Answered step by step

Verified Expert Solution

Question

1 Approved Answer

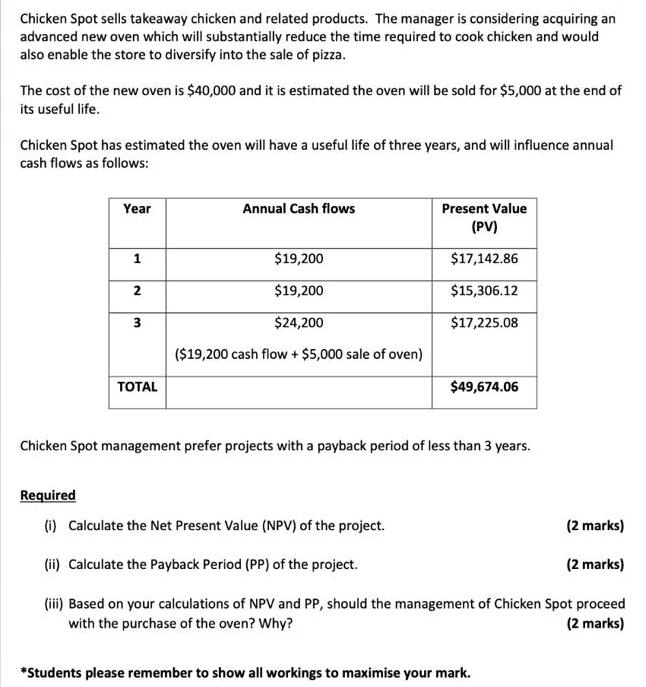

Chicken Spot sells takeaway chicken and related products. The manager is considering acquiring an advanced new oven which will substantially reduce the time required

Chicken Spot sells takeaway chicken and related products. The manager is considering acquiring an advanced new oven which will substantially reduce the time required to cook chicken and would also enable the store to diversify into the sale of pizza. The cost of the new oven is $40,000 and it is estimated the oven will be sold for $5,000 at the end of its useful life. Chicken Spot has estimated the oven will have a useful life of three years, and will influence annual cash flows as follows: Year Annual Cash flows Present Value (PV) $19,200 $17,142.86 2 $19,200 $15,306.12 3 $24,200 $17,225.08 ($19,200 cash flow + $5,000 sale of oven) OTAL $49,674.06 Chicken Spot management prefer projects with a payback period of less than 3 years. Required (i) Calculate the Net Present Value (NPV) of the project. (2 marks) (ii) Calculate the Payback Period (PP) of the project. (2 marks) (ii) Based on your calculations of NPV and PP, should the management of Chicken Spot proceed with the purchase of the oven? Why? (2 marks) *Students please remember to show all workings to maximise your mark. Part (b) (4 marks) Your friend has a small business that only deals with customers in cash sales. As the business is currently struggling, your friend is considering the option of granting credit to customers and allowing sales to be made via accounts receivable in the hope that it boosts performance. Explain to your friend at least two advantages and two disadvantages of changing from a cash-based business to a business that grants credit to customers and allows sales to be made via accounts receivable.

Step by Step Solution

★★★★★

3.51 Rating (144 Votes )

There are 3 Steps involved in it

Step: 1

Answey Paut ONet Poreiont value NP of the puoject ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started