accounting questions, hope you can help

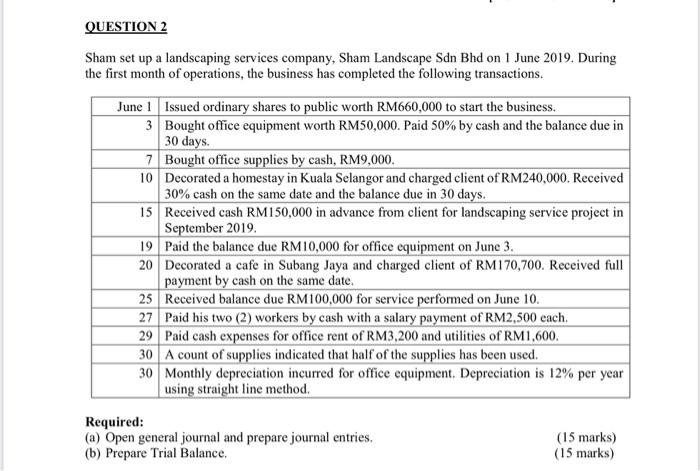

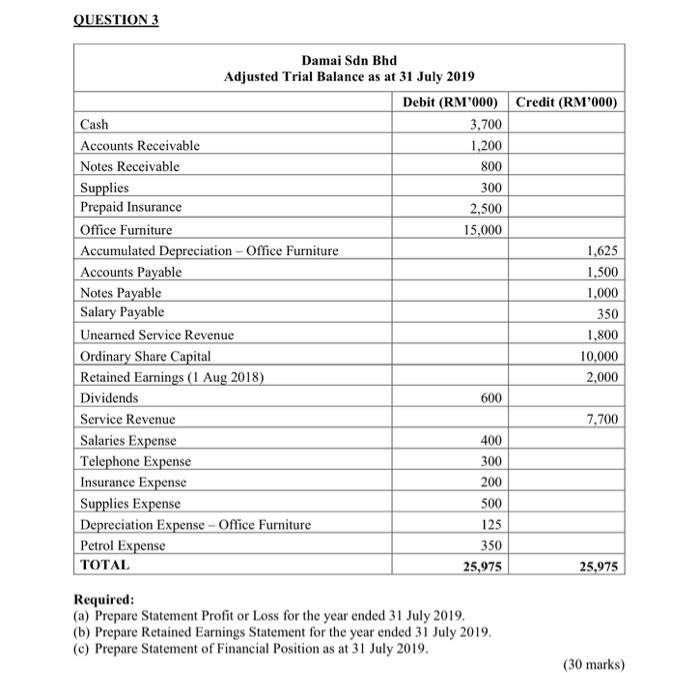

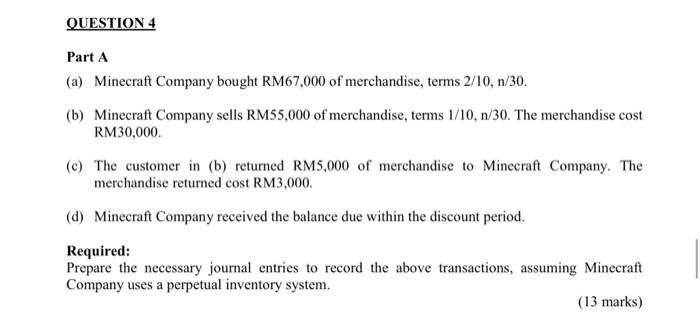

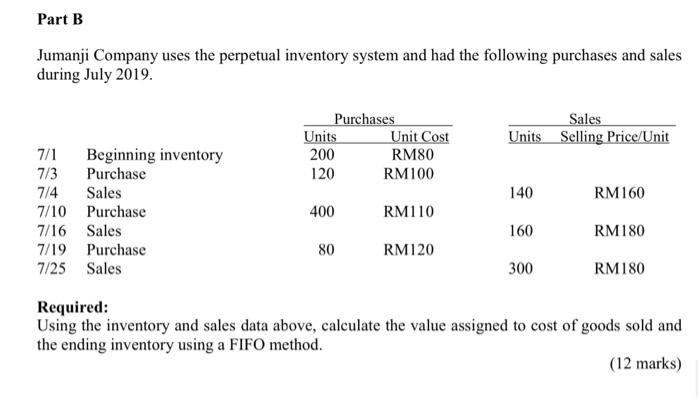

QUESTION 2 Sham set up a landscaping services company, Sham Landscape Sdn Bhd on 1 June 2019. During the first month of operations, the business has completed the following transactions. June 1 Issued ordinary shares to public worth RM660,000 to start the business. 3 Bought office equipment worth RM50,000. Paid 50% by cash and the balance due in 30 days. 7 Bought office supplies by cash, RM9,000. 10 Decorated a homestay in Kuala Selangor and charged client of RM240,000. Received 30% cash on the same date and the balance due in 30 days. 15 Received cash RM150,000 in advance from client for landscaping service project in September 2019. 19 Paid the balance due RM10,000 for office equipment on June 3. 20 Decorated a cafe in Subang Jaya and charged client of RM170,700. Received full payment by cash on the same date. 25 Received balance due RM100,000 for service performed on June 10. 27 Paid his two (2) workers by cash with a salary payment of RM2,500 each. 29 Paid cash expenses for office rent of RM3,200 and utilities of RM1,600. 30 A count of supplies indicated that half of the supplies has been used. 30 Monthly depreciation incurred for office equipment. Depreciation is 12% per year using straight line method. Required: (a) Open general journal and prepare journal entries, (15 marks) (b) Prepare Trial Balance. (15 marks) QUESTION 3 300 Damai Sdn Bhd Adjusted Trial Balance as at 31 July 2019 Debit (RM'000) Credit (RM'000) Cash 3,700 Accounts Receivable 1,200 Notes Receivable 800 Supplies Prepaid Insurance 2,500 Office Furniture 15,000 Accumulated Depreciation - Office Furniture 1,625 Accounts Payable 1,500 Notes Payable 1,000 Salary Payable 350 Unearned Service Revenue 1,800 Ordinary Share Capital 10.000 Retained Earnings (1 Aug 2018) 2,000 Dividends 600 Service Revenue 7,700 Salaries Expense 400 Telephone Expense 300 Insurance Expense 200 Supplies Expense 500 Depreciation Expense - Office Furniture 125 Petrol Expense 350 TOTAL 25,975 25,975 Required: (a) Prepare Statement Profit or Loss for the year ended 31 July 2019. (b) Prepare Retained Earnings Statement for the year ended 31 July 2019. (c) Prepare Statement of Financial Position as at 31 July 2019. (30 marks) QUESTION 4 Part A (a) Minecraft Company bought RM67,000 of merchandise, terms 2/10, n/30. (b) Minecraft Company sells RM55,000 of merchandise, terms 1/10, n/30. The merchandise cost RM30,000 (c) The customer in (b) returned RM5,000 of merchandise to Minecraft Company. The merchandise returned cost RM3,000. (d) Minecraft Company received the balance due within the discount period. Required: Prepare the necessary journal entries to record the above transactions, assuming Minecraft Company uses a perpetual inventory system. (13 marks) Part B Jumanji Company uses the perpetual inventory system and had the following purchases and sales during July 2019. Purchases Units Unit Cost 200 RM80 120 RM100 Sales Units Selling Price/Unit 140 RM160 7/1 Beginning inventory 7/3 Purchase 7/4 Sales 7/10 Purchase 7/16 Sales 7/19 Purchase 7/25 Sales 400 RM110 160 RM180 80 RM120 300 RM180 Required: Using the inventory and sales data above, calculate the value assigned to cost of goods sold and the ending inventory using a FIFO method. (12 marks)