Answered step by step

Verified Expert Solution

Question

1 Approved Answer

? ? ? Kaya is the managing director of, and 100% shareholder in, Hopi Ltd. Hopi Ltd has no other employees. For the year ended

?

?

?

?

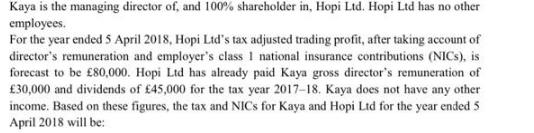

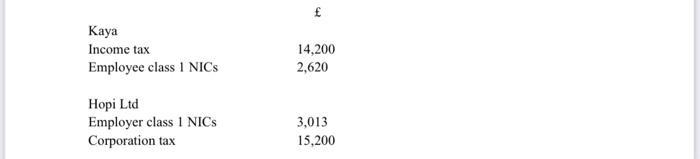

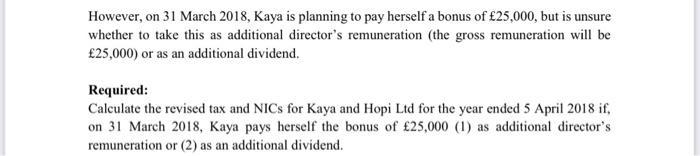

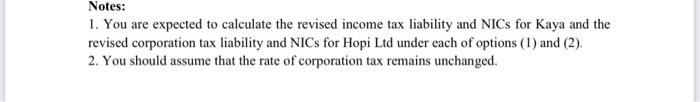

Kaya is the managing director of, and 100% shareholder in, Hopi Ltd. Hopi Ltd has no other employees. For the year ended 5 April 2018, Hopi Ltd's tax adjusted trading profit, after taking account of director's remuneration and employer's class 1 national insurance contributions (NICs), is forecast to be 80,000. Hopi Ltd has already paid Kaya gross director's remuneration of 30,000 and dividends of 45,000 for the tax year 2017-18. Kaya does not have any other income. Based on these figures, the tax and NICs for Kaya and Hopi Ltd for the year ended 5 April 2018 will be: Kaya Income tax Employee class 1 NICS Hopi Ltd Employer class 1 NICs Corporation tax 3 14,200 2,620 3,013 15,200 However, on 31 March 2018, Kaya is planning to pay herself a bonus of 25,000, but is unsure whether to take this as additional director's remuneration (the gross remuneration will be 25,000) or as an additional dividend. Required: Calculate the revised tax and NICs for Kaya and Hopi Ltd for the year ended 5 April 2018 if, on 31 March 2018, Kaya pays herself the bonus of 25,000 (1) as additional director's remuneration or (2) as an additional dividend. Notes: 1. You are expected to calculate the revised income tax liability and NICs for Kaya and the revised corporation tax liability and NICs for Hopi Ltd under each of options (1) and (2). 2. You should assume that the rate of corporation tax remains unchanged.

Step by Step Solution

★★★★★

3.40 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION ADDITIONAL DIRECTOR REMUNERATION 1 KAYAS REVISED INCOME TAX LIABILITY WILL BE DIRECTOR...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started