Answered step by step

Verified Expert Solution

Question

1 Approved Answer

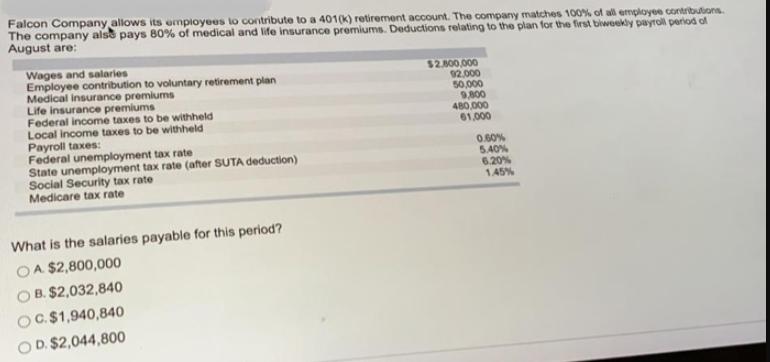

Falcon Company allows its employees to contribute to a 401(K) retirement account. The company matches 100% of all employee contributions. The company alss pays

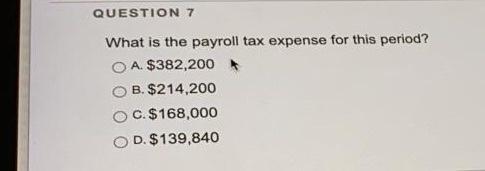

Falcon Company allows its employees to contribute to a 401(K) retirement account. The company matches 100% of all employee contributions. The company alss pays 80% of medical and life insurance premiums. Deductions relating to the plan for the first biwoekly payrol period of August are: Wages and salaries Employee contribution to voluntary retirement plan Medical insurance premiums Life insurance premiums Federal income taxes to be withheld Local income taxes to be withheld Payroll taxes: Federal unemployment tax rate State unemployment tax rate (after SUTA deduction) Social Security tax rate Medicare tax rate $2.800,000 92.000 50,000 9,800 480,000 61,000 0.60% 5.40% 6.20% 1.45% What is the salaries payable for this period? OA $2,800,000 O B. $2,032,840 OC.$1,940,840 O D. $2,044,800 QUESTION 7 What is the payroll tax expense for this period? O A. $382,20o O B. $214,200 O C.$168,000 O D. $139,840

Step by Step Solution

★★★★★

3.52 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Answer6 Explanation c 1940840 Wages and Salaries expense 2...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started