Question: You will use the three-stage DDM with a linearly declining growth rate in stage 2 to compute the intrinsic value of Walt Disney stock by

You will use the three-stage DDM with a linearly declining growth rate in stage 2 to compute the intrinsic value of

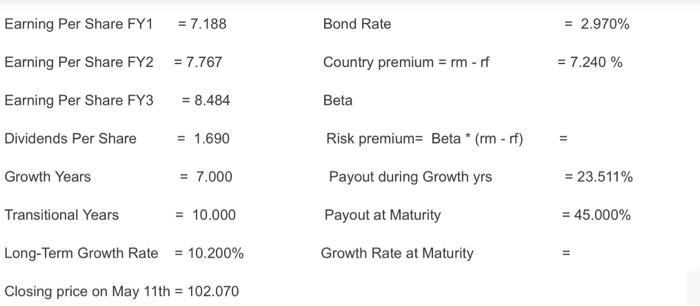

Walt Disney stock by employing the information in the picture below:

You are expected to examine the following underlying assumptions of the DDM model provided by Bloomberg:

- The short and long-term growth rate

- Long-term payout ratio

- The usage of the three-stage model versus the one and two stage models

- The number of years in the growth and transition stages

Earning Per Share FY1 Earning Per Share FY2 Earning Per Share FY3 Dividends Per Share Growth Years = 7.188 = 7.767 = 8.484 = 1.690 = 7.000 Transitional Years Long-Term Growth Rate = 10.200% Closing price on May 11th = 102.070 = 10.000 Bond Rate Country premium = rm -rf Beta Risk premium Beta * (rm -rf) Payout during Growth yrs Payout at Maturity Growth Rate at Maturity = 2.970% = 7.240 % = 23.511% = 45.000%

Step by Step Solution

3.45 Rating (148 Votes )

There are 3 Steps involved in it

The detailed answer for the above question is provided below B Longterm ... View full answer

Get step-by-step solutions from verified subject matter experts