $0.75 on its common stock? 10) Record the payment of the dividend? 11) What is the effect on the accounting equation and the debt ratio if the company borrowed $500,000 to repurchase additional shares? 12) What is the effect on the accounting equation and the debt ratio if the company sold additional preferred stock? Liabilities Current Liabilities $7,500,000 Long-Term Liabilities 9,800,000 Total Liabilities $17,300,000 Stockholders' Equity Preferred Stock Class A - issued 70,000 shares 3.5% $700,000 Class B - issued 98,000 shares $0.50 980,000 Common Stock - $5 par: Authorized 1,000,000 shares Issued 270,000 shares 1,350,000 5,540,000 Additional Paid-in-Capital - Common Treasury Stock - 25,000 shares (883,000) Retained Earnings 9,193,000 Total Equity $16,880,000 Total Liabilities and Stockholders' Equity $34,180,000 5) What was the average price the company received for its common stock? 6) What is the average price the company paid to repurchase shares of common stock? 7) What reasonable conclusion can you draw from your response to (5) and (6) 8) What might justify your response to (7)? 9) What is the entry if the company declared a dividend of $0.75 on its common stock? 10) Record the payment of the dividend? 11) What is the effect on the accounting equation and the debt ratio if the company borrowed $500,000 to repurchase additional shares? 12) What is the effect on the accounting equation and the debt ratio if the company sold additional preferred stock? Liabilities Current Liabilities $7,500,000 Long-Term Liabilities 9,800,000 Total Liabilities $17,300,000 Stockholders' Equity Preferred Stock Class A - issued 70,000 shares 3.5% $700,000 Class B - issued 98,000 shares $0.50 980,000 Common Stock - $5 par: Authorized 1,000,000 shares Issued 270,000 shares 1,350,000 5,540,000 Additional Paid-in-Capital - Common Treasury Stock - 25,000 shares (883,000) Retained Earnings 9,193,000 Total Equity $16,880,000 Total Liabilities and Stockholders' Equity $34,180,000 5) What was the average price the company received for its common stock? 6) What is the average price the company paid to repurchase shares of common stock? 7) What reasonable conclusion can you draw from your response to (5) and (6) 8) What might justify your response to (7)? 9) What is the entry if the company declared a dividend of $0.75 on its common stock? 10) Record the payment of the dividend? 11) What is the effect on the accounting equation and the debt ratio if the company borrowed $500,000 to repurchase additional shares? 12) What is the effect on the accounting equation and the debt ratio if the company sold additional preferred stock?

Step by Step Solution

★★★★★

3.50 Rating (170 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started