Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Accounting question. Please solve Part (b) only and provide justification. I already asked for the other parts on chegg. Thank you. Required: a) Rick and

Accounting question. Please solve Part (b) only and provide justification. I already asked for the other parts on chegg. Thank you.

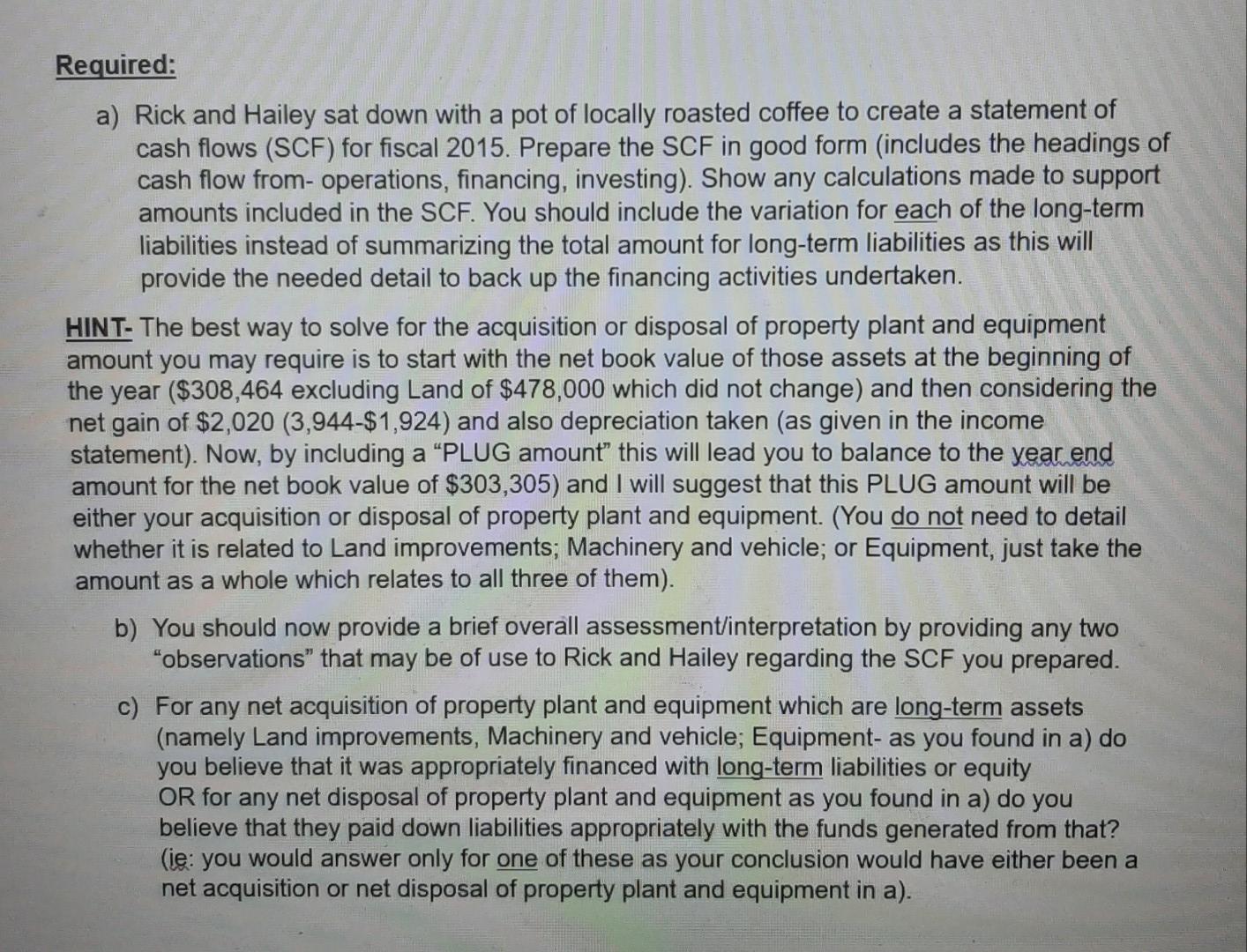

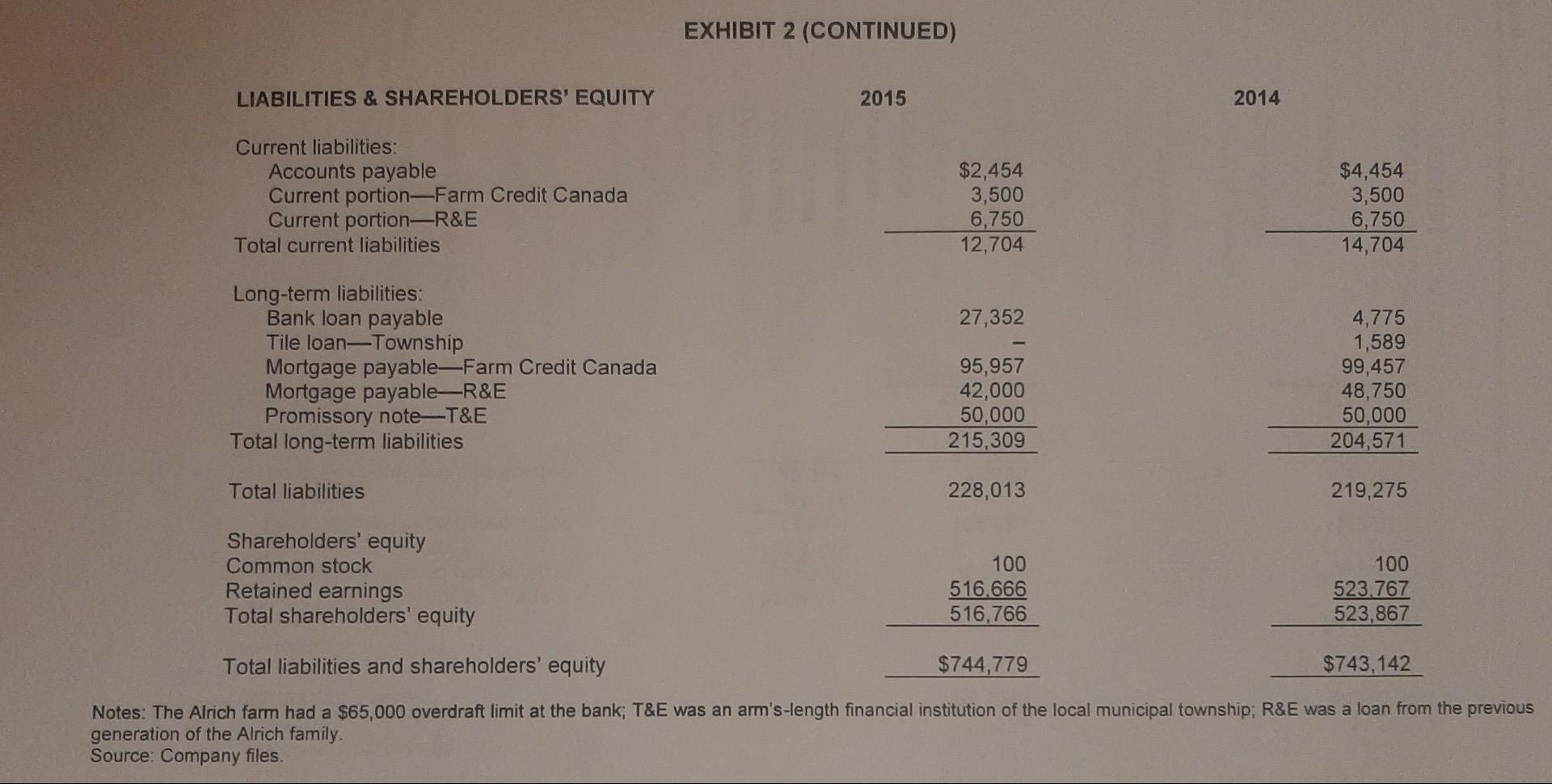

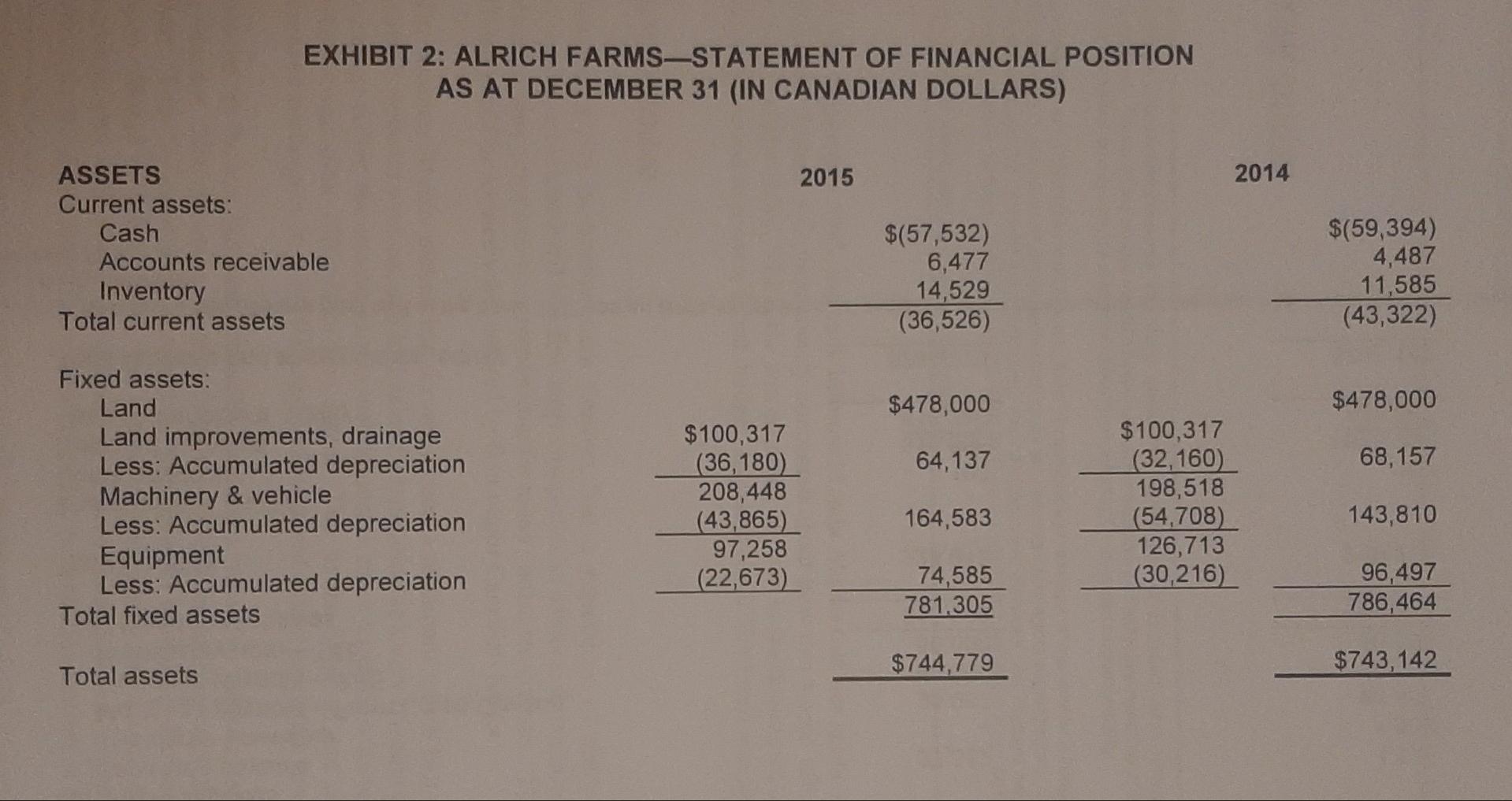

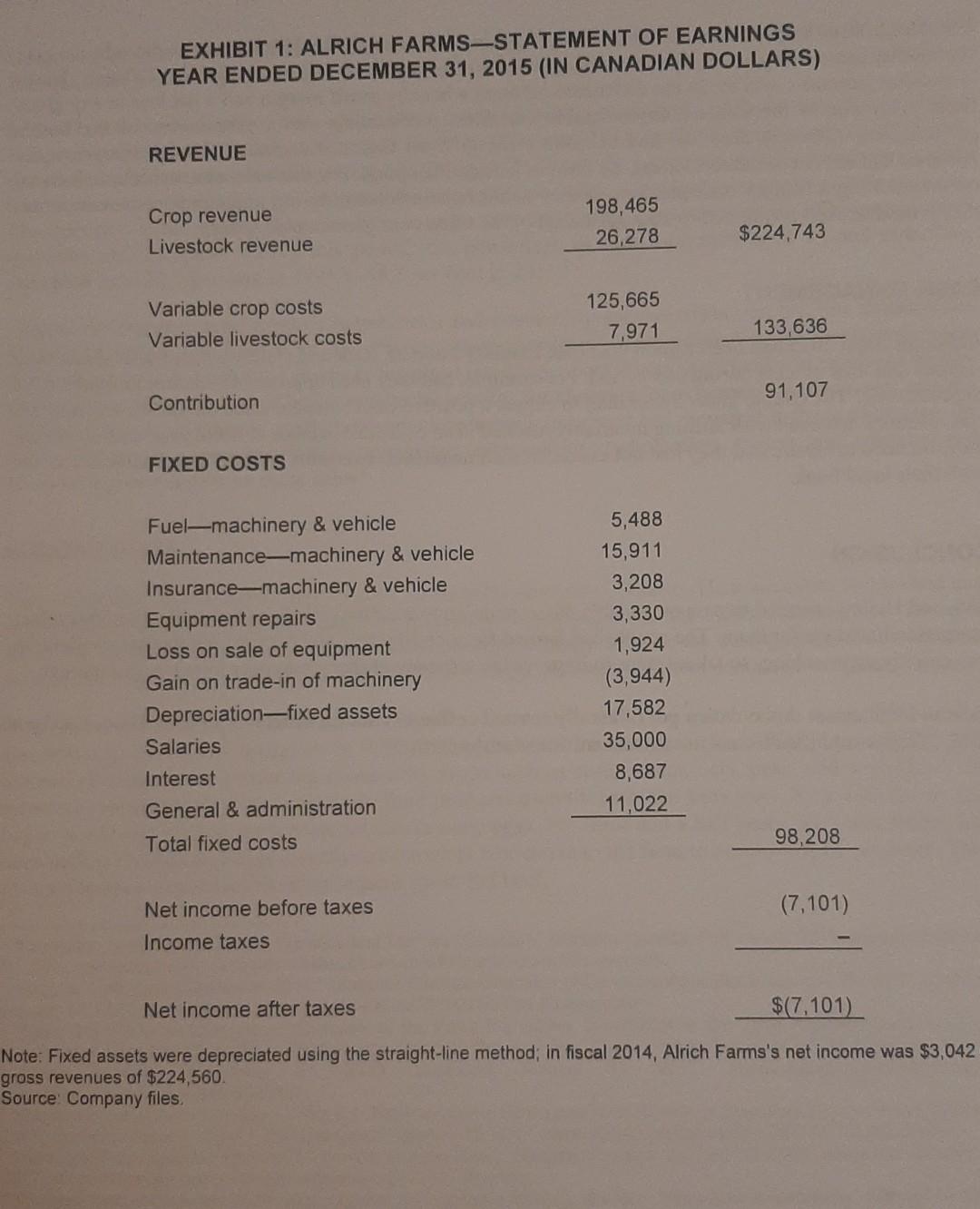

Required: a) Rick and Hailey sat down with a pot of locally roasted coffee to create a statement of cash flows (SCF) for fiscal 2015. Prepare the SCF in good form (includes the headings of cash flow from- operations, financing, investing). Show any calculations made to support amounts included in the SCF. You should include the variation for each of the long-term liabilities instead of summarizing the total amount for long-term liabilities as this will provide the needed detail to back up the financing activities undertaken. HINT- The best way to solve for the acquisition or disposal of property plant and equipment amount you may require is to start with the net book value of those assets at the beginning of the year ($308,464 excluding Land of $478,000 which did not change) and then considering the net gain of $2,020(3,944$1,924) and also depreciation taken (as given in the income statement). Now, by including a "PLUG amount" this will lead you to balance to the year end amount for the net book value of $303,305 ) and I will suggest that this PLUG amount will be either your acquisition or disposal of property plant and equipment. (You do not need to detail whether it is related to Land improvements; Machinery and vehicle; or Equipment, just take the amount as a whole which relates to all three of them). b) You should now provide a brief overall assessment/interpretation by providing any two "observations" that may be of use to Rick and Hailey regarding the SCF you prepared. c) For any net acquisition of property plant and equipment which are long-term assets (namely Land improvements, Machinery and vehicle; Equipment- as you found in a) do you believe that it was appropriately financed with long-term liabilities or equity OR for any net disposal of property plant and equipment as you found in a) do you believe that they paid down liabilities appropriately with the funds generated from that? (ie: you would answer only for one of these as your conclusion would have either been a net acquisition or net disposal of property plant and equipment in a). EXHIBIT 2: ALRICH FARMS-STATEMENT OF FINANCIAL POSITION AS AT DECEMBER 31 (IN CANADIAN DOLLARS) EXHIBIT 2 (CONTINUED) LIABILITIES \& SHAREHOLDERS' EQUITY Current liabilities: Accounts payable Current portion-Farm Credit Canada Current portion-R\&E Total current liabilities Long-term liabilities: Bank loan payable Tile loan-Township Mortgage payable-Farm Credit Canada Mortgage payable-R\&E Promissory note-T\&E Total long-term liabilities Total liabilities Shareholders' equity Common stock Retained earnings Total shareholders' equity Total liabilities and shareholders' equity 2015 $2,4543,5006,75012,704 27,35295,95742,00050,000215,309228,013 100516,766516,666$744,779 2014 $4,4543,5006,75014,704 4,7751,58999,45748,75050,000204,571219,275 100523,767523,867$743,142 Notes: The Alrich farm had a $65,000 overdraft limit at the bank; T\&E was an arm's-length financial institution of the local municipal township; R\&E was a loan from the previous generation of the Alrich family. Source: Company files. EXHIBIT 1: ALRICH FARMS-STATEMENT OF EARNINGS YEAR ENDED DECEMBER 31, 2015 (IN CANADIAN DOLLARS) Note: Fixed assets were depreciated using the straight-line method; in fiscal 2014, Alrich Farms's net income was $3,042 gross revenues of $224,560. Source: Company files

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started