Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Star Textile Company has issued preferred stocks that are at par value of Rs. 100 each. Dividend on these preferred stocks is 11% that

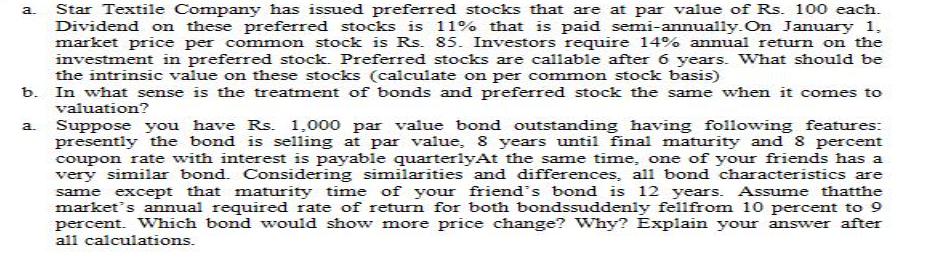

Star Textile Company has issued preferred stocks that are at par value of Rs. 100 each. Dividend on these preferred stocks is 11% that is paid semi-annually.On January 1, market price per common stock is Rs. 85. Investors require 14% annual return on the investment in preferred stock. Preferred stocks are callable after 6 years. What should be the intrinsic value on these stocks (calculate on per common stock basis) b. In what sense is the treatment of bonds and preferred stock the same when it comes to a. valuation? Suppose you have Rs. 1,000 par value bond outstanding having following features: presently the bond is selling at par value, 8 years until final maturity and 8 percent coupon rate with interest is payable quarterlyAt the same time, one of your friends has a very similar bond. Considering similarities and differences, all bond characteristics are same except that maturity time of your friend's bond is 12 years. Assume thatthe market's annual required rate of return for both bondssuddenly fellfrom 10 percent to 9 percent. Which bond would show more price change? Why? Explain your answer after a. all calculations.

Step by Step Solution

★★★★★

3.29 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

a Par value of Preferred Shares Rs 100 Dividend rate 11 Semia...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started