Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On December 31, Year 3, ABC Corporation, a public company, issues ten-year convertible bonds with a face value of $2,000,000 and a stated rate

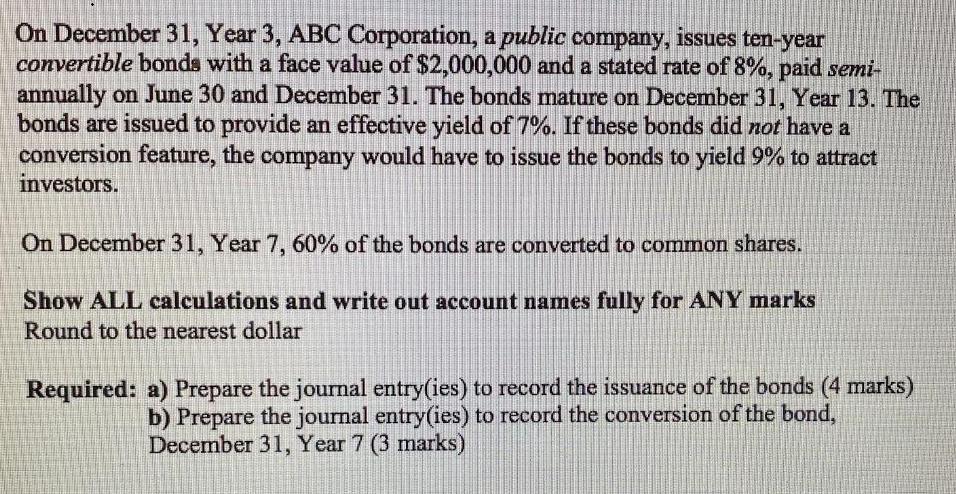

On December 31, Year 3, ABC Corporation, a public company, issues ten-year convertible bonds with a face value of $2,000,000 and a stated rate of 8%, paid semi- annually on June 30 and December 31. The bonds mature on December 31, Year 13. The bonds are issued to provide an effective yield of 7%. If these bonds did not have a conversion feature, the company would have to issue the bonds to yield9% to attract investors. On December 31, Year 7, 60% of the bonds are converted to comnon shares. Show ALL calculations and write out account names fully for ANY marks Round to the nearest dollar Required: a) Prepare the journal entry(ies) to record the issuance of the bonds (4 marks) b) Prepare the journal entry(ies) to record the conversion of the bond, December 31, Year 7 (3 marks)

Step by Step Solution

★★★★★

3.41 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

Facevalue of issued bonds 200000 interest for semi annual period facevalue Stated rate of interest 6...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started