Answered step by step

Verified Expert Solution

Question

1 Approved Answer

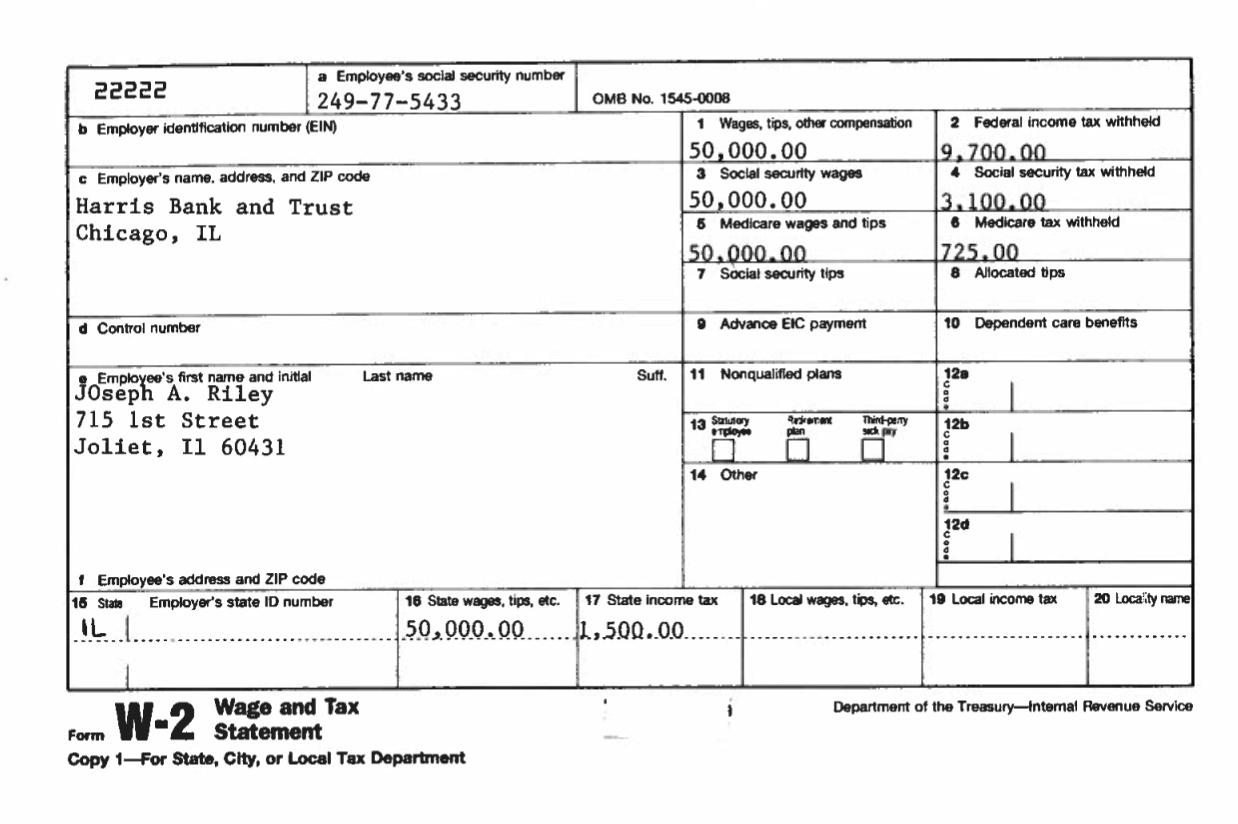

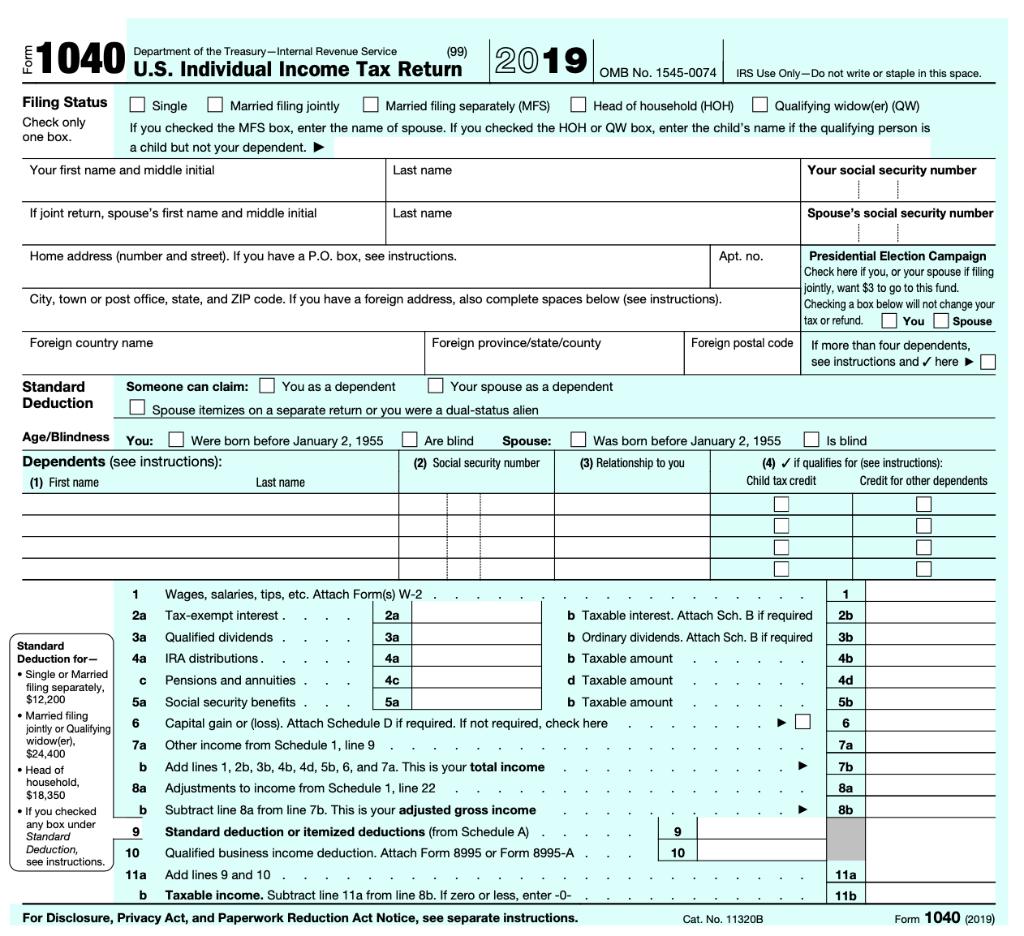

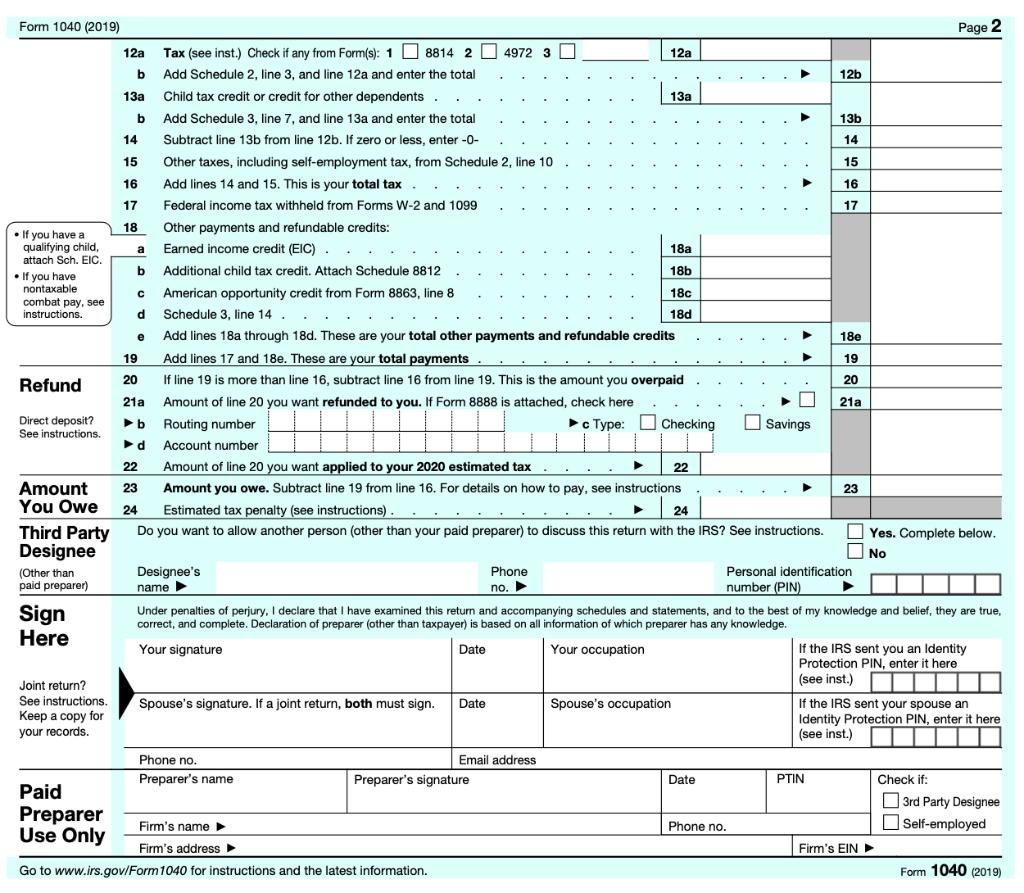

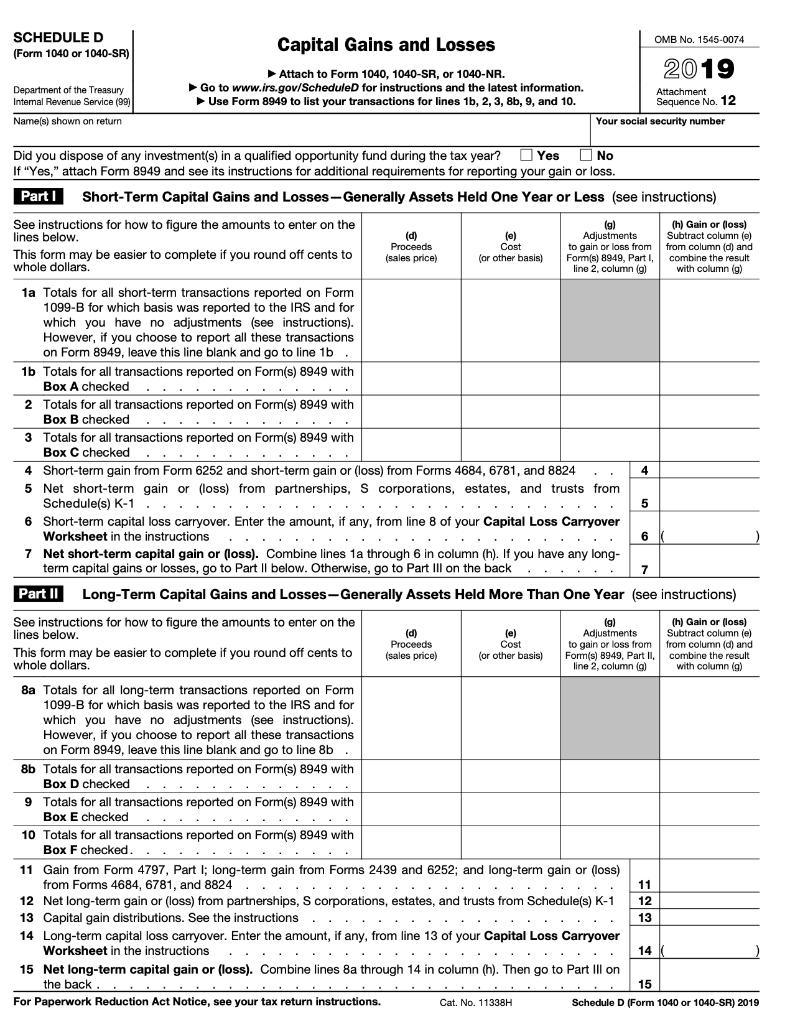

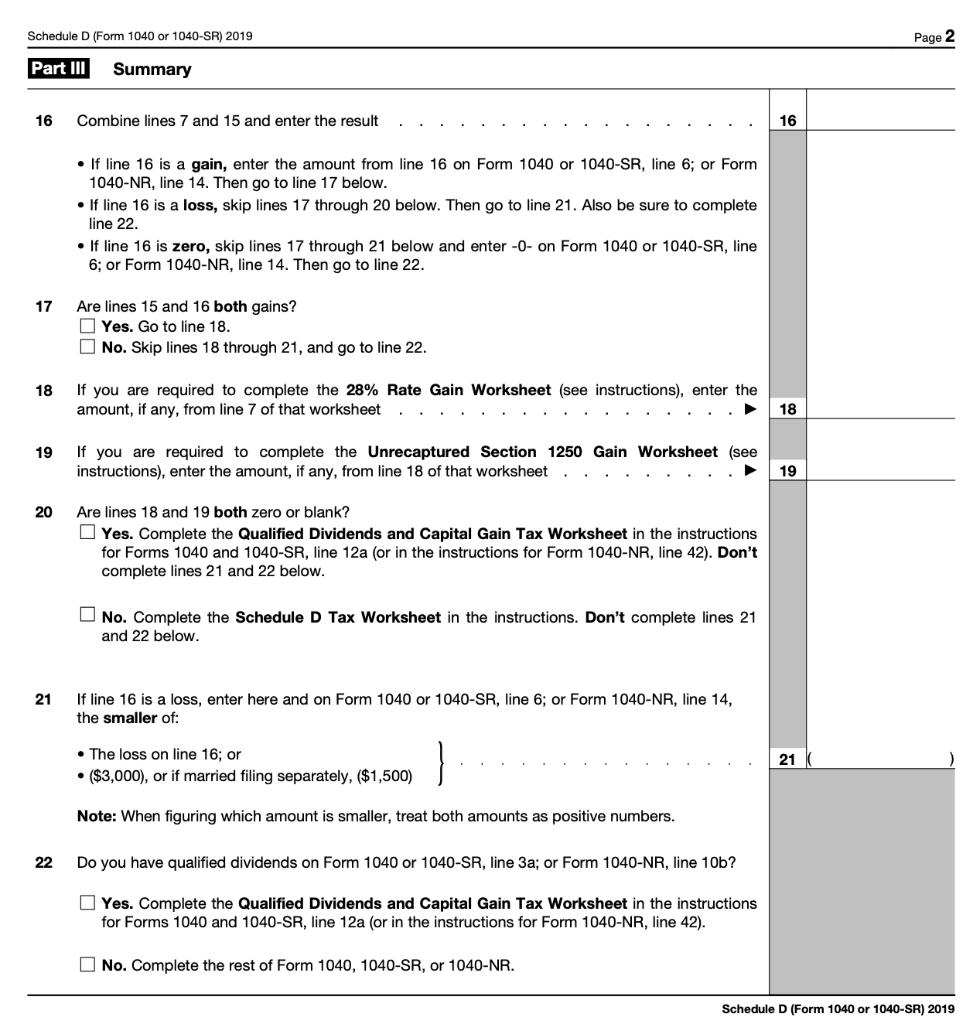

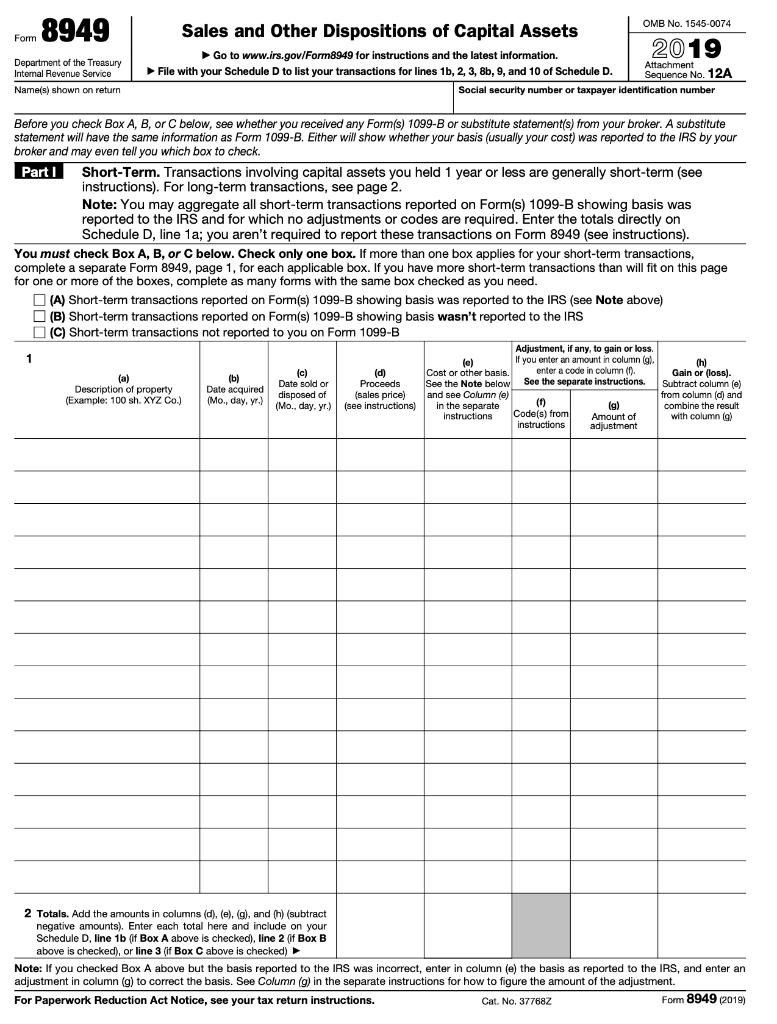

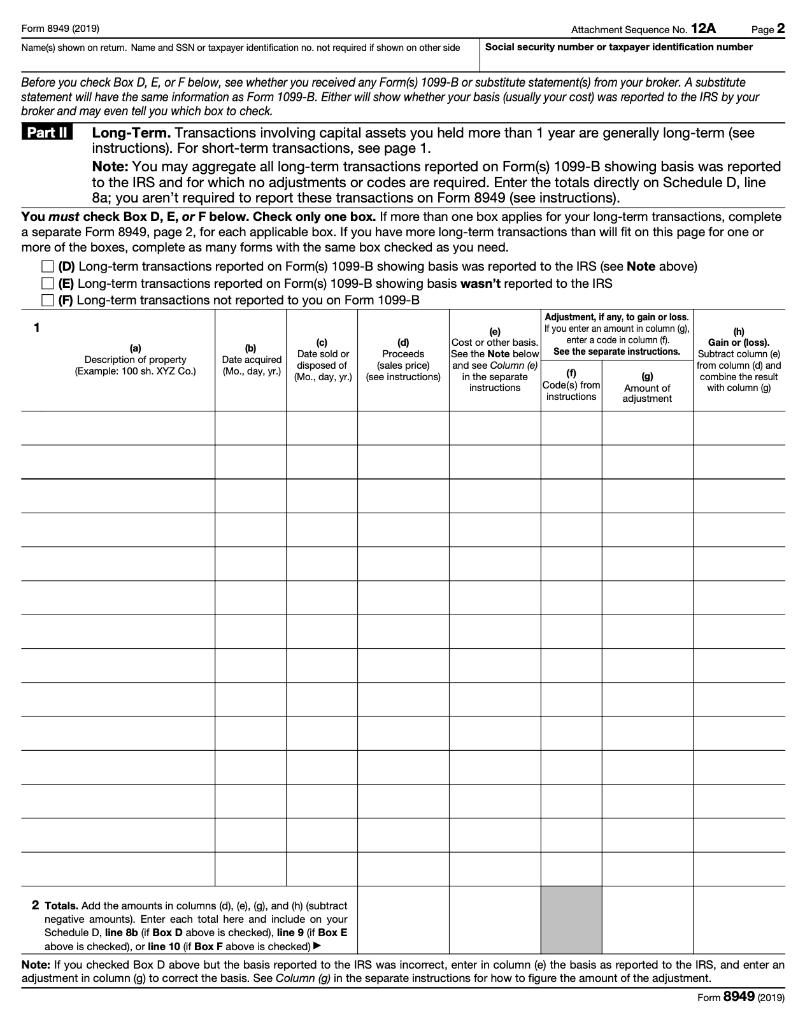

Follow the instructions on the Joe Riley 2 file (click next at the bottom of this page) to prepare Joe's 2019 federal income taxes. You

Follow the instructions on the Joe Riley 2 file (click next at the bottom of this page) to prepare Joe's 2019 federal income taxes. You will find all of the 2019 tax forms that you will need at the bottom of the Modules page under "Tax Forms." You are to hand write on the forms or type in a fillable pdf form. Do not use tax preparation software. You must attach computations for any box that includes more than one amount as well as the computation of tax.

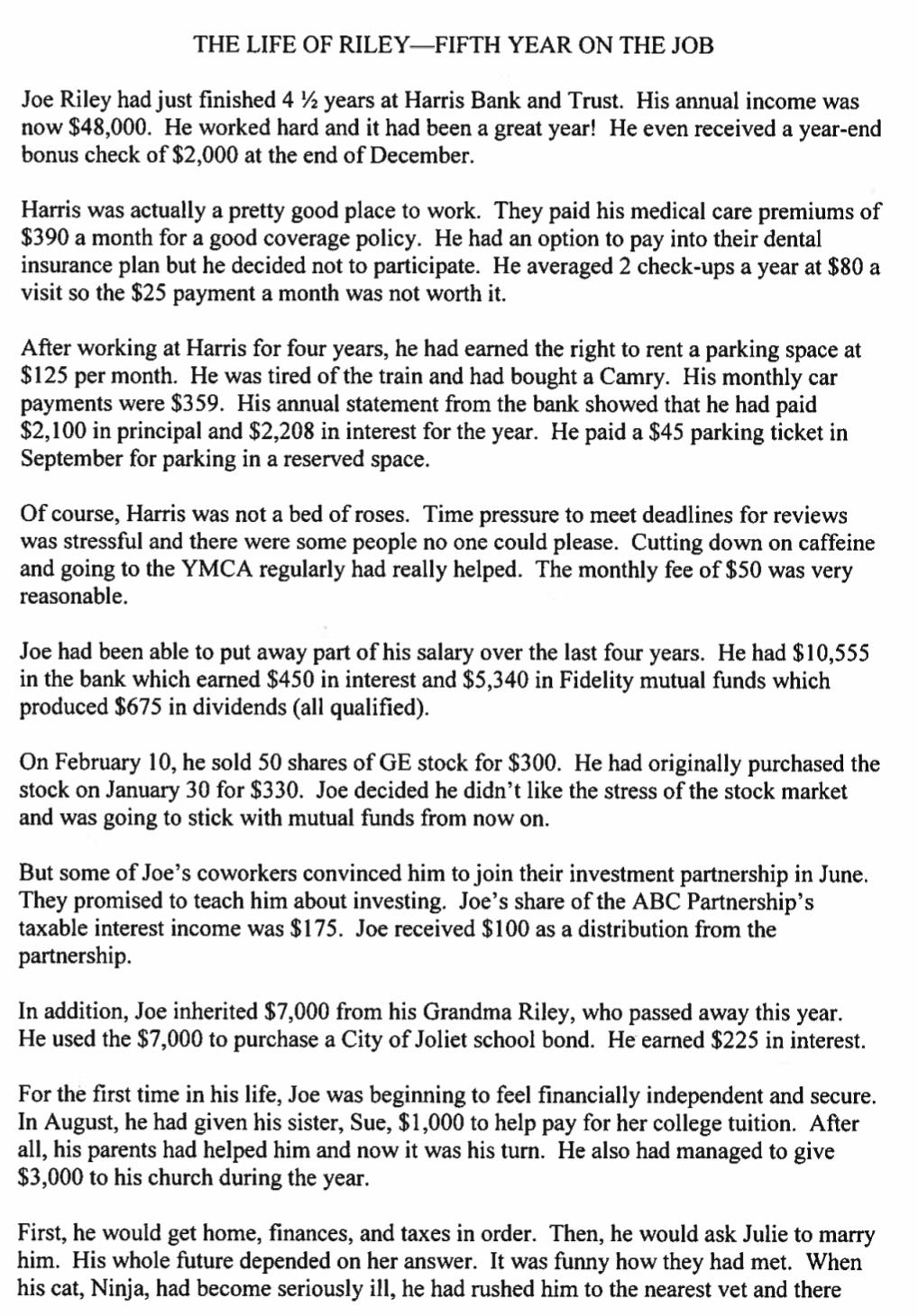

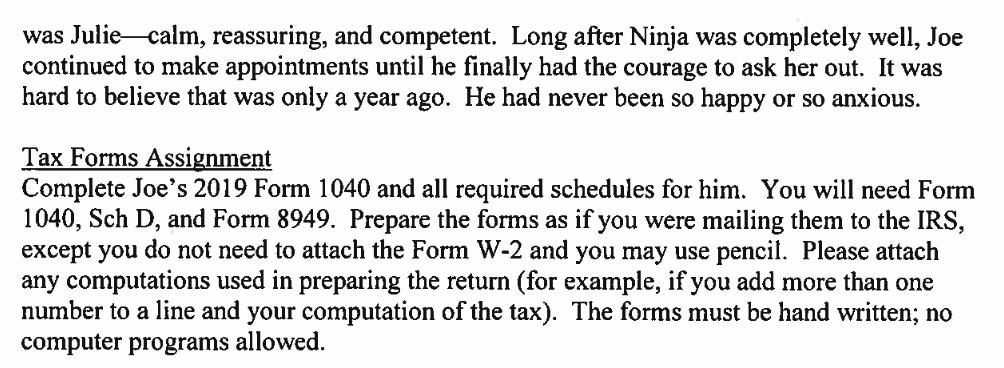

THE LIFE OF RILEY-FIFTH YEAR ON THE JOB Joe Riley had just finished 4 years at Harris Bank and Trust. His annual income was now $48,000. He worked hard and it had been a great year! He even received a year-end bonus check of $2,000 at the end of December. Harris was actually a pretty good place to work. They paid his medical care premiums of $390 a month for a good coverage policy. He had an option to pay into their dental insurance plan but he decided not to participate. He averaged 2 check-ups a year at $80 a visit so the $25 payment a month was not worth it. After working at Harris for four years, he had earned the right to rent a parking space at $125 per month. He was tired of the train and had bought a Camry. His monthly car payments were $359. His annual statement from the bank showed that he had paid $2,100 in principal and $2,208 in interest for the year. He paid a $45 parking ticket in September for parking in a reserved space. Of course, Harris was not a bed of roses. Time pressure to meet deadlines for reviews was stressful and there were some people no one could please. Cutting down on caffeine and going to the YMCA regularly had really helped. The monthly fee of $50 was very reasonable. Joe had been able to put away part of his salary over the last four years. He had $10,555 in the bank which earned $450 in interest and $5,340 in Fidelity mutual funds which produced $675 in dividends (all qualified). On February 10, he sold 50 shares of GE stock for $300. He had originally purchased the stock on January 30 for $330. Joe decided he didn't like the stress of the stock market and was going to stick with mutual funds from now on. But some of Joe's coworkers convinced him to join their investment partnership in June. They promised to teach him about investing. Joe's share of the ABC Partnership's taxable interest income was $175. Joe received $100 as a distribution from the partnership. In addition, Joe inherited $7,000 from his Grandma Riley, who passed away this year. He used the $7,000 to purchase a City of Joliet school bond. He earned $225 in interest. For the first time in his life, Joe was beginning to feel financially independent and secure. In August, he had given his sister, Sue, $1,000 to help pay for her college tuition. After all, his parents had helped him and now it was his turn. He also had managed to give $3,000 to his church during the year. First, he would get home, finances, and taxes in order. Then, he would ask Julie to marry him. His whole future depended on her answer. It was funny how they had met. When his cat, Ninja, had become seriously ill, he had rushed him to the nearest vet and there

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To compute Joes 2019 federal income taxes I will guide you through the details on his income and deductions as stated in The Life of RileyFifth Year o...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started