Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Eite Ltd sold 41,000 units of its product for $6l per unit in 2019. Variable cost per unit is $0 and total fixed costs

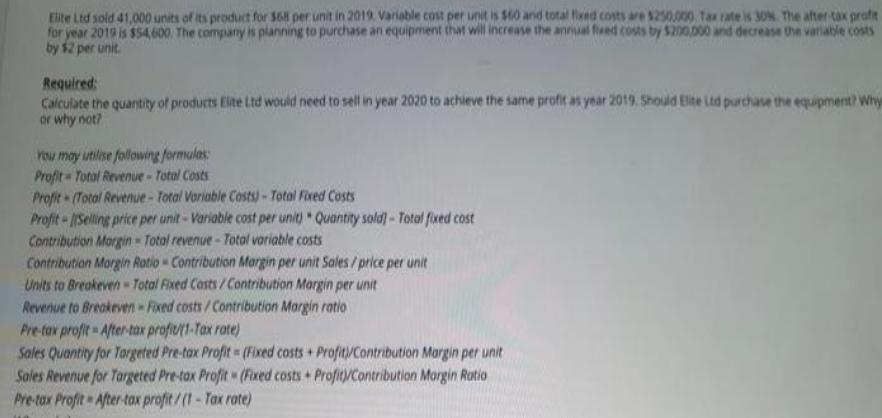

Eite Ltd sold 41,000 units of its product for $6l per unit in 2019. Variable cost per unit is $0 and total fixed costs are $250.000. Tax rate is 30%. The after tax prote for year 2019 is $54,600 The company is planning to purchase an equipment that will increase the annual fieed costs by $200,000 and decrease the variable costs by $2 per unit. Required: Calculate the quantity of products Elite Ltd would need to sell in year 2020 to achieve the same profit as year 2019. Should Elte Ltd purchase the equipment? Why or why not? You may utilise following formulas: Profit Total Revenue-Total Costs Profit (Total Revenue-Total Variable Costs)- Total Fired Costs Profit Selling price per unit- Variable cost per unit) " Quantity sold)-Total fixed cost Contribution Morgin Total revenue-Total variable costs Contribution Morgin Rotio Contribution Margin per unit Sales / price per unit Units to Breakeven Total Fixed Costs / Contribution Margin per unit Revenue to Breakeven Fixed costs/Contribution Margin ratio Pre-tax profit = After-tax profivt-Tax rate) Sales Quantity for Targeted Pre-tax Profit = (Fixed costs + Profit/Contribution Margin per unit Soles Revenue for Targeted Pre-tax Profit (Fixed costs Profit/Contribution Morgin Ratio Pre-tox Profit After-tax profit/(1-Tax rate)

Step by Step Solution

★★★★★

3.53 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

In the given case the details of 2019 is given the profit before and after tax is as follows Amount ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started