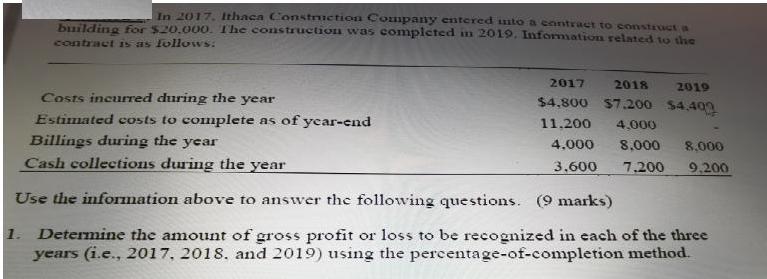

Question: In 2017. Ithaca Constniction Company entered uto a cantract to construct a building for $20.000. The conastruction was complcted in 2019. Information related to

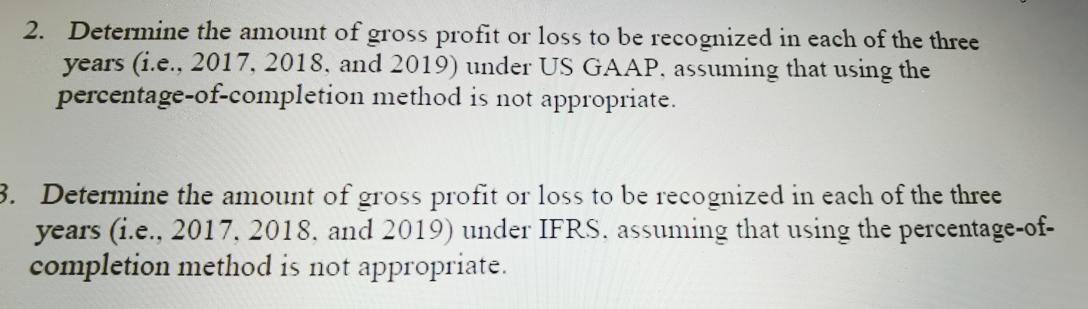

In 2017. Ithaca Constniction Company entered uto a cantract to construct a building for $20.000. The conastruction was complcted in 2019. Information related to the contract s as lollovs: 2017 2018 2019 Costs incurred during the year Estimated costs to complete as of year-end $4,800 $7.200 $4.400 11.200 4,000 Billings during the year 4,000 8,000 .000 Cash collections during the year 3,600 7.200 9.200 Use the information above to answer the following questions. (9 marks) 1. Determine the amount of gross profit or loss to be recognized in each of the three years (i.e., 2017, 2018. and 2019) using the percentage-of-completion method. 2. Determine the amount of gross profit or loss to be recognized in each of the three years (i.e., 2017, 2018, and 2019) under US GAAP, assuming that using the percentage-of-completion method is not appropriate. 3. Determine the amount of gross profit or loss to be recognized in each of the three years (i.e., 2017, 2018, and 2019) under IFRS, assuming that using the percentage-of- completion method is not appropriate.

Step by Step Solution

3.41 Rating (157 Votes )

There are 3 Steps involved in it

Determination of Gross profitloss under percentage completion method Total contract revenue 20000 Particulars Cumulative Cost Estimated additional cost Total estimated cost of completion Cost incurred ... View full answer

Get step-by-step solutions from verified subject matter experts