Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a. What method of accounting did Camire use to account for this acquisition? b. What amount(s) will be recorded in the investment account of

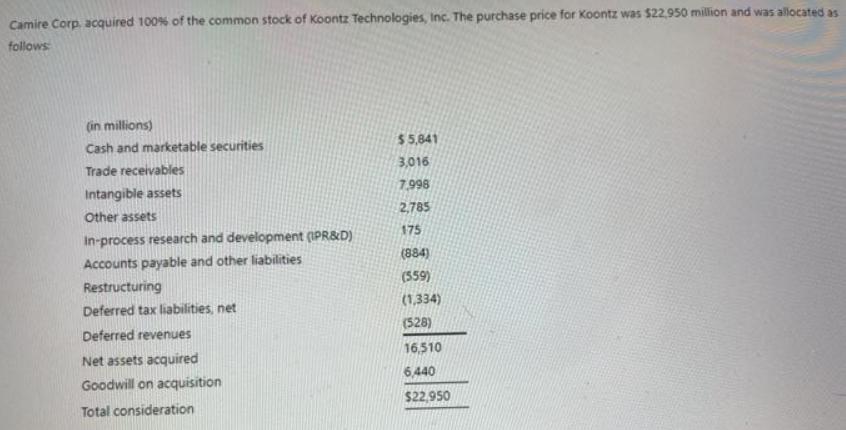

a. What method of accounting did Camire use to account for this acquisition? b. What amount(s) will be recorded in the investment account of Camire's balance sheet for the Koontz Technologies acquisition? c. Are the intangible assets purchased in the Koontz Technologies acquisition, reported on Camire's consolidated balance sheet at book value or at fair value on the date of the acquisition? Explain. d. How will the intangible assets account balance change on the consolidated balance sheet in subsequent years? e. How will the recognition of goodwill affect Camire's consolidated balance sheet? How will this asset change in subsequent years? Camire Corp. acquired 100% of the common stock of Koontz Technologies, Inc. The purchase price for Koontz was $22,950 million and was allocated as follows (in millions) $ 5,841 Cash and marketable securities 3,016 Trade receivables 7.998 Intangible assets 2,785 Other assets 175 in-process research and development (IPR&D) (884) Accounts payable and other liabilities (559) Restructuring (1,334) Deferred tax liabilities, net (528) Deferred revenues 16,510 Net assets acquired 6,440 Goodwill on acquisition $22,950 Total consideration

Step by Step Solution

★★★★★

3.41 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

1 The method of accounting adopted by the Camire is Purchase Acquisition method in which net value o...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started