Question

On 30 June 2014 Anglesea Ltd acquired 100% of the shares in Lorne Ltd for a cost of $500000. The account balances of the

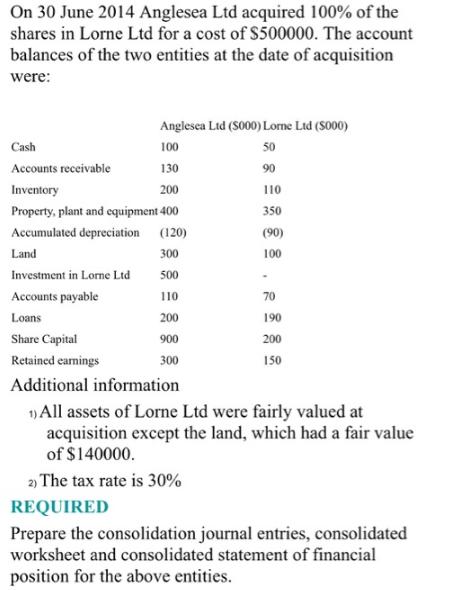

On 30 June 2014 Anglesea Ltd acquired 100% of the shares in Lorne Ltd for a cost of $500000. The account balances of the two entities at the date of acquisition were: Anglesca Ltd (S000) Lome Ltd (S000) Cash 100 50 Accounts receivable 130 90 Inventory 200 110 Property, plant and equipment 400 350 Accumulated depreciation (120) (90) Land 300 100 Investment in Lorne Ltd 50 Accounts payable 110 70 Loans 200 190 Share Capital 900 200 Retained eamings 300 150 Additional information 11All assets of Lorne Ltd were fairly valued at acquisition except the land, which had a fair value of $140000. 2) The tax rate is 30% REQUIRED Prepare the consolidation journal entries, consolidated worksheet and consolidated statement of financial position for the above entities.

Step by Step Solution

3.43 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Accounting and Reporting

Authors: Barry Elliott, Jamie Elliott

14th Edition

978-0273744535, 273744445, 273744534, 978-0273744443

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App